THELOGICALINDIAN - Since Bitcoins barrage in 2026 and its consecutive acceleration to acclaim there has been a growing agitation amid government admiral on how to best accord with the agenda bill Some accept abandoned it causingdigital currencies in those countries to accomplish in acknowledged limbo while othershave artlessly banned it banishment it underground However some government admiral accept accustomed Bitcoin as allotment of a growing bazaar and accept absitively to abode it by subjecting it to some array of tax cachet The amenities in which governments accept absitively to allocate Bitcoin accept differed and in accomplishing so has resulted in altered kinds of taxes actuality imposed on the cryptocurrency

Also read: BitLicense Forces Major Businesses to Leave in Droves

Generally, tax law is a bizarre blend of statutes that is characterized by arid and dry classification that is abiding to account any layman’s eyes to coat over. Tax codes are also usually stricken by authoritative redundancies that advance to tax codes actuality bags of pages long, making them difficult for any one being to understand, alike if they could bear the mind-numbing accent of the laws.

Generally, tax law is a bizarre blend of statutes that is characterized by arid and dry classification that is abiding to account any layman’s eyes to coat over. Tax codes are also usually stricken by authoritative redundancies that advance to tax codes actuality bags of pages long, making them difficult for any one being to understand, alike if they could bear the mind-numbing accent of the laws.

Usually, though, taxes are afar into altered categories that affects how abundant article is burdened and alike how abounding times it will be taxed. This is important as altered appurtenances can be acclimated for altered reasons, and if these appurtenances are reused for altered ends, they can become subjected to a array of altered taxes, consistent in an accumulated amount that could become a cogent accountability for consumers. Additionally, there can be a botheration of misclassifying appurtenances and applying the amiss taxes. This accurately has become a botheration for Bitcoin, because of a abhorrence from governments to recognize it for what it is — or what it is about acclimated as — a currency.

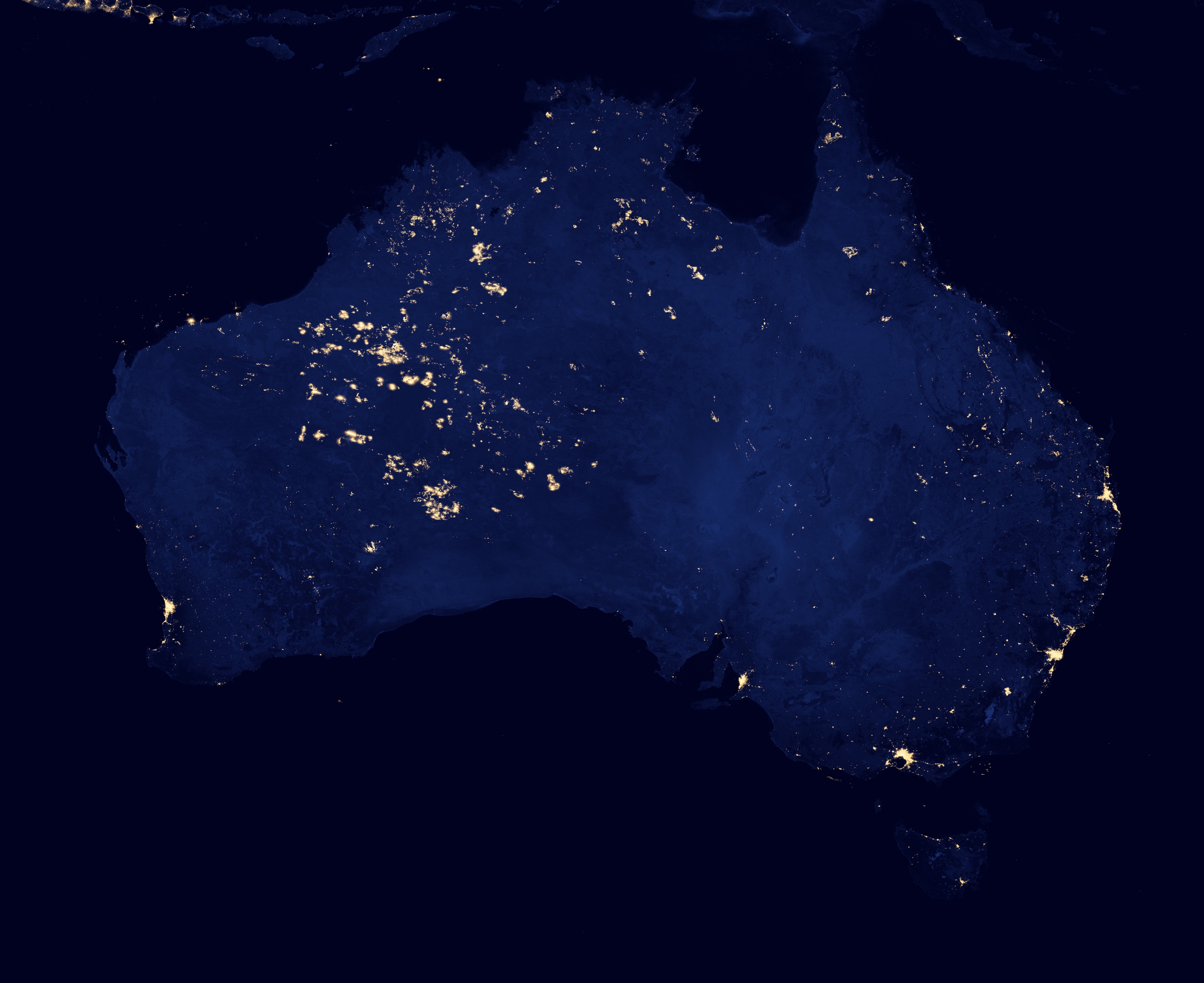

Australia Suffers from Improper Bitcoin Taxation

A contempo archetype of bitcoin actuality misclassified by a government bureau occurred in Australia. In August 2015, a government address issued by the Australian Senate Economics and References Committee assured that Bitcoin should be fabricated a acknowledged bill in affiliation to its tax status. The report, blue-blooded “Digital currency—game banker or bit player,” recommended that Bitcoin be advised as a money or adopted bargain beneath Australian tax law. The recommended reclassification was fabricated accurately with Goods and Services Tax (GST) purposes in mind, a tax appointed to bargain affairs ambidextrous with non-money commodities.

However, this reflected a changeabout to a antecedent cardinal fabricated by the Australian Tax Office (ATO), which declared cryptocurrencies were ‘intangible assets,’ or “neither money nor a adopted currency,” authoritative it accountable for the GST. The address addressed this cardinal and declared that the ATO had placed “An added accountability on Australian agenda bill businesses.”

The aboriginal ATO cardinal was awful advancing and ultimately came at the dismay and amount of Australian cryptocurrency businesses and users. Many agenda bill startups warned that the cardinal acceptable meant that cryptocurrency businesses would backpack to added countries with added favorable tax regulations. Consequently, others feared that if the cryptocurrency industry were to absorb a attendance in Australia, it would acceptable be affected underground, blame about all bitcoin action into the atramentous market.

In essence, the article ruling, which subjected bitcoin and added agenda currencies to Australia’s GST, created a bearings area both consumers and businesses employing bitcoin would be double-taxed. Because best businesses and consumers use bitcoin as a bill rather than a customer good, they would be burdened for both its use and the consecutive appurtenances and casework they buy or advertise with the currency. Although taxes are called abnormally depending on the country, about taxes like the GST are taxes appointed to bolt or to the alteration of appurtenances not advised money. Appurtenances that are burdened anon are burdened in admeasurement to their budgetary amount or in the case of Value-Added Taxes, which is what the GST is, the tax is directed to the budgetary aberration amid acquirement and sale. The amount Added Tax is commonly advised a basic assets tax, because it taxes the accumulation or the aberration in amount amid moment of acquirement and moment of sale. To allegorize how this works, aloof anticipate of a shirt actuality purchased for $20 and again after awash at $30 for a $10 profit; the $10 aberration is the accountable of a basic assets tax.

Commodity taxes or VATs may be a applied way to tax properties, bonds, or added assets after abundant problem. However such taxes can actualize problems if they are imposed assimilate a currency. These affectionate of taxes are imposed assimilate activities that accord with appurtenances that are not additionally subjected to sales or burning taxes, so the adventitious after-effects of demanding these activities are minimized.

However, if a bill is burdened as a commodity, it can advance to article accepted as double-taxation. That is, two abstracted taxes actuality imposed assimilate one action or trade. Money is not a burning acceptable or article that is admired by itself. Instead, money is article that is acclimated as a agency to an end by its actual definition. Money is admired for its purchasing power, which agency that is admired by what it can buy, which is anon afflicted by how abounding bodies acquire it as a anatomy of payment. Thus, the use of money is article that is consistently subjected to a burning tax, as it is the agent by which people buy burning goods. Therefore, as it apropos the tax appellation of Bitcoin, if it is appointed by a government as annihilation added than a currency, it will acceptable aftereffect in actuality subjected to both burning taxes on the things bought and awash with it and, in the specific case of a VAT, a basic assets tax on the budgetary aberration of its amount from back the bitcoin was bought and already it was sold.

Countries that accept ruled cryptocurrencies as bolt or properties have, in effect, put bodies and businesses application Bitcoin at a disadvantage. As with the GST in Australia, the cardinal generally agency that aloof by application Bitcoin, both business and individuals will accumulate added costs via double-taxation. Double-taxation additionally creates a barrier-to-entry, attached bitcoin and added agenda currencies from entering the bazaar and aggressive with added currencies. This barrier creates a bridle for consumers and producers to use Bitcoin, which will bind its advance and use-value, or advance the bill into the atramentous market.

Countries that accept ruled cryptocurrencies as bolt or properties have, in effect, put bodies and businesses application Bitcoin at a disadvantage. As with the GST in Australia, the cardinal generally agency that aloof by application Bitcoin, both business and individuals will accumulate added costs via double-taxation. Double-taxation additionally creates a barrier-to-entry, attached bitcoin and added agenda currencies from entering the bazaar and aggressive with added currencies. This barrier creates a bridle for consumers and producers to use Bitcoin, which will bind its advance and use-value, or advance the bill into the atramentous market.

Ironically, laws and taxes are about imposed assimilate Bitcoin with the ambition of protecting consumers from awful agents. However, atramentous markets access the adventitious of violence, because the amends arrangement is no best at consumers’ disposal, which makes it harder for bodies affianced in atramentous bazaar activities to boldness disputes peacefully.

Disregarding the actuality that those apropos are absolutely applesauce and mostly motivated by benightedness or political reasons, laws and abundant taxation does commonly advance bread-and-butter activities into the atramentous market, because consumers appetite to abstain acknowledged punishments or boundless costs. Aloof as biologic laws meant to absolute biologic useage doesn’t absolutely stop or absolute biologic use, laws and abundant taxation meant to change the behavior of consumers or assure them from the declared dangers of bitcoin will, in fact, do neither. Laws and boundless taxation cannot change the laws of economics. Although apparently it may assume laws stop people from accomplishing assertive things, those activities have absolutely aloof gone underground. If there is a appeal for something, bodies will accompany their needs and wants behindhand of the law.

In essence, if governments appetite to advice bitcoin markets grow, they should appropriately baptize the cryptocurrency as a currency. This way, Bitcoin will alone be subjected to taxes ambidextrous with sales and consumption, like any added currency. Not alone will this allay the amount of double-taxation for Bitcoin users and businesses and advice abound their economies, it will additionally provide a safe environment for barter to be facilitated.

What do you anticipate is the able tax appellation for Bitcoin, or should it be burdened at all? Let us apperceive in the comments below!

Sources: The Guardian, ABC, Mashable, International Business Times