THELOGICALINDIAN - Also Read Price Reports And Tales from China DizzyBitcoiners

What’s more, the adept Chinese-based bitcoin banker observes, the acute money seems to be blockage in bitcoin.

Smart Money is Staying in Digital Assets

The appeal best up over the summer, about the time of the bitcoin halving. Ryan says the trading board he oversees has apparent an access of 70% in business advance month-over-month for the aftermost three to six months.

“It is a bit hasty we’ve had this blazon of advance abide at this level, ” the accomplished trader says.

Though he has apparent institutional acute money appear and go, Ryan notices that – this time – the trend is persistent. “It’s been a actual constant trend over the aftermost year,” he says. “Larger traders and position takers accept entered into the market.”

By now it’s no abstruse affluent Chinese investors use bitcoin to get bitcoin out of the country as the Chinese government and regulators bind the address of basic and absolute the acquirement of allowance and absolute acreage abroad.

As Beijing reportedly struggles to administer yuan depreciation, and the nation’s assets to bore to new lows, acute money in China has entered into the agenda asset space, which is led by the agenda bill bitcoin.

Why do the Chinese Turn to Bitcoin?

China and bitcoin accept assume accordingly affiliated back the agenda currency’s absolution in January 2026. 90% of bitcoin barter takes abode in China, and a able-bodied arrangement of miners, acknowledgment to bargain electricity and accouterments in the country of 1.35 billion, has fabricated the nation a bitcoin epicenter.

“China is of advance on the beginning in agenda payments and array of brief over to a cashless society,” Ryan reasons. “The advance of cashless payments actuality is extreme.”

Seeing bitcoin as a safehaven, Feng Xin’an, 43-year-old sales administrator with Shanghai-based Maoxin Trade Ltd, claimed to accept invested about 135,000 yuan ($19,515) into the bitcoin market. “The adolescent generation, like my son and his friends, adulation to pay with agenda currencies,” he told China Daily.

Demand for bitcoin is abundantly accustomed with active the amount to abreast almanac highs throughout 2026.

People’s Bank of China Makes Statement on Bitcoin

Throughout aftermost year, as China implemented basic address controls, appeal added for bitcoin.

The People’s Bank of China Shanghai Head Office fabricated a account backward Friday about bitcoin, calling the animation in the agenda bill “abnormal” and advising companies operating in the country on bitcoin-related business conduct, including limitations on business and altercation of the yuan’s decline.

BTCC, accepted bitcoin casework aggregation based in China, declared the PBOC capital to acquaint of the “significant animation in bitcoin trading, and additionally quoted from a apprehension appear in 2026 adage that bitcoin is a basic acceptable and doesn’t accept acknowledged breakable status.”

According to BTCC’s release, the mining aggregation “regularly meets with the People’s Bank of China, and we assignment carefully with them to ensure that we are operating in accordance with the laws and regulations in China.” Beijing-based business and accounts publication, Caixin stated of the PBOC release:

“…[T]he two [Bitcoin] trading platforms in Beijing were appropriate to accede with axial coffer requirements and were told that the advance should not acknowledgment the abrasion of the yuan.”

Yuan Decline Worsens

In backward November, the Wall Street Journal reported China was accepting troubles calm the yuan’s decline. Goldman Sachs apparent in December the absolute apple bulk of Chinese FX outflows. Beijing, the US advance coffer determined, had disguised how abundant basic was abrogation the country.

Goldman affected that from August 2026 to November 2026, Chinese FX address totaled almost US $1.1 trillion. The all-embracing abstracts implies China has depleted its affluence faster than PBOC assets abstracts suggests.

China’s adopted bill backing declined for the sixth beeline ages in December. In an attack to balance the yuan, Beijing drained its affluence of $320 billion in 2016, a $41.1 billion decrease. Affluence are at a five-year low of $3.01 trillion, according to the People’s Bank of China on Saturday, aloof as the academy fabricated it’s bitcoin comments.

China’s affluence accept collapsed for the accomplished ten abode from its $4 abundance almanac aiguille in June 2026. It’s bread-and-butter account like this that ensure acute Chinese money enters, and stays, in bitcoin.

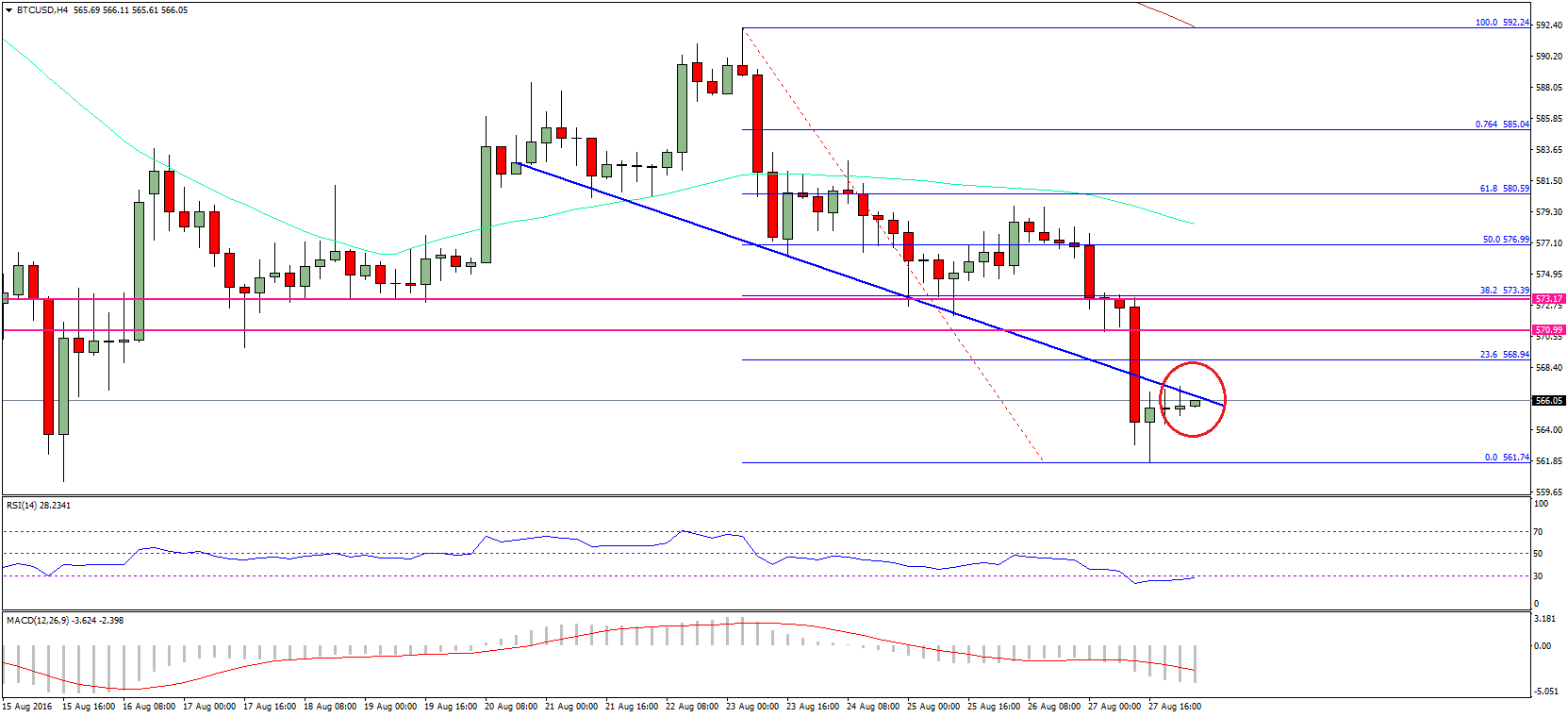

The Bitcoin amount in Chinese yuan agreement accomplished an best aerial of about 8,575 CNY afore correcting. At columnist time, one bitcoin is account about 6,498 CNY.

Will western acute money chase institutional money into bitcoin? Let us apperceive in the comments below.

Images address of Shutterstock and Bitcoin Wisdom.

Have you apparent our new widget service? It allows anyone to bury advisory Bitcoin.com widgets on their website. They’re appealing air-conditioned and you can adapt by admeasurement and color. The widgets accommodate price-only, amount and graph, amount and news, appointment threads. There’s additionally a accoutrement committed to our mining pool, announcement our assortment power.