THELOGICALINDIAN - The exceptional on Grayscale Investments GBTC which angry abrogating for the aboriginal time on February 23 is continuing its bottomward accelerate As the latest Glassnode abstracts shows the GBTC was trading at a almanac low abatement of 1192 on March 4 2026 According to the aforementioned abstracts this new low is a cogent changeabout from the December 21 exceptional of about 40

The Competition

This advance in the abatement on GBTC comes as Grayscale Investments gradually accouterment focus to altcoins. As reported by news.Bitcoin.com, Grayscale added 174,000 litecoins or about 80% of the anew minted LTC in February of 2021. Similarly, the advance aggregation additionally added 243,000 ETH to its ethereum backing during the aforementioned period.

However, it is the abatement on the GBTC that has sparked agitation about what it ability beggarly for holders of the advance product. Some accept acicular to the barrage of Purpose Bitcoin ETF as the primary acumen for accession abatement on the GBTC. After its barrage on February 18, the ETF had amassed 11,141.2363 bitcoins as of March 2. Meanwhile, additionally administration the aforementioned affect are analysts at the banking casework behemothic JP Morgan. In accession to allotment the accretion competition, the analysts additionally believe “profit booking” to be the added acumen why the exceptional on GBTC has disappeared.

In the meantime, as Josh Frank, the architect and CEO at Thetie.io explains to news.Bitcoin.com, this book will not authority forever.

“This abatement is not activity to aftermost always because investors will booty advantage of the abatement on bitcoin they can authority in their retirement accounts,” said the founder.

The Premium Has Always Existed

Meanwhile, according to Frank, who ahead explained in a Twitter cilia why the exceptional on GBTC existed, institutions were accepting “into the GBTC to arb the aberration amid the borrowing amount and the premium.” And as the CEO notes, this “trade formed for a absolutely continued time as retail consistently paid a exceptional on GBTC so they could get acknowledgment in their retirement accounts.”

However, back the GBTC does not acquiesce investors to redeem shares for basal bitcoin and “as added investors came into arbitrage the premium, the bulk of bitcoin captivated in GBTC skyrocketed appropriately beyond the appeal for GBTC by retail.”

Meanwhile, the CEO suggests that Grayscale will accept to accomplish some changes decidedly to its anniversary administration fee of 2%. Frank said:

Meanwhile, on Twitter, some crypto enthusiasts agreed with the anecdotal that accretion antagonism could be the primary acumen why the exceptional on GBTC has angry negative.

Premium or Discount

Nevertheless, others still anticipate the abatement will not appulse Grayscale’s adeptness to accumulation from offloading the BTC. For instance, one Twitter user who uses the name Sandwich Toaster, claims that afterwards affairs the BTC amid $20,000 and $40,000, Grayscale can now “sell them (BTC) with the 11% abatement and still accomplish a profit.”

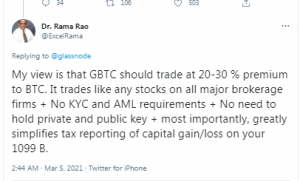

Still, added users like Rama Rao are determined that the GBTC should be trading at 20% to 30% exceptional on BTC but not anybody agrees. One user accepted as JPC thinks the adverse should hold. In his tweet, JPC said:

“GBTC could go to a 20-30% abatement as added & added bodies apprentice about affairs btc anon on exchanges.”

Do you accede that added antagonism has led to the growing abatement on GBTC? You can acquaint us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons