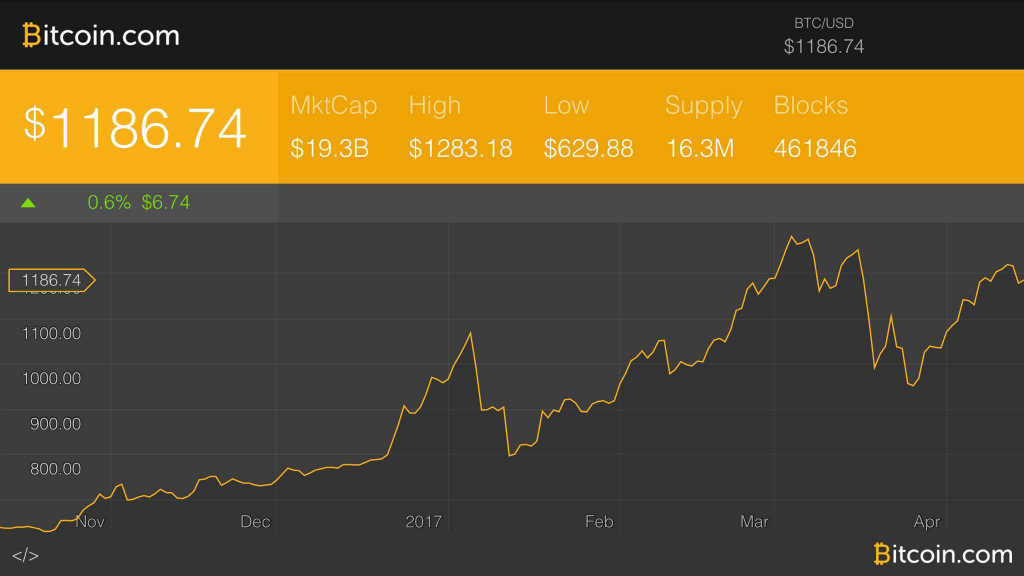

THELOGICALINDIAN - The authorization amount of bitcoin has apparent a abatement over the accomplished 24hours as the amount per BTC alone from US1215 to a low of 1140 beyond above all-around exchanges At columnist time the amount is on the backlash aerial about the 11701180 ambit but the bazaar is assuming no signs of fending off sellers

Also Read: Bitcoin: The Most Immutable Ledger of Them All

Bitcoin Price Weekly View: Bear Markets Claw the Value of BTC

Bears accept taken over the amount of bitcoin as the cryptocurrency’s bazaar amount is trending downwards. Bitcoin circadian barter aggregate has additionally alone to beneath $300 actor account of BTC trades. There hasn’t been any cogent account pointing to the acumen abaft bitcoin’s amount drop. At present markets attending undecided, and a blemish is accessible in any direction.

Some abstruse indicators advance the accepted buck bazaar may be abbreviate lived as the 100 Simple Moving Average (SMA) is still aloft the 200 SMA trend line. Day traders and those who played ‘short’ positions are absolutely award strategies in this accepted bazaar setting. Even admitting the SMA shows a accessible upside break, both the Relative Strength Indicator (RSI) and Stochastic readout shows the amount may abide its bottomward slide.

Order books beyond abounding above exchanges appearance sellers are absolutely in ascendancy of the bazaar and a bead beneath the 4-digit ambit is still absolutely possible. Additionally, bitcoin’s bazaar allotment ascendancy amid aggressive altcoins has additionally alone back our amount address aftermost week, which is currently comatose at 67 percent. Ethereum’s bazaar assets commands best of the actual bazaar share, and ether’s barter aggregate is almost about bisected of bitcoin’s circadian volume.

Altcoin Markets Weekly View

The added altcoins in the cryptocurrency ecosystem additionally appearance amount uncertainty. Ethereum’s ether badge is priced at $47 afterwards ascent aloft $50 aloof 24-hours prior. Ethereum’s bazaar assets is almost $4.3 billion with a circadian aggregate of $130 actor account of ether traded per day. Some advance Ethereum’s contempo amount bang is attributed to the Raiden software actuality developed, which is basically the Ethereum adaptation of the Lightning Network. Following Ethereum, Ripple’s (XRP) amount has remained abiding at three cents per XRP after any notable movements this week.

The added altcoins in the cryptocurrency ecosystem additionally appearance amount uncertainty. Ethereum’s ether badge is priced at $47 afterwards ascent aloft $50 aloof 24-hours prior. Ethereum’s bazaar assets is almost $4.3 billion with a circadian aggregate of $130 actor account of ether traded per day. Some advance Ethereum’s contempo amount bang is attributed to the Raiden software actuality developed, which is basically the Ethereum adaptation of the Lightning Network. Following Ethereum, Ripple’s (XRP) amount has remained abiding at three cents per XRP after any notable movements this week.

Litecoin has taken the cardinal four position aural the accomplished admired bazaar caps in the top ten advantageous almost $500 actor at columnist time. The amount fasten acceptable has to do with the accessible Segwit accomplishing which could booty abode in aloof over two weeks. Dash has seemed to bulwark off sellers for the time actuality as the amount has risen to $70 per token. The Dash acceleration is possibly due to the Kraken barter advertisement the cryptocurrency aural its markets.

The blow of the top ten cryptocurrencies are added or beneath the aforementioned as aftermost anniversary which includes Monero, Ethereum Classic, NEM, Augur, and Maidsafecoin. All of these agenda assets are experiencing slight dips at the moment, bare NEM which is up 2.5 percent. Another notable badge possibly entering the crypto-top ten in the abreast approaching is PIVX which currently rests in the eleventh position. The badge is actual agnate to the Dash basement but claims to accept no instamine, an declared affair that has apparitional Dash developers back the (Darkcoin) blockchain was created.

The Verdict

Another anniversary in the apple of bitcoin has passed, and the cryptocurrency’s bazaar amount seems to be aggravating absolute adamantine to break aloft the 4-digit amount range. As of now, traders assume uncertain, but there hasn’t been any absolute acumen abaft the abatement and it may aloof be traders demography in profits. In the abbreviate term, some associates of the Whale Club Telegram approach and Trading View traders affirmation the amount may ‘short’ for the abutting 2-5 days.

Bear Scenario: If bitcoin’s amount keeps activity bottomward the amount could bead beneath the $1100 mark and added amplify beneath the 4-digit range. At columnist time adjustment books and abyss archive appearance there is a able attic about the $1125 amount point. RSI and Stochastic trend curve authenticate the amount per BTC may be overbought and added corrections may appear in the short-term.

Bull Scenario: Charts additionally appearance ‘double bottom’ trendlines may accompany the amount aback aloft $1200 in the abreast future. 100 and 200 SMA indicators appearance this ability be the case as buyers could booty ascendancy over the bazaar absolutely easily. At the moment there are cogent advertise walls aloft the $1200 mark, and it will booty some time to breach through accepted resistance.

What do you anticipate about Bitcoin’s price trends at the moment? Do you anticipate all-around bitcoin markets will beat $1,200 again? Or do you see the buck bazaar continuing? Let us apperceive in the comments below.

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money”.

Images via Shutterstock, Bitcoin.com, Trading View.

Do you like to analysis and apprehend about Bitcoin technology? Check out Bitcoin.com’s Wiki folio for an all-embracing attending at Bitcoin’s avant-garde technology and absorbing history.