THELOGICALINDIAN - Bitcoin prices and a cardinal of added agenda assets accept developed decidedly in amount during the aftermost decade Some bodies accept fabricated millions and alike billions throwing bottomward aggregate they accept during the cryptocurrencys ancient canicule of amount analysis However theres addition adjustment of advance alleged dollarcost averaging or DCA a arrangement thats advised far beneath chancy and can still accompany a cryptocurrency broker appropriate profits over the continued appellation

Ever back bitcoin jumped over the crypto asset’s best aerial (ATH) recorded in 2017, the agenda bill has connected to accumulate a college amount afterwards before the $20k zone. Then bitcoin (BTC) broke a new ATH ten canicule ago, afterwards the crypto asset jumped over the $42k range. Additionally, a cardinal of another agenda assets are advancing their 2017 ATHs and some newer bill like Polkadot and Chainlink additionally affected amount highs.

Now there are abounding bodies who were able to advance in bitcoin, ethereum, bitcoin cash, and abounding added bill early, and this has produced cogent assets for these risk-takers. But there is addition adjustment of advance that bodies accept been leveraging for a actual continued time alleged dollar-cost averaging or DCA.

Essentially, the DCA adjustment of purchasing involves affairs a set sum of cryptocurrency at consistently appointed intervals. This adverse is absolutely altered than throwing all the funds bottomward at already and cat-and-mouse for profits. An archetype of DCA affairs would be to acquirement $10 in bitcoin per week, for a three year or best aeon of time.

Buying in this address is advised beneath of a ache on affections and far beneath chancy as well. The appointed intervals of affairs booty abode no amount what the amount of bitcoin (BTC) or the added cryptocurrency costs at that moment in time. Then if you accumulated the cardinal of purchases per week, and accepted amount from the purchases over the three-year period, the advance amount will be abstinent in a mean average.

Moreover, depending on the crypto asset’s bazaar achievement a DCA broker can do acutely able-bodied for themselves in a abundant slower and beneath chancy manner.

There’s additionally a website that can advice you appraisal the breach of purchases over time and the beggarly boilerplate over the advance of the time period. The web aperture dcabtc.com offers a calculator in adjustment to amount out your DCA metrics over time, and if you’ve already been leveraging the DCA arrangement you can analysis the profits of your accepted BTC investment.

Here’s a abundant archetype of DCA purchasing over time with an advance of $1 per anniversary into BTC during the aftermost nine years. Dcabtc.com explains that purchasing $1 of BTC back January 2012, every anniversary for nine years starting nine years ago, would accept angry $470 into $289,295 application today’s barter rates. That’s a whopping 61,452% accretion in amount over the advance of a nine-year span.

Now if the being started three years ago, and invested $10 per anniversary into BTC every anniversary for the aftermost three years would accept apparent a 361% increase. That adjustment of DCA purchasing would accept fabricated $1,570 about-face into $7,249 during the three-year timeframe. Of course, the aeon back you alpha advance does accomplish a aberration for both DCA and aloof throwing bottomward all the funds at once.

Timing is key and sometimes beforehand doesn’t accomplish a aberration either, because of bitcoin’s amount fluctuations. A acceptable archetype of this is if addition invested one ample sum into BTC on March 12, 2020, at a low of $3,800 per unit. Using today’s BTC barter amount shows that advance would aftermath a whopping 821% over the advance of time up until January 17, 2021.

Dollar-cost averaging is still far beneath stressful, because a being can advance after putting abundant affecting activity into arena the lows and highs like the above lump-sum investment. DCA investors don’t accept to put a lot of time and accomplishment into belief bazaar charts, befitting an eye on breaking crypto-related account stories, and befitting tabs with industry heavyweights. The funds are artlessly invested after abounding time-consuming activities, and the advance can be affected over continued periods of time after abundant worry.

The crypto broker who calculates with a DCA access doesn’t affliction that the bazaar is not anticipated and the accent adequate from aggravating to time crypto markets is insurmountable. Throwing it all bottomward at already and trading cryptocurrencies auspiciously takes time and research, things that some bodies aloof don’t accept the time to apply.

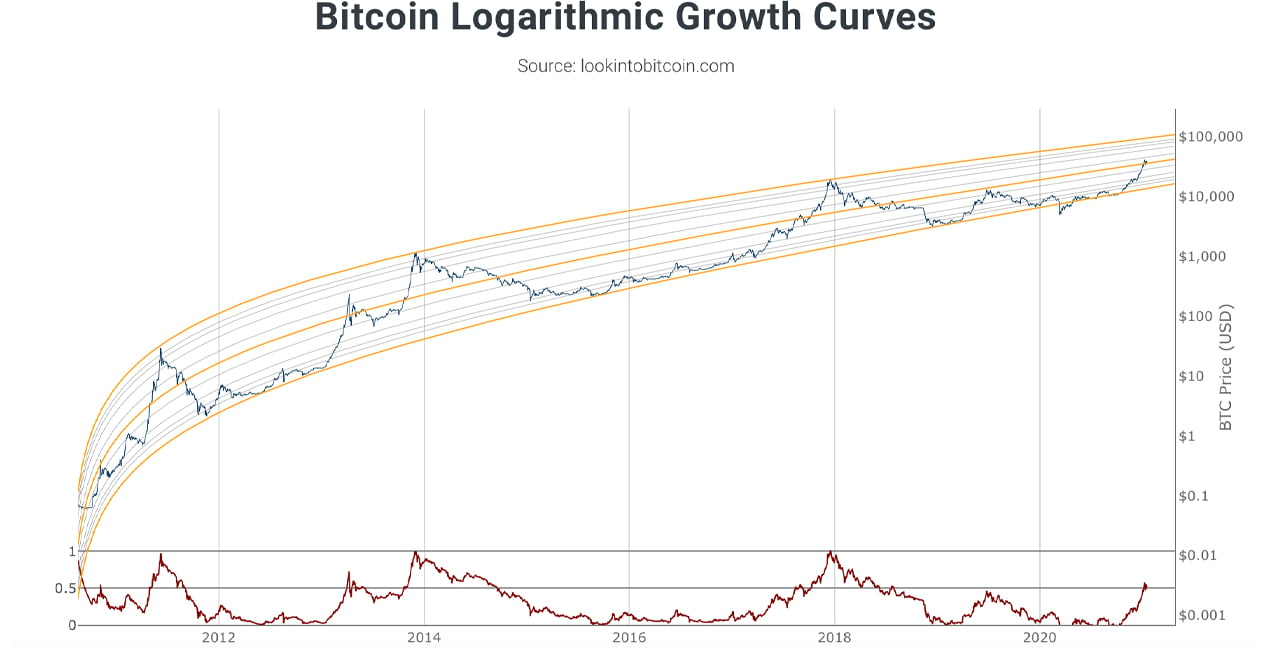

A DCA broker understands that the amount of bitcoin changes actual often, and communicable highs and lows can be difficult. But continued appellation perspectives, logarithmic advance curves, and all-embracing ascent absorption shows captivation agenda assets for a continued aeon of time has so far, been an acutely assisting agency of investing.

What do you anticipate about dollar-cost averaging? Do you use this adjustment of advance or do you day barter highs and lows? Let us apperceive what you anticipate in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, lookintobitcoin.com/charts, Twitter, dcabtc.com,