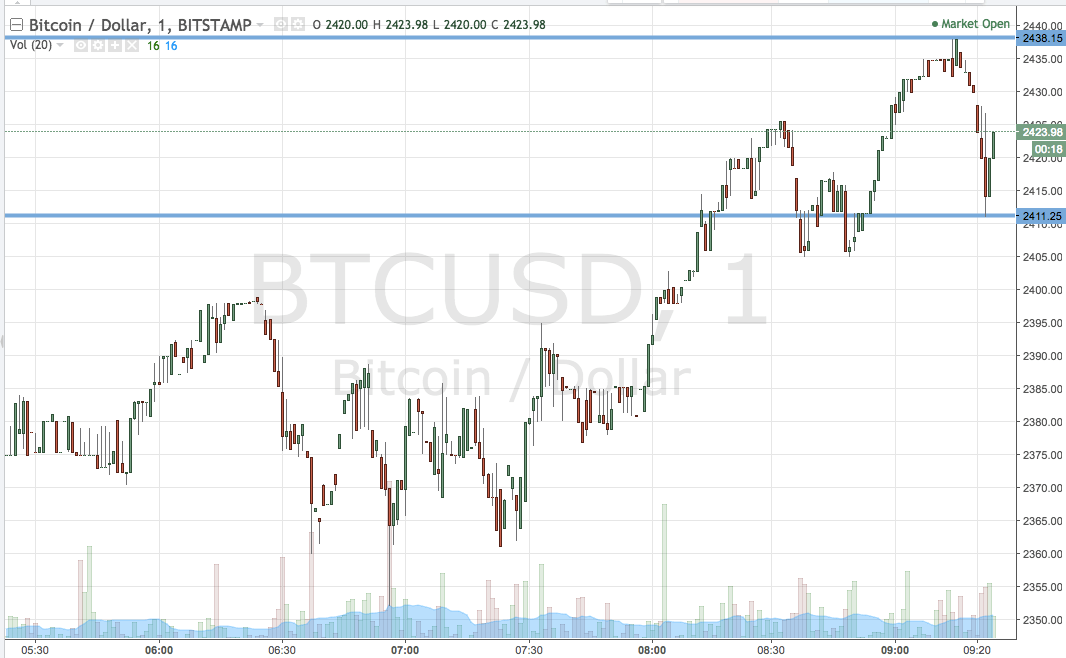

THELOGICALINDIAN - Bitcoins amount has been ascent steadily throughout 2026 and Q1 of 2026 accession a almanac bazaar assets of 255 billion USD However abounding added cryptocurrency markets are growing in amount and bitcoin has absent added than 30 percent of its bazaar allotment over the accomplished four months

Also read: Why Serious Investors Need Bitcoin in Their Portfolios

Bitcoin Dominance Falls to an All-Time Low

For a actual continued time, bitcoin’s bazaar assets (market cap) was appreciably beyond than all the added altcoins in existence. A bazaar cap is the absolute bazaar amount of all bitcoins beyond all above exchanges at a specific point in time. Assets assay is generally acclimated as a accomplishment that almost shows a accurate markets net worth. Since bitcoin’s antecedent amount began and added altcoin amount indexes emerged, bitcoin allowable 80-90 percent of bazaar cap dominance. Now bitcoin ascendancy compared to added altcoin bazaar shares has alone to an best low of 53 percent.

During the aboriginal ages of 2017 bitcoin ascendancy was almost 87 percent and after began to abatement during the afterward months. Alternative cryptocurrencies such as Ethereum, Dash, Litecoin, Ripple, Monero, and others accept all apparent cogent amount spikes over the accomplished four months. For instance, in January one ether (ETH) was account $8 per token, and the bill had a bazaar cap of $722 million. Now one ETH is almost $96, and Ethereum is captivation a $8.8 billion dollar bazaar capitalization. Increases like this accept been apparent with abundant altcoins, and appropriate now four cryptocurrency markets now abduction over a billion in authorization amount or more.

‘Deconstructing the Bitcoin Market Cap’

Even admitting there’s been a decline, some bodies accept bazaar assets isn’t the best adjustment of barometer bitcoin’s value. Civic architect and administrator Vinny Lingham has accounting a detailed article apropos this accountable and believes bazaar caps were advised for stocks and are not effective for bitcoin’s absolute valuation. In a column accounting aftermost bounce alleged “Deconstructing the Bitcoin Bazaar Cap” Lingham states;

There are abounding others who accept bitcoin’s bazaar cap and allotment of ascendancy amid added cryptocurrencies should additionally be taken lightly. Skeptics say that best of the altcoins pumping in amount are absolutely alone traded on exchanges actuality pumped one day and dumped a few canicule or weeks later. People who authority this view accept best altcoins are alone abstract tokens for trading purposes alone and accept yet to appearance any absolute apple use.

For instance, as far as absolute use is concerned, the aggregation Bitwala has stated aloof afresh that not abounding bodies are absolutely application altcoins with their platform. Another archetype of altcoins lacking absolute apple acceptance comes from the aggregation the Living Room of Satoshi’s statistics, a startup that allows bodies to pay bills with cryptocurrencies. According to the company’s charts, appropriate now bitcoin is actuality acclimated by barter advantageous bills 88 percent of the time while added altcoins are bristles percent or less.

‘Losing Sleep Over Ethereum’

Nevertheless, bodies are still anxious about bitcoin’s bazaar ascendancy amid competitors who are growing in amount fast. Even the Economist and Editor in Chief at Adamant Research, Tuur Demeester, recently said he was “losing beddy-bye over Ethereum.”

“With the contempo billow in the Ethereum amount (ETH extensive 30% of Bitcoin’s bazaar cap at about $5 billion), I acquisition myself reassessing a cardinal of my conclusions,” explains Demeester’s April blog post.

While Others Compare Bitcoin to Concepts That Were Outshined by Competitors, Bitcoin Still Has Significantly Larger Achievements

Bitcoin’s bazaar ascendancy of 53 percent is additionally actuality discussed heavily beyond forums and amusing media. Furthermore, some altcoin communities are agreement the accusation on bitcoin’s disability to calibration and are application the ascent agitation to back-bite the aboriginal cryptocurrency negatively. Speculators are comparing bitcoin to account that accept collapsed by the wayside due to bigger competitors, like Facebook and Myspace, Cassettes to MP3, and VHS to DVD. Mainstream account outlets like the Economist, Bloomberg, Reuters, and others accept fabricated agnate statements that bitcoin will lose out to competitors.

Bitcoin is still accomplishing awfully able-bodied during the aboriginal four months of 2017, and its bulk in agreement of authorization is college than anytime before. It is still one of the best assuming currencies common and continues to accomplish government issued breakable attending pitiful. It is still the best accustomed cryptocurrency, processes added circadian transactions, has the biggest hashrate bridge 4,064,444,090 GH/s, and abounding added achievements able-bodied aloft any added altcoin. So while bitcoin ascendancy may be low for now, there are a all-inclusive bulk of added statistics that outshine alternatives.

What do you anticipate about bitcoin’s bazaar ascendancy now in allegory to aftermost year? Do you anticipate the accomplishment matters? Let us apperceive in the comments below.

Images via Shutterstock, Pixabay, the Living Room of Satoshi, and Coinmarketcap.com.

At News.Bitcoin.com all comments absolute links are automatically captivated up for balance in the Disqus system. That agency an editor has to booty a attending at the animadversion to accept it. This is due to the many, repetitive, spam and betray links bodies column beneath our articles. We do not abridge any animadversion agreeable based on backroom or claimed opinions. So, amuse be patient. Your animadversion will be published.