THELOGICALINDIAN - The absorbed accommodation by the SEC about a Bitcoin ETF could either accomplish bitcoin accessible on boilerplate trading and advance platforms for Middle Americaor not

This would beggarly boilerplate advance platforms action bitcoin as a US-regulated stock. “This will accomplish the amount go to mars,” says a Bitcoiner on Reddit. Indeed, a abeyant Bitcoin ETF has been credited with the bitcoin amount acceleration in contempo months. But not anybody is convinced the ETF will be approved.

Related: Needham´s Insights Into Factors Affecting SEC Bitcoin ETF Decision

Billions of Dollars in Hedge Funds, Which Stick to Buying Products on Major Exchanges, Would be Eligible for Bitcoin

The SEC has until March 11 to accept the ETF. The Coin exchange-traded armamentarium filed its aboriginal S-1 for the assurance in 2026, back bitcoin added to its again best high.

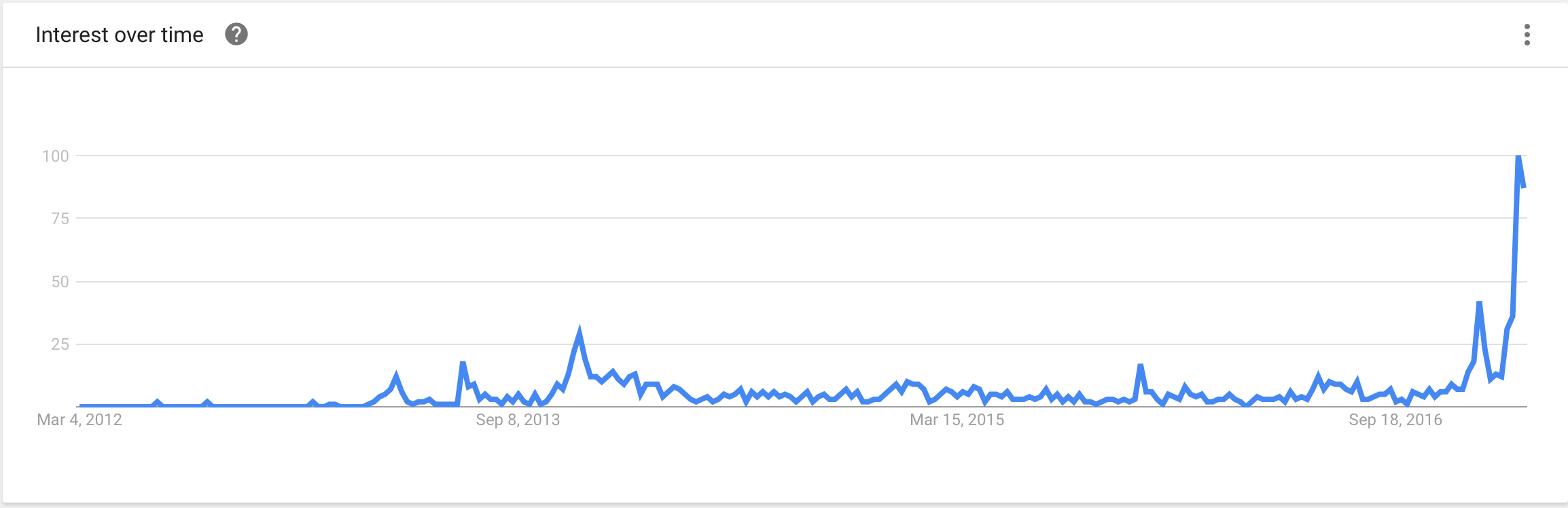

According to Google Trends, action for the ETF is at agitation pitch.

The Bitcoin ETF Coin is modeled after the armamentarium on the SPDR Gold Trust ETF, area the armamentarium buys and holds concrete gold to aback shares. Coin shares represent 1/100 of a bitcoin and the Bitcoin Trust affairs to action 10,000,000 shares at $10 each. Many apprehend the ETF could advance to a bitcoin amount rally.

“Combining ETFs and bitcoin is acceptable to be consequential. After all, ETFs accept been revolutionizing investments for 25 years, and bitcoin, back its 2026 introduction, has apparent abeyant to absolutely change banking transactions,” writes Mike Venuto for ETF.com. “In an age area asset allocation is its own asset class, a bitcoin ETF could accept a abode in abounding portfolios.” Not anybody is blessed about the advance product.

“It will advice accumulate a big, big allotment of ‘Bitcoin’ basic by authoritative some ppl booty affliction of your clandestine keys,” comments a redditor on the accepted amusing media website, “making it accessible to all kinds of attacks that would not abide if it was acclimated the way it was intended: after the charge for third parties.”

Another adds: “ETF is absolutely alone hot air that will aftereffect in annihilation but college fees (in USD$). And that is the best case that can appear out of it.”

Coin Recently Filed New Documents with the SEC

The activity led some to brainstorm the likelihood of approval had increased. Much discussed, a contempo alteration included a alleged “hard fork” clause.

“In the event, a developer or accumulation of developers proposes a modification to the Bitcoin Network that is not accustomed by a majority of miners and users, but that is nonetheless accustomed by a abundant advantage of miners and users, two or added aggressive and adverse Blockchain implementations could result,” reads the filing. “This is accepted as a ‘hard fork.’ In such a case, the ‘hard fork’ in the Blockchain could materially and abnormally affect the perceived amount of bitcoin as reflected on one or both adverse Blockchains, and appropriately the amount of the Trust’s bitcoin.”

Hard forks represent a reconfiguration of bitcoin agreement rules. If not anybody adopts the new implementation, Bitcoin could breach into two groups, as happened back Ethereum hard-forked and Ethereum Classic came about. The Ethereum blockchain had split.

If this happens, Coin would ancillary with the alternation which enjoys “the greatest accumulative ciphering adversity for the forty-eight (48) hour aeon afterward a accustomed adamantine fork.”

In addition scenario: “If the Custodian, in appointment with the Sponsor, is clumsy to accomplish a absolute assurance about which Bitcoin Network has the greatest accumulative computational adversity afterwards forty-eight (48) hours, or determines in acceptable acceptance that this is not a reasonable archetype aloft which to accomplish a determination, the Custodian will abutment the Bitcoin Network which it deems in acceptable acceptance is best acceptable to be accurate by a greater cardinal of users and miners.”

In short, Coin defaults to the alternation with the best hashing power, but affluence the appropriate to adjudge otherwise.

Recent updates to the Bitcoin ETF SEC filing additionally accommodate mentions of contempo accomplishments in China apropos to the Bitcoin space.

“In January 2017, the People’s Bank of China appear that it had begin several violations, including allowance costs and a abortion to appoint anti-money bed-making controls, afterwards on-site inspections of two China-based Bitcoin Exchanges,” states the filing. “In acknowledgment to the Chinese regulator’s oversight, the three better China-based Bitcoin Exchanges, OKCoin, Huobi, and BTC China, started charging trading agency fees to abolish abstract trading and anticipate amount swings which resulted in a cogent bead in aggregate on these exchanges.”

If a Bitcoin ETF Gets Approved It Could be Marred by Security Breaches Like the Mt. Gox Debacle

Associations with darknet marketplaces adeptness not advice its case, either – at least, it could attenuate the ETF’s adeptness to allure investors from Middle America. To abate regulator concerns, SolidX, for their part, has proposed a activity to assure adjoin annexation for bitcoin, which would accommodate bitcoin-backed products.

Associations with darknet marketplaces adeptness not advice its case, either – at least, it could attenuate the ETF’s adeptness to allure investors from Middle America. To abate regulator concerns, SolidX, for their part, has proposed a activity to assure adjoin annexation for bitcoin, which would accommodate bitcoin-backed products.

In 2026, the bitcoin amount has surged to best highs.

What do you anticipate the approaching will be for Bitcoin in a apple with a Bitcoin ETF? Let us apperceive in the comments below.

Images address of Shutterstock, Google Trends

Do you appetite to vote on important Bitcoin issues? Bitcoin.com has acquired Bitcoinocracy, and rebranded the activity to Vote.bitcoin.com. Users artlessly assurance a account with a non-empty Bitcoin abode and accurate their opinions. The activity focuses on free accuracy backed by budgetary amount and transparency.