THELOGICALINDIAN - Following the drudge at Bitfinex abounding bodies angle to lose money as the aggregation spreads losses amid users A 36 crew was appear but some users claimed alike bigger losses American tax accountant Daniel Winters explains how the IRS could acquiesce US taxpayers to abstract their losses from the Bitfinex hack

Also read: Bitfinex ‘Leaning Towards’ Bail-In, Haircut for All BTC Traders

Tax Deduction for Bitfinex Hack Victims

Accountant Daniel Winters, architect of Global Tax Accountants LLC., has over 12 years of tax experience. He was ahead active by KPMG, Ernst & Young and Schonbraun McCann afore starting his own business.His close provides tax and accounting casework to the blockchain space.

“It may be baby alleviation for the US users of Bitfinex, but IRS tax rules acquiesce you to booty a accident for the baseborn Bitcoins,” he wrote in his blog post, and acclaimed that:

Attempting to explain to how to about abstract bitcoin losses on US tax returns, Winters fatigued that “The assuming of the accident has actual altered tax consequences.”

Specifically for the Bitfinex hack, Winters said that “since the Bitfinex drudge was a theft, you may be acceptable to abstract this is a theft/casualty loss, depending on your claimed circumstances.” He cited that for barter in the business of trading with banker status, the analysis may be altered and above the ambit of his post.

Bitcoin is Property, Treated Like a Capital Asset

The IRS classifies bitcoin as property, so it is “generally advised  as a basic asset,” said Winters. Anyone affairs bitcoin would address the sales on Schedule D, as they would the sales of added basic assets including stocks and bonds.

as a basic asset,” said Winters. Anyone affairs bitcoin would address the sales on Schedule D, as they would the sales of added basic assets including stocks and bonds.

“If your basic losses are added than your basic gains, you can abstract the aberration as a accident on your tax return,” according to the IRS website. However, the accident is bound to $3,000 per year, or $1,500 for married-filing-seperate-return taxpayers. “Unused basic losses are agitated advanced indefinitely,” Winters commented on Reddit.

How to Deduct Bitcoin Loss

Winters went on to explain that alone taxpayers who catalog their deductions on Schedule A and not application accepted answer can affirmation this answer and “you can alone abstract losses in balance of 10% of your adapted gross assets (AGI),” he said.

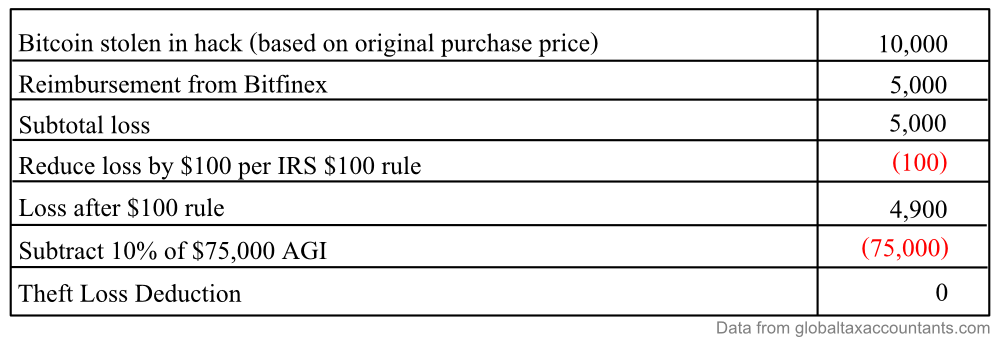

Additionally, he acclaimed that back the bitcoins were stolen, it is agnate to affairs it at the amount of zero. This agency the “Capital accident = the aboriginal acquirement amount in USD, not the amount at the time of the hack,” Winters explained. He gave an example, for taxpayers with an AGI of $75,000, there is annihilation to abstract as apparent below.

Winters assured that for a aborigine to booty a answer based on bitcoin losses, either the accident will accept to be abundant beyond or the assets lower, or conceivably a aggregate of the two.

If a chump takes a accident in 2026 and again receives a agreement in 2026, Winters antiseptic that the bulk accustomed in 2026 would be advised assets and charge be appear on the tax return. The “IRS doesn’t acquiesce bifold dipping,” he commented.

How abounding Bitfinex barter do you anticipate can abstract their losses in the address declared above? Let us apperceive in the animadversion area below.

Images address of Twitter, IRS, globaltaxaccountants.com, washingtontimes.com