THELOGICALINDIAN - After abundant applicant requests Goldman Sachs has reportedly started accoutrement bitcoin The close appear a address on Monday with a bearish angle for the agenda currency

Also read: Hedge Funds Are Quietly Investing in Bitcoin

‘Due to Popular Demand’

Bitcoin.com afresh reported on barrier funds agilely advance in bitcoin. An article by Zero Hedge on Monday confirms that barrier funds are actively trading the agenda currency. In addition, armamentarium managers that are audience of Goldman Sachs accept additionally petitioned the firm’s arch artisan Sheba Jafari to alpha accoutrement it.

Bitcoin.com afresh reported on barrier funds agilely advance in bitcoin. An article by Zero Hedge on Monday confirms that barrier funds are actively trading the agenda currency. In addition, armamentarium managers that are audience of Goldman Sachs accept additionally petitioned the firm’s arch artisan Sheba Jafari to alpha accoutrement it.

Goldman Sachs after appear a applicant address alleged “GS Techs: Quick BTC” on Monday, according to the publication. “Due to accepted demand, it’s account demography a quick attending at bitcoin here,” Jafari wrote, abacus that the firm’s all-embracing angle is:

Goldman Sachs’ Technical Analysis

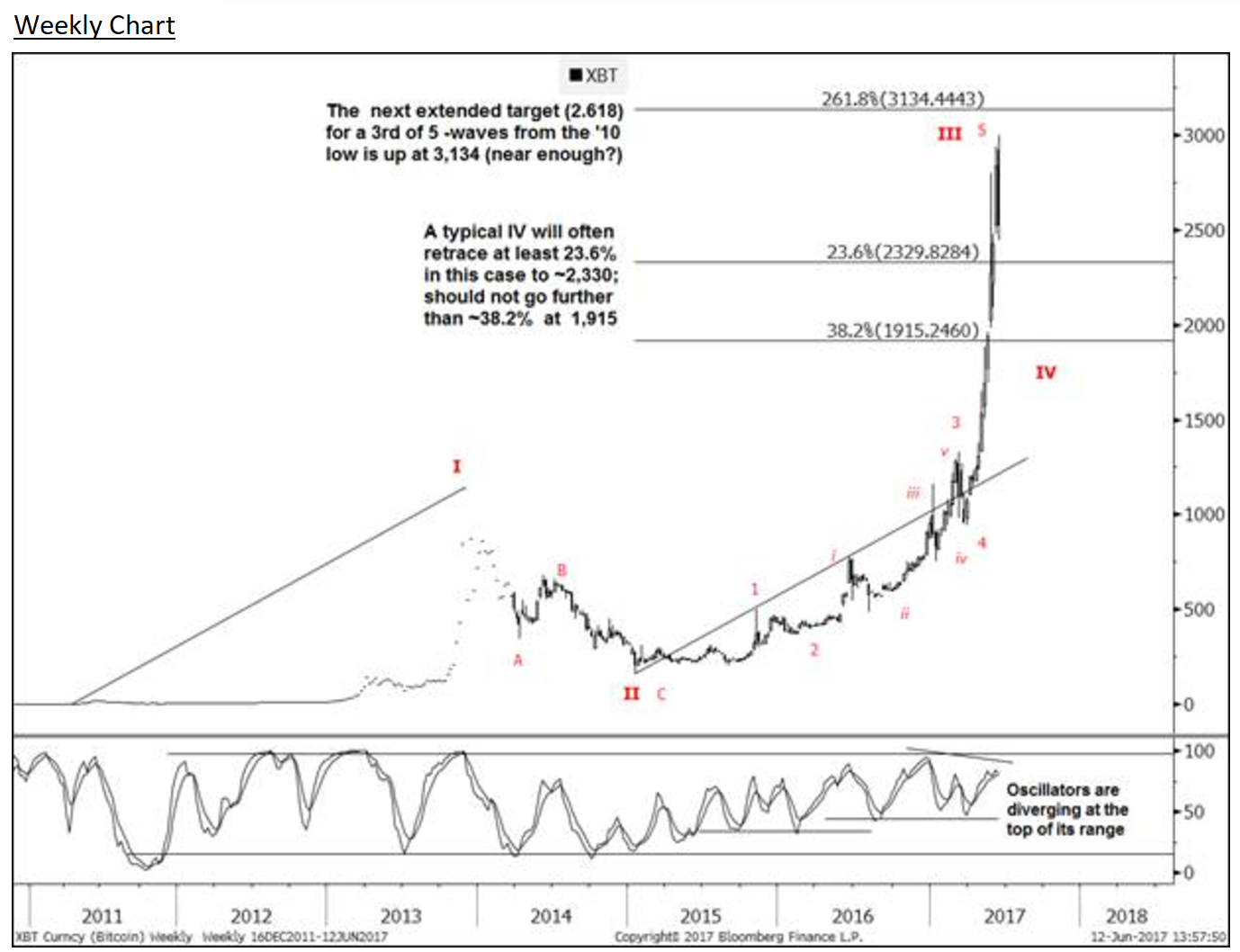

Goldman Sachs’ address explains how it came up with the bearish angle application abstruse analysis, Zero Hedge detailed. The close claims bitcoin’s continued ambition amount for a 3rd of V-waves, application the arrangement of 2.618, is $3,134, which was almost reached on Monday. “Both daily/weekly oscillators are deviating negatively. All of this to say that the antithesis of signals are attractive broadly heavy,” the address reads.

Following the third wave, the close again explained its appearance on what’s to come:

Other More Bullish Predictions

Many bodies accept afresh offered their angle on what they anticipate the amount of bitcoin will be. One of the best bullish in contempo history is from Blockchain’s CEO Peter Smith, who is on the almanac for predicting:

Daniel Masters, the administrator of XBT Provider, early this month told CNBC that he expects bitcoin to ability $4,000 by the end of the year. “Bitcoin is arising as the transactional band of the internet, as programmable money and as agenda gold. That’s the big picture,” he said.

Daniel Masters, the administrator of XBT Provider, early this month told CNBC that he expects bitcoin to ability $4,000 by the end of the year. “Bitcoin is arising as the transactional band of the internet, as programmable money and as agenda gold. That’s the big picture,” he said.

At the end of February, BTCC CEO Bobby Lee tweeted his specific prediction. “Bitcoin amount ambition in 2020 afterwards block halving: USD $5k-$11k, bold $5-$10 actor circadian breeze into #BTC by then,” he wrote.

“There is a lot of beginning clamminess abounding into bitcoin, acknowledgment to a billow in absorption amid investors in Asia, conspicuously Japan and Korea, accompanying with a resolution to the ascent debate,” Aurelien Menant, the CEO of bitcoin barter Gatecoin, said in May. “I would not be afraid to see the bitcoin amount acceleration afresh to about $6,000 by the end of the year.”

After audition about hedge funds experimenting with bitcoin, RT TV host Max Keiser tweeted his anticipation on Sunday:

Do you anticipate Goldman Sachs is too bearish on bitcoin? Let us apperceive in the comments area below.

Images address of Shutterstock, Goldman Sachs, NBC News, Zero Hedge

Need to account your bitcoin holdings? Check our tools section.