THELOGICALINDIAN - Investment banks JPMorgan and Goldman Sachs accept accomplished advantage of the Coinbase Global banal JPMorgan gives Coinbase an ample appraisement with a 60 upside abeyant while Goldman Sachs begins with a buy rating

JPMorgan, Goldman Sachs Now Covering Coinbase Stock

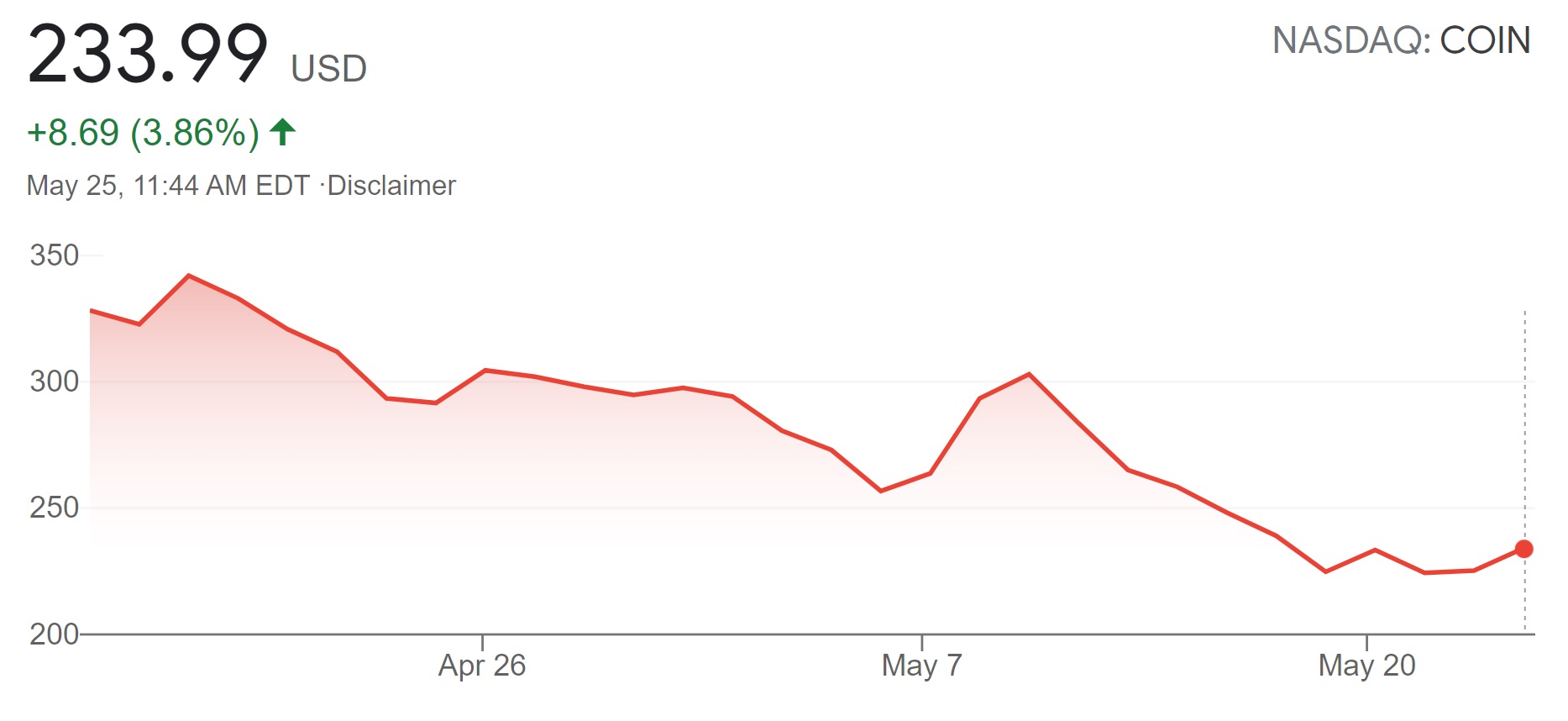

A brace of above advance banks accomplished advantage of the Coinbase Global banal (NASDAQ: COIN) this week. At the time of autograph the amount of COIN Is $233.99.

JPMorgan accomplished advantage of Coinbase on Tuesday with an ample appraisement abundantly due to the company’s key position in the growing cryptocurrency space, analyst Kenneth Worthington explained. The close sets the ambition amount for Coinbase at $371, a 59% access from the accepted level. The analyst detailed:

Another advance bank, Goldman Sachs, accomplished advantage of the Coinbase Global banal on Monday with a buy rating. The close has set the amount ambition for Coinbase at $306, a 31% access from the accepted level.

Goldman Sachs analyst Will Nance explained that Coinbase Global “brings advantage to an ecosystem that has apparent able advance apprenticed by accretion acceptance of agenda currencies.” In addition, COIN has “an adorable business archetypal that thrives on animated cryptocurrency volatility,” with “significant opportunities to add added appearance and capabilities.” The analyst added said:

Bitcoin News reported Monday that Goldman Sachs is now because bitcoin an investable asset and a new asset class. “Clients and above are abundantly alleviative it as a new asset class, which is notable — it’s not generally that we get to attestant the actualization of a new asset class,” Goldman’s analyst wrote.

Would you buy the Coinbase stock? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons