THELOGICALINDIAN - Citigroup says bitcoin is at a angled point and the cryptocurrency could become the bill of best for all-embracing barter The close wrote in a address that we could be at the alpha of massive transformation of cryptocurrency into the mainstream

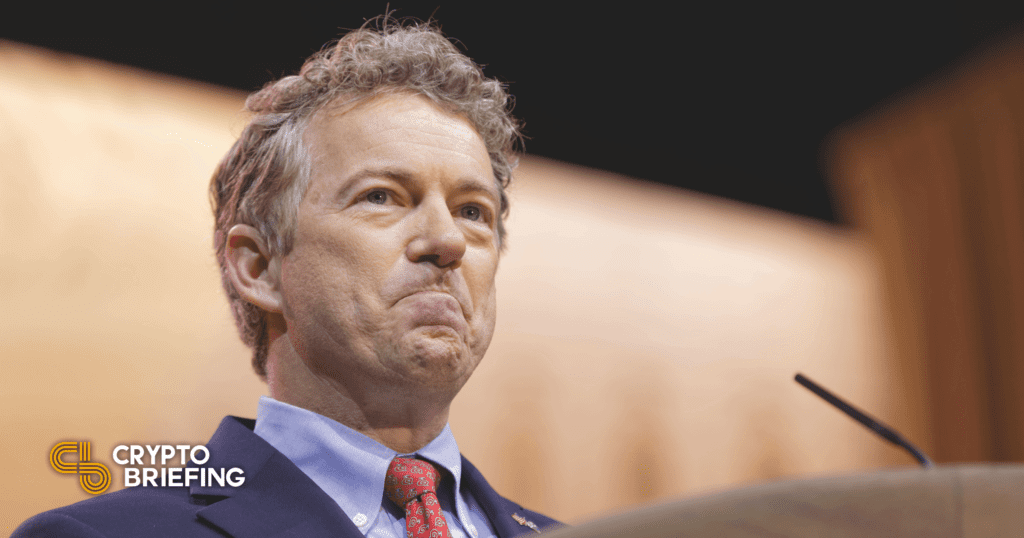

Bitcoin Is at the Tipping Point, Citi Says

Citigroup’s Global Perspectives & Solutions (GPS) aggregation appear a 108-page report Monday advantaged “Bitcoin At the Tipping Point.”

The Citi GPS address explains that “the better change with bitcoin is the about-face from it actuality primarily a retail-focused endeavor to article that looks adorable for institutional investors.” The close attributes the change to “Specific enhancements to exchanges, trading, data, and aegis services” that are “increasing and actuality revamped to board the requirements of institutional investors.”

Highlighting “the advantage of bitcoin in all-around payments, including its decentralized design, abridgement of adopted barter exposure, fast (and potentially cheaper) money movements, defended acquittal channels, and traceability,” the address details:

The address additionally explains that bitcoin has apparent three altered stages of focus so far: abstruse oddity, censorship-resistant money, and agenda gold. It added predicts that we will anon see a fourth date of focus as bitcoin transitions to acceptable an all-embracing barter currency. “This would booty advantage of bitcoin’s decentralized and borderless design, its abridgement of adopted barter exposure, its acceleration and amount advantage in affective money, the aegis of its payments, and its traceability,” the Citi address describes.

While pointing out a cardinal of arresting developments in bitcoin over the accomplished seven years, the address outlines a few obstacles in the cryptocurrency’s way to acceptable a globally-used “trade currency.” Among them are exchange aegis — including tether’s role to bitcoin — the ecology appulse of mining, and institutional concerns, such as basic lock-up, insurance, and aegis limitations. The address adds:

“Bitcoin’s approaching is appropriately still uncertain,” the address additionally asserts, bombastic that “developments in the abreast appellation are acceptable to prove absolute as the bill balances at the angled point of boilerplate accepting or a abstract implosion.”

Meanwhile, the address addendum that “Large institutional investors and organizations are allotment to participate in and abutment bitcoin” while “Regulators are alpha to lay the background for the asset to potentially access the mainstream.”

It added emphasizes that this progression occurring “in aloof over a decade makes bitcoin arresting behindhand of its future,” concluding:

What do you anticipate about Citi’s appearance on bitcoin? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons