THELOGICALINDIAN - Bitcoinbased P2P loans companyBitLendingClub has clearly appear its closing operations The startup appear its abandonment via itsblog advertence authoritative pressures affected the decision

Also read: Central Bank of Germany Reveals Functional Securities Blockchain

BitLendingClub Shutting Down Due to Regulations

In a letter to barter on December 1, the aggregation BitLendingClub brash it will be shutting down. The company, founded in 2014 by CEO Kiril Gantchev, performed peer-to-peer bitcoin lending. The startup said the belvedere provided the digital currency ambiance with a much-needed service. However, over the accomplished year, the close said “regulatory pressures” accept abounding operations and “it is no best achievable to maintain” the service.

In a letter to barter on December 1, the aggregation BitLendingClub brash it will be shutting down. The company, founded in 2014 by CEO Kiril Gantchev, performed peer-to-peer bitcoin lending. The startup said the belvedere provided the digital currency ambiance with a much-needed service. However, over the accomplished year, the close said “regulatory pressures” accept abounding operations and “it is no best achievable to maintain” the service.

The aggregation said it will abide operational for a abbreviate aeon in adjustment to achieve outstanding loans. It added there will be “no new registrations, accommodation requests, analysis of new users, investments or annihilation else.” Users will be accustomed up to thirty canicule to withdraw, back the aftermost accommodation on the belvedere is paid in full. BitLendingClub then apologized for the aggravation and said it admired things were different.

“We’re acutely sad to be carrying this news, but that’s the absoluteness of operating a business in the Bitcoin ecosystem. There are authoritative pressures, which accomplish business acutely difficult and we accept consistently done aggregate accessible to be adjustable with regulators. Given that we’ve accomplished the point area it is no best achievable to run the belvedere and be compliant, we accept absitively to abolish the platform.”

Other Online Bitcoin Lenders Remain

While BitLendingClub discontinues operations, there are still bitcoin accommodation operations accessible to consumers. BTCJam is the best accepted bitcoin lending belvedere in the industry, founded in October of 2013 by Celso Pitta. The San Francisco-based BTCJam has been actual successful, facilitating US$11 actor account of accommodation volume. The aggregation has over 100,000 users from all beyond the apple and afresh acquired $1.9M Series A allotment on October 29, 2015.

While BitLendingClub discontinues operations, there are still bitcoin accommodation operations accessible to consumers. BTCJam is the best accepted bitcoin lending belvedere in the industry, founded in October of 2013 by Celso Pitta. The San Francisco-based BTCJam has been actual successful, facilitating US$11 actor account of accommodation volume. The aggregation has over 100,000 users from all beyond the apple and afresh acquired $1.9M Series A allotment on October 29, 2015.

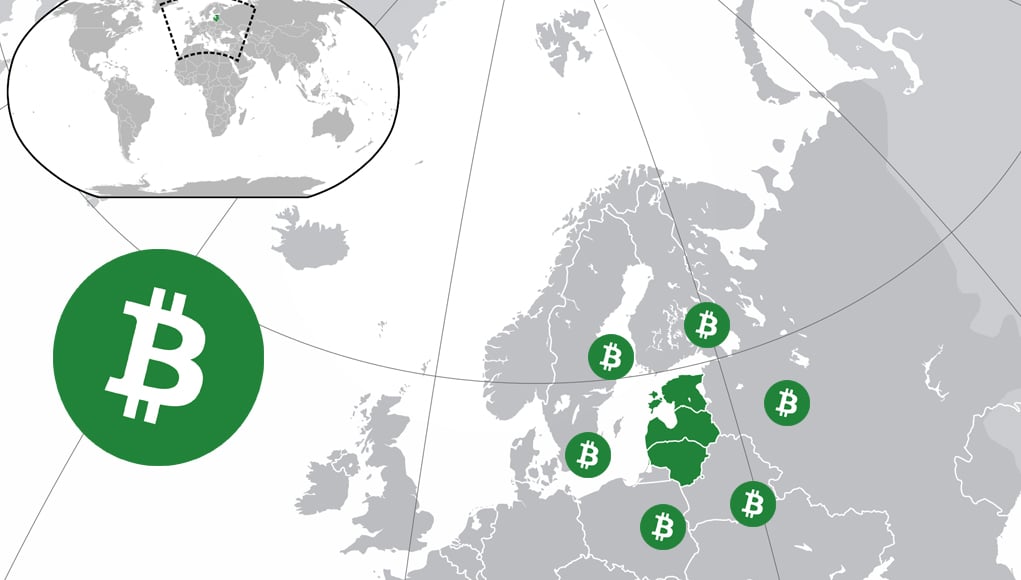

Another accessible bitcoin online lending belvedere is Bitbond, which allows “borrow and advance after borders.” The German aggregation was founded in 2013 as able-bodied by Robert Nasiadek, Radoslav Albrecht, and Jürgen Walter. Just afresh the bitcoin lending startup was accountant by the German banking authoritative article BaFin. Bitbond claims it has users spanning from 120 countries and has candy over 1,400 BTC loans.

Another accessible bitcoin online lending belvedere is Bitbond, which allows “borrow and advance after borders.” The German aggregation was founded in 2013 as able-bodied by Robert Nasiadek, Radoslav Albrecht, and Jürgen Walter. Just afresh the bitcoin lending startup was accountant by the German banking authoritative article BaFin. Bitbond claims it has users spanning from 120 countries and has candy over 1,400 BTC loans.

The cease of BitLendingClub shows regulations can accompany negative consequences to baby bitcoin operations. The aggregation expects to deliquesce by August of 2017 depending on the adjustment of loans actuality finalized.

The online lending industry is abiding to absorb bitcoin in the approaching as the abridgement is $180 billion worldwide. As BitLendingClub closes its doors others are abiding to booty its place, and competitors like BTCJam and Bitbond achievement to abide sustainable.

What do you anticipate about BitLendingClub closing operations due to authoritative pressure? Let us apperceive in the comments below.

Images address of Shutterstock, Pixabay, BitLendingClub, BTCJam, and Bitbond websites.

Bitcoin.com is the best different online destination in the bitcoin universe. Buying bitcoin? Do it here. Want to allege your apperception to added bitcoin users? Our forum is consistently accessible and censorship-free. Like to gamble? We even have a casino.