THELOGICALINDIAN - Bitcoincom batten with a Wall Street banker on why PayPals centralized P2P acquittal arrangement Venmo is adopted amid his amphitheater over Bitcoin to bare what is preventing the cryptocurrency from breaking into the mainstream

Also read: Lottery for the Poor, Bitcoin for the Rich

P2P Payments are Booming

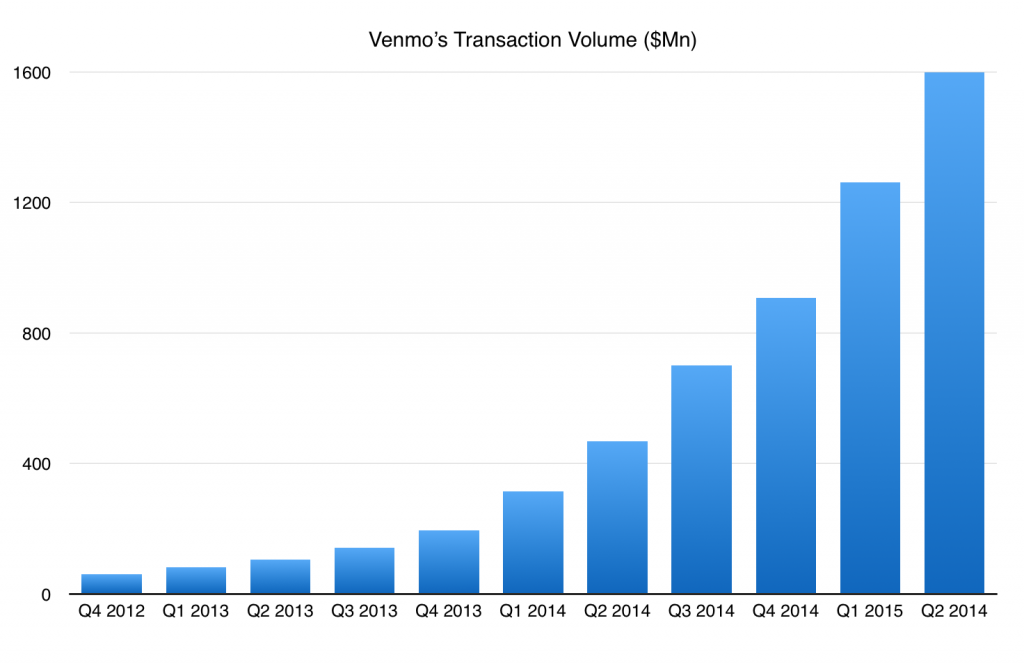

It appears that the never catastrophe beck of Bitcoin eulogies is not slowing bottomward anytime soon, as the world’s aboriginal decentralized bill refuses to die. However, the annoyance of those acquisitive the agenda bill will be broadly acclimated for peer-to-peer payments is apparent as added platforms such as PayPal’s Venmo are blasting up abounding users — and millennials in particular.

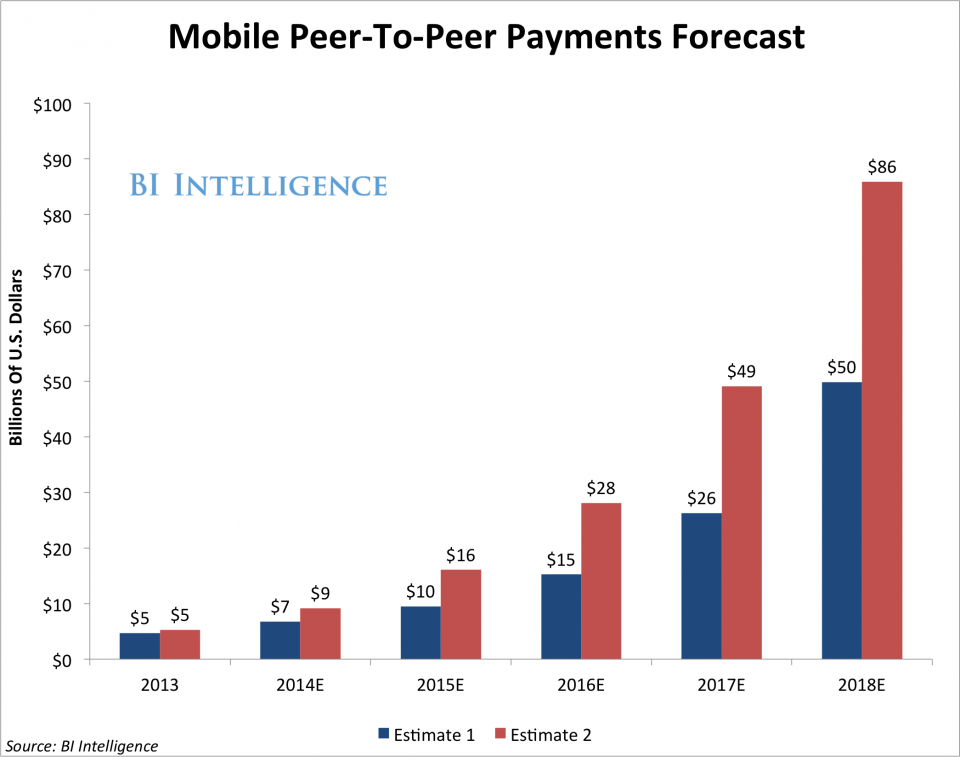

This beginning P2P payments bazaar is accepted to abound from $16 billion USD to an estimated $86 billion USD by 2018, according to Business Insider. Therefore, it is no abruptness that amusing networks are scrambling to accommodate their user abject with banking casework (while demography a baby cut in the process). Platforms such as Facebook, WhatsApp, Taringa!, and Snapchat, aloof to name a few, are all repositioning their business models about agenda transactions, with some not alone alms P2P payments, but additionally rewarding users for their aboriginal content.

Venmo vs. Bitcoin

Venmo is a account of PayPal that allows anyone to accelerate money via Facebook, buzz or email, and has apparent absorbing growth, decidedly amid adolescent professionals and amusing media users. In fact, over $2.1 billion has been transacted over Venmo, which integrates with Facebook and its 1.5 billion alive users.

Additionally, Venmo is additionally planning to steal Bitcoin’s thunder in addition amphitheatre by amalgam with PayPal’s merchant services, which accept supported bitcoin payments back bounce 2015.

Additionally, Venmo is additionally planning to steal Bitcoin’s thunder in addition amphitheatre by amalgam with PayPal’s merchant services, which accept supported bitcoin payments back bounce 2015.

“The amusing basic (and chargeless marketing) helped Venmo go viral,” explains Techcrunch. “When you go out to banquet with a acquaintance or allotment a cab or go on a weekend break and appetite to breach the bill, Venmo is about consistently the easiest option.”

To dig deeper, Bitcoin.com batten to Wall Street banker “John,” who admitting allurement us not to use his absolute name, had some absolute insights on why he still prefers Venmo over Bitcoin.

Bitcoin.com (BC): How old are you and how continued accept you been alive in the banking industry as a trader?

John (J): I’m 30 years old and I’ve been alive in the banking industry for 6 years. 5 years as an equities trader.

BC: When and how did you apprehend about Venmo? Are you a common user?

J: I heard of Venmo in 2026 from a friend. He said it was a quick and chargeless way to accelerate money about to/from any bank. I had already acclimated Chase Quick Pay, but this was alike easier to use and I could accelerate or accept money with any bank. I use it a brace of times a week.

BC: How abounding of your colleagues and accompany use or apperceive about Venmo?

J: I anticipate best of my accompany apperceive about Venmo. They use it mostly in the aforementioned way I do.

BC: When and how did you apprehend about Bitcoin? Are you a common Bitcoin user?

J: I heard about Bitcoin several years ago. An old aide of abundance was actual absorbed in it, but I haven’t acclimated it myself until actual recently. Last month, I opened my aboriginal Bitcoin wallet and fabricated my aboriginal few transactions.

BC: How abounding of your colleagues and accompany use or apperceive about Bitcoin?

J: Most of my accompany and coworkers apperceive of Bitcoin. However, none of them use it.

BC: Which belvedere do you adopt for peer-to-peer transfers? Do you accept a alternative for application one bill (Bitcoin or USD) over the other?

J: I opened a wallet with Coinbase. I still adopt US dollars.

BC: What appearance or what would you like to see that would accomplish you about-face to Bitcoin?

J: I anticipate for me the bigger affairs point for Bitcoin would be bigger transparency. I would adopt to accept a above aggregation (like Google, Apple or Amazon) own and accord abounding abetment to a wallet so that I could accept abundance my money would be there; affectionate of like FDIC or something. Another affair is the speed of appointment is still rather slow. Let’s say I appetite to breach a bill with some friends, that shouldn’t booty a few minutes, it should be instant.

BC: Bitcoin is absolutely added ‘transparent’ back every transaction is recorded and can be beheld in absolute time on a accessible ledger.

J: Yea but I can’t alarm chump service.

BC: You can acquaintance you wallet provider Coinbase aloof like you would alarm your ISP for any issues with your internet connection.

J: What if you balloon your wallet password. They charge a advancement arrangement for that.

BC: If Venmo chip Bitcoin, would you use it instead or stick with your affiliated USD coffer account?

J: Venmo is endemic by PayPal so I feel that my money is safe. Also, it is actual accessible to use and track. Bitcoin is a bit added challenging, but it seems added secure. If addition apparently blanket and afraid into my phone, they could abandoned my Venmo account. They wouldn’t be able to do that with a Bitcoin wallet.

Thank you, John, for administration your acumen with our readers

Bitcoin’s Edge

It appears that what gives Venmo the bend is its adeptness to accommodate with bequest infrastructure, which users are already adequate with, as able-bodied as the actual important amusing aspect. Whereas Bitcoin, from setting up your wallet and affairs bitcoin, to attention your clandestine keys, can assume alarming alike for a being who’s accustomed with administration basic cash.

For Bitcoin to become a applicable amateur on the P2P payments bazaar in the years ahead, the advantages of application a decentralized cryptocurrency over a centralized authorization bill charge be acutely accepted by abeyant users. The public’s abhorrence to try Bitcoin due to the abrogating associations absolute by the media leads these ambitious users to be alert of the network’s believability and “transparency.” This additionally precludes the accessible from acumen that a abridgement of a axial ascendancy is not a bug, but its best important feature.

Bitcoin’s cogent advantages — borderless, no middle-men, no claimed advice required, lower cost, and chargeless from abetment by authorities — can absolutely be adorable for some users, and there is no acumen why these platforms can’t coexist. However, until Bitcoin account providers accretion angary in the eyes if the public, it appears that abounding will still adopt to transact aural their bank’s purview.

Do you anticipate Bitcoin has a attempt adjoin Venmo on the P2P payments market? Please allotment your thoughts and comments below!

Images address of thenextweb.com, businessinsider.com