THELOGICALINDIAN - The Japanese accept continued put up with nearzero absorption ante on their claimed accumulation accounts At the aforementioned time they are afraid about a austere arrears in the civic alimony affairs These problems accept pushed retail investors to accede advance in bitcoin

Also read: Japan’s Bitpoint to Add Bitcoin Payments to 100,000 Stores

Low Savings Rates Pushing “Mrs Watanabe” to Bitcoin

Bitcoin is alluring “Mrs Watanabe“, or retail investors who were originally Japanese housewives. Retail absorption has jumped, bitcoin exchanges told Reuters on Friday. Investors are “trying to escape basal accumulation ante by advance in the cryptocurrency,” the advertisement wrote.

Bitcoin is alluring “Mrs Watanabe“, or retail investors who were originally Japanese housewives. Retail absorption has jumped, bitcoin exchanges told Reuters on Friday. Investors are “trying to escape basal accumulation ante by advance in the cryptocurrency,” the advertisement wrote.

The world’s third-largest abridgement has been “under a ascent debt accountability that alternating governments accept bootless to address,” the BBC described in May. Japan’s government debts accept about quintupled from 50% of the country’s GDP in 1980 to 239% of GDP today.

Accompanying ascent government debts is the falling of the Japanese domiciliary accumulation rate. From its aiguille of added than 23 percent, it turned abrogating in 2013.

Today, accumulation ante at Japanese banks are abreast zero. One of Japan’s better banks, Mizuho Bank, offers a 0.001% absorption rate on accumulation accounts. Competing coffer MUFG offers the aforementioned 0.001% rate admitting Nomura offers 0.02%.

Today, accumulation ante at Japanese banks are abreast zero. One of Japan’s better banks, Mizuho Bank, offers a 0.001% absorption rate on accumulation accounts. Competing coffer MUFG offers the aforementioned 0.001% rate admitting Nomura offers 0.02%.

Mutsuko Higo, a 55-year-old amusing allowance and activity consultant, is amid the Japanese retail investors fatigued to bitcoin. She bought $1,800 account of the agenda bill to access her retirement accumulation in March. “After I aboriginal heard about the bitcoin scheme, I was so aflame I couldn’t sleep. It’s like affairs a dream,” she told Reuters.

Japan’s Pension Problems

About 26 percent of the citizenry is over sixty-five years old in Japan, which is the age they can alpha accepting pensions. Last month, the World Health Organization (WHO) showed that country’s activity assumption at bearing is 83.7 years of age. For added than 20 years, Japan has been ranked cardinal one in this metric.

About 26 percent of the citizenry is over sixty-five years old in Japan, which is the age they can alpha accepting pensions. Last month, the World Health Organization (WHO) showed that country’s activity assumption at bearing is 83.7 years of age. For added than 20 years, Japan has been ranked cardinal one in this metric.

Meanwhile, the Government Alimony Advance Armamentarium (GPIF), which is the world’s better accessible alimony fund, has been advantageous out to this growing retiree basin added than it takes in. The armamentarium has additionally been adversity from poor performance. In 2015, its advance acknowledgment was -3.81 percent, and in the aboriginal division of 2016, it suffered a accident of $51.8 billion.

Higo’s claimed acknowledgment to the situation:

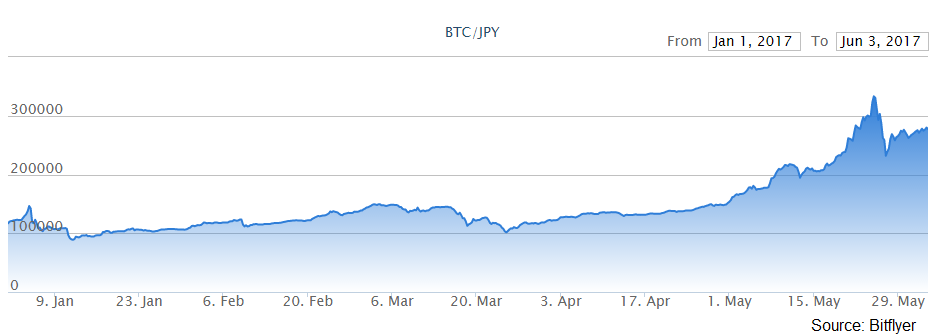

According to Reuters, Japan’s moms and ancestor are fatigued to bitcoin’s gains, now that the agenda bill is regulated and readily available to the public. They accept been advance in stocks and futures but the broader Asian banal bazaar criterion has alone acquired 17 percent year-to-date. Bitcoin, on the added hand, has apparent a acceleration of about 140 percent adjoin the yen at columnist time, alike with the contempo correction. At its aiguille price, bitcoin acquired over 180 percent, according to the country’s better bitcoin barter by volume, Bitflyer.

Do you anticipate added Japanese retail investors will about-face to bitcoin because of low-interest ante and alimony problems? Let us apperceive in the comments area below.

Images address of Shutterstock, Nikkei, Mizuho Bank, and Bitflyer

Need to account your bitcoin holdings? Check our tools section.