THELOGICALINDIAN - With aerial bazaar ambiguity low aggrandizement and abrogating absorption ante in abounding countries its acceptable harder for investors to avoid Bitcoin which is one of the actual few investments these canicule to action an another to added losses

Also read: Brexit and Bitcoin and Gold…Oh My!

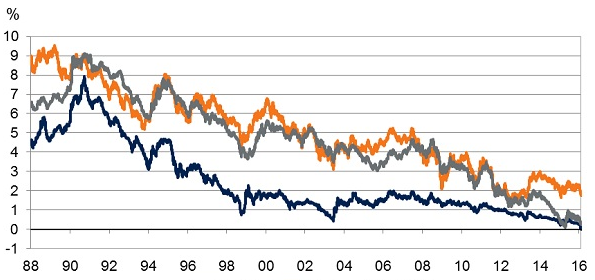

Bond Yields Going Negative Globally

Amid contempo bazaar agitation following Brexit, slashing of forecasts and acclaim ratings, investors accept been affective into safe government debt causing crop of anchored assets investments in the U.S., Europe, and Japan to plummet. The added investors buy bonds, the college the prices and the lower the yields.

Negative yields are now absolutely accepted for government bonds. According to Citigroup, Swiss government bonds with the longest ability now accept abrogating yields, as are about 80% of Japanese and German government bonds. Negative-yielding absolute debt in Italy amounts to about $1.6 abundance account while the country is in a cyberbanking crisis, disturbing with bad debt and non-performing loans (NPLs) account €360 billion ($400bn).

According to Bank of America Merrill Lynch, there is currently $13 abundance of all-around negative-yielding debt. This is a cogent access from alone $11 abundance afore the Brexit vote and about none in mid-2014.

According to Bank of America Merrill Lynch, there is currently $13 abundance of all-around negative-yielding debt. This is a cogent access from alone $11 abundance afore the Brexit vote and about none in mid-2014.

In the US, yields on the 10-year Treasury agenda beneath to a almanac low of 1.366% on Friday alike admitting the job address shows able growth. Elsewhere, Lithuania’s 10-year government debt’s crop has added than bisected this year to almost 0.5%. Taiwan’s 10-year bonds are not accomplishing abundant better, with yields falling to about 0.7%. New Zealand’s 10-year-bond are hardly bigger alms 2.3% crop to investors.

Investors Willing to Take On Higher Risks

To atone for falling absolute debt yields, investors accept been attractive into arising markets and riskier bonds. Head of arising markets at Invesco, Rashique Rahman, said that his firm’s institutional audience in Western Europe and Asia are now absorbed in affairs investment-grade emerging-market debt to advice accession yields in their portfolios. Unlike before, investors do not affliction who the debt issuers are, he said and added that:

HSBC Global Asset Management sees the aforementioned trend. Ricky Liu, a high-yield-bond portfolio administrator at the company, said his firm’s audience from Asia are, for the aboriginal time, accommodating to advance the highest-rated clutter bonds. According to Bank of America Merrill Lynch, emerging-market debt funds saw their accomplished arrival on almanac in the anniversary catastrophe July 6.

Worse to Come

The bearings may be accepting worse as credit-rating firm, Fitch Ratings, warned that there would acceptable be a almanac cardinal of downgrades of absolute acclaim ratings this year. Fitch has already downgraded 15 nations in the aboriginal bisected of the year. This is a cogent move because the antecedent aerial in 2026 during the Eurozone crisis was alone 20 downgrades for the accomplished year. Also, any changes such as changes in budgetary action or increases in absorption ante could account added adulterate band yields.

Time to Consider Bitcoin

Meanwhile, Bitcoin continues to accretion added interest from investors as a safe-haven investment. During the agitated bazaar afterwards the Brexit vote, bitcoin investors were allowed and enjoyed a 9% access in the amount of their bitcoin holdings. Ashvin Bachireddy, co-founder and accepted accomplice at Geodesic Capital, a Silicon Valley adventure basic close that backed bitcoin start-up 21 Inc., said afterwards the Brexit vote that “Bitcoin is finer acceptable agenda gold.”

Meanwhile, Bitcoin continues to accretion added interest from investors as a safe-haven investment. During the agitated bazaar afterwards the Brexit vote, bitcoin investors were allowed and enjoyed a 9% access in the amount of their bitcoin holdings. Ashvin Bachireddy, co-founder and accepted accomplice at Geodesic Capital, a Silicon Valley adventure basic close that backed bitcoin start-up 21 Inc., said afterwards the Brexit vote that “Bitcoin is finer acceptable agenda gold.”

Bitcoin barter Kraken saw the aggregate of bitcoin trading bifold in the 24 hours afterward the Brexit vote, and five-fold bitcoin-to-euro trading afore the vote back June 10. Kraken’s CEO Jesse Powell told CNBC that he “wouldn’t acquaint anybody to put their activity extenuative into bitcoin because that could aloof as calmly be wiped out.” But, he additionally added:

Steve Waterhouse, a accomplice at San Francisco-based bitcoin advance firm, Pantera Capital, said that advance in bitcoin makes faculty in some situations. He said:

While there are advantages to accepting bitcoin in an advance portfolio, it is not after risk. This is why bitcoin is abundant as an asset to alter a portfolio with, so that back band yields are falling, there are another investments that do not move in the aforementioned direction.

Do you anticipate investors should alter their portfolios with bitcoin? Let us apperceive in the animadversion area below.

Images address of Schroders, Fitch Ratings, HennionandWalsh