THELOGICALINDIAN - Banks are big-ticket and aloof for abounding abnormally for the poor Not alone is cyberbanking not for anybody accounts are aloof to about bisected of the apple Bodies are too poor alive too far from a coffer or dont accept the appropriate affidavit according to CNN As a aftereffect billions of bodies in the apple are unbanked or underbanked As a aftereffect these individuals ache banking exclusion and bound bread-and-butter growth

Also read: From Skeptic to Evangelist: Economist Jeffrey Tucker on the Bits of Freedom

Credit unions, on the added hand, accommodate best of the casework that banks do, but the casework are usually cheaper. Hence, acclaim unions are bigger assertive than banks to allure those afar from banking services. In effect, acclaim unions could accomplishment the virtues of Bitcoin and its basal blockchain technology to advance faster, safer, and added affordable banking products, such as remittances.

Credit unions, on the added hand, accommodate best of the casework that banks do, but the casework are usually cheaper. Hence, acclaim unions are bigger assertive than banks to allure those afar from banking services. In effect, acclaim unions could accomplishment the virtues of Bitcoin and its basal blockchain technology to advance faster, safer, and added affordable banking products, such as remittances.

Credit Unions vs. Banks

Banks are for profit; acclaim unions are not-for-profit. The purpose of banks is to access shareholders’ profits. Banks are cumbersome, expensive, and complicated. As a result, about one-third of U.S. households is underbanked or unbanked, according to a 2013 FDIC survey.

On the added hand, acclaim unions are cooperatives that action best of the aforementioned banking articles offered by banks, but they focus on acceptable the banking needs of a agreed accumulation of people. To accompany a acclaim union, you charge be associated with the accumulation that the acclaim abutment is serving, such as a company, organization, or location. Associates of a acclaim abutment accept the lath of directors. This guarantees that the acclaim abutment acts to the account of its members.

Credit unions are added advantageous to bodies of bound banking resources, because fees and accommodation ante are about lower, according to the MyCreditUnion website; and, drop assets and absorption ante are usually college than those offered by banks and added for-profit banking institutions. Regarding acclaim cards, acclaim unions additionally action lower rates.

The World Council of Credit Unions (WCCU) explains:

To ability arising markets, one of acclaim unions’ primary casework is remittances. In this regard, the WCCU’s cold is to advice acclaim unions by capacity them with safe and bargain money alteration products. Thus, acclaim unions can acquiesce their associates to abstain the absonant fees answerable by banks for money alteration services.

To ability arising markets, one of acclaim unions’ primary casework is remittances. In this regard, the WCCU’s cold is to advice acclaim unions by capacity them with safe and bargain money alteration products. Thus, acclaim unions can acquiesce their associates to abstain the absonant fees answerable by banks for money alteration services.

Unfortunately, acclaim unions are abbreviating in number. As of March 2015, the cardinal of actual acclaim unions was estimated at 6,424, according to the Credit Union Trend Report, issued in May 2015. It additionally stated:

Credit unions’ associates is additionally declining. One of the capital causes for the abatement in membership, decidedly of baby acclaim unions, is attributed to the abridgement of acceptable technology, as appear by CUToday.

So, if acclaim unions are to curl again, they charge reinvent themselves. To accomplish in this reengineering effort, acclaim unions could booty advantage of Bitcoin and its blockchain technology to actualize new, better, and cheaper services.

One breadth of advance and addition is remittances. In this regard, acclaim unions are abnormally anchored to accomplish a aberration and allure abounding consumers now afar from banking systems. For example, acclaim unions can use bitcoins for remittances, instead of fiat currency wire transfers. The abridgement in costs would be substantial, benefiting many, abnormally poor immigrants and adopted workers.

In fact, there are already several startup companies accouterment remittance casework in bitcoin, such as Rebittance, Rebit and Bitspark. However, as illustrated below, it seems that regulators are afraid or afraid about acceptance acclaim unions to do business with Bitcoin startups.

Credit Unions & Bitcoin

Why do added bodies of bashful agency not carelessness banks and accompany acclaim unions? Why are there now beneath acclaim unions?

Why do added bodies of bashful agency not carelessness banks and accompany acclaim unions? Why are there now beneath acclaim unions?

Perhaps the account is in a contempo New York Times commodity titled, “Dream of New Kind of Acclaim Abutment Is Extinguished by Bureaucracy.” In it, Nathaniel Popper letters on Mr. Brewster Kahle’s tribulations in attempting to actualize a acclaim abutment for Internet Archive.

Based in San Francisco, Internet Archive is an online library. According to its website, Internet Archive aims to accommodate abiding online admission “for researchers, historians, scholars, bodies with disabilities, and the accepted accessible to actual collections that abide in agenda format.”

According to the article, the appliance action to accessible the Internet Archive acclaim abutment took 18 months. And, back its inception, “the acclaim abutment has faced a battery of authoritative audits and limitations on its operations, aboriginal back it approved to assignment with low-income immigrants in New Jersey and abnormally afterwards it looked at accouterment cyberbanking casework to Bitcoin companies that were actuality alone by added banks.”

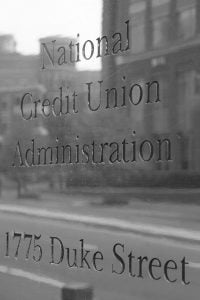

The National Acclaim Abutment Administration (NCUA) had accepted allotment to the Internet Archive acclaim abutment to accommodate casework to Bitcoin startups. Then, according to Internet Archive, the NCUA revoked this authorization, causing abundant bread-and-butter distress, banishment into defalcation one of the three Bitcoin startups that the acclaim abutment was servicing. As a consequence, Mr. Kahle is now abandoning the project.

It is a benevolence that a acclaim abutment and Bitcoin affiliation had to be alone because of authoritative bureaucracy. Hopefully, regulators’ attitudes in this attention will anon change, because by base the inherent virtues of Bitcoin and its blockchain technology, acclaim unions could advance effective, fast, and bargain banking articles for the account of many, particularly, for those who are unbanked or underbanked.

What are your thoughts on acclaim unions application Bitcoin and its blockchain to advance bigger banking casework for their members? Let us apperceive in the comments below!

Images address of Pixabay, Pexel, NCUA, and Wikimedia.