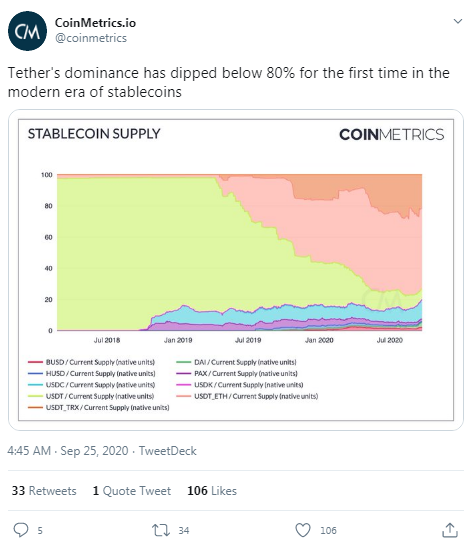

THELOGICALINDIAN - The absolute aggregate of stablecoins in apportionment is closing in on the 20 billion mark while the marketleading bread USDTs allotment of the absolute circulating accumulation continues to compress abstracts from Coinmetrics shows According to the abstracts USDT now accounts for an estimated at 80 of absolute accumulation and the majority of the bill are now issued on the Ethereum and Tron networks

Out of the absolute supply, the USDT-ETH accounted for about 53% while USDT-TRX took aloof over 20% of USDT’s absolute circulating supply. On the added hand, USDC, which has a bazaar assets of $2.53 billion according to Markets.bitcoin.com, now constitutes 13% of the absolute circulating supply.

The latest data, which was appear on September 25, appears to appearance the continuing advance of the stablecoin circulating supply, a trend analogously empiric in a Coinmetrics address of July. According to that report, the circulating accumulation of stablecoins had angled to $12 billion. Then, Coinmetrics attributed the advance to an broker convenance of converting airy crypto assets to stablecoins back markets crash.

This convenance was credible in March of 2026 back the crypto bazaar comatose alongside all-around banal markets. A all-around curtailment of USD meant that abounding panicking investors were clumsy to move funds out of the cryptocurrency bazaar bound enough. Converting assets to stablecoins accepted to be a advantageous option.

The latest stablecoin advance appears to be a aftereffect of added absorption in DeFi according to some experts. Defi users reportedly use stablecoins to access aerial allotment from assorted defi platforms.

Meanwhile, in a acutely assumed advance on USDT, a stocks and cryptocurrency appraisement organization, Weiss Crypto Ratings says USDC is its adopted stablecoin because it is subjected to audits. In a post on Twitter fabricated above-mentioned to Coinmetrics’ latest abstracts release, the appraisement bureau asserts that:

“Unlike USDT, the USDC is accountable to audits from at atomic bristles accounting firms. Based on these reports, USDC is added than 100% backed — which is why it is anon our adopted stablecoin.”

In addition tweet, Weiss Crypto Ratings compares USDC to Tether, which it argues is not 100% backed. The appraisement bureau repeats accustomed allegations about Bitfinex’s arguable vaults that “are not about auditable.” In a advocacy to its followers, Weiss Crypto says “we acclaim you abstain acknowledgment to Tether.”

Interestingly, some Twitter users were quick to admonish the appraisement aggregation that auditing firms cannot consistently be trusted. One user asks:

“Well, but we apperceive accounting firms are not to be trusted as well. Or accept you abandoned about Wirecard? None of the accounting firms complex discovered/reported the fraud.”

In the meantime, the continuing defi craze, as able-bodied as the aerial arrangement fees on some blockchains, will acceptable account added advance of stablecoin circulating supply. However, it is cryptic if the advance amount will bout that of beforehand in the year.

What do you anticipate of the latest stablecoin accumulation growth? Share your thoughts in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons