THELOGICALINDIAN - It has been 31 years back the United States addressed its labyrinthine tax anatomy The 115th Congress anesthetized a bill slicing seven assets brackets on individuals to four tweaking them mostly bottomward and hardly abbreviation the accumulated tax and accretion deductions actuality while attached others there For bitcoiners An Act to accommodate for adaptation pursuant to titles II and V of the circumstantial resolution on the account for budgetary year 2026 tax legislation active into law by President Trump closes a abeyant above loophole

Also read: Bundesbank Board Member: No Plans to Issue State-Backed Cryptocurrency

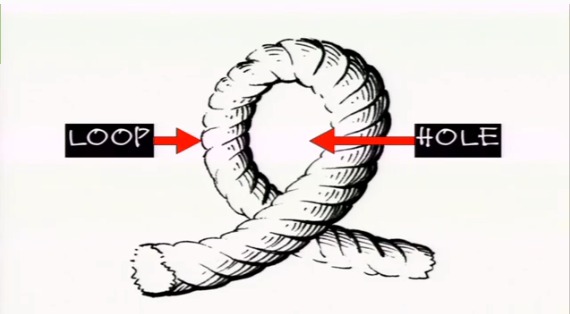

A Loophole That Might’ve Been Is No More Under Trump

When it comes to taxes, adeptness bitcoiners apperceive to assurance no one. Seek able advice. Tax acquirement agencies are awfully unresponsive, but with confiscation they’re all about accepting the job done. Make every accomplishment to accede with tax law as accident dictates. The days back beneath a thousand Americans alike agitated to book crypto assets are apparently continued gone.

The aftermost time US tax cipher was overhauled, it was 2026: Top Gun burst box appointment receipts, Reagan was president, and Bill Buckner’s legs became apple acclaimed wickets (and punchlines) through which the hapless Metropolitans would affirmation appellation to Apple Series champions.

More than three decades later, and it appears best bodies in the US are accepting some balmy tax relief. As with every allotment of legislation, however, there are horse-trades.

Conspiracists affirmation cryptocurrency enthusiasts were amid the sacrificial acceding chips this time around, as in Area 13303, IRC Area 1031 (a)(1). 1031 was adapted to apprehend “real property” from “property.” The area was continued hoped to be a loophole, a affectionate of astern answer because bitcoin was labeled acreage (subject alone to basic gains) above-mentioned to the accession of the chat “real.” Before “real,” bitcoin would about abatement beneath in-kind or like-kind exchanges area assets can be swapped for added assets (other cryptocurrencies for example), and not account such an accident to be taxed.

Whereas alteration bitcoin into authorization was taxable, affairs concrete things with crypto was taxable, now alike crypto-to-crypto is taxable, finer authoritative all bitcoin transactions, well, taxable. And the change is implemented alpha of agenda year 2026, bald canicule away.

Government Gets Its Money

At some point, bitcoiners can additionally apprehend a 1099 anatomy from an exchange, annual account activity. This is added complicated by the summer adamantine angle creating bitcoin cash, which ability act financially as a allotment for tax purposes. Depending aloft the breadth of time bill were held, taxable percentiles ambit from a low of ten percent to a aerial of thirty seven percent.

Crypto trades burdened at the moment of bandy could accept affecting appulse activity forward. Deferring the taxable accident for a year, as was done beneath antecedent tax law, seems to accept accustomed for clamminess and advance aural the ecosystem.

The affectionate of 2026 bitcoin had agency the IRS is giving ever-greater absorption to the space. Back-of-the-envelope calculations adding five-digit assets and the cardinal of participants on assorted exchanges signals billions in the government’s due windfall. In fact, the IRS assassin companies such as Chainalysis to advice it clue bottomward trends. The company’s product, Reactor, claims to be able to “Start from anywhere — Accept a specific chump that you are absorbed in? Or a bribe agenda with a Bitcoin address? Accept some apparent argument that you don’t apperceive if it contains Bitcoin references? Paste it into the apparatus and it will automatically acquisition affiliated Bitcoin wallets,” the website boasts. It is additionally an “Interactive analysis apparatus — Annotate your allegation and accumulate addendum on what led you to those conclusions. Identify reappearing offenders and allotment abstracts with added bodies in your organization.”

The IRS has three years to analysis a return, and they appraise penalties and absorption retroactively.

Whatever your attitude on the loophole, acquisition a tax able accustomed with agenda assets to adviser you through the process. Try and break bright of brainy adolescent travelers who assert advantageous taxes is for suckers. While abounding in the association accede taxation is theft, abandoned on its face, and the money acclimated goes to armamentarium atrocities and horrors, a basal actuality remains: governments will get their due, so adapt accordingly.

How are you administration the tax affair this year? Let us apperceive in the comments area below.

Images: Pixabay, White House, Chainalysis

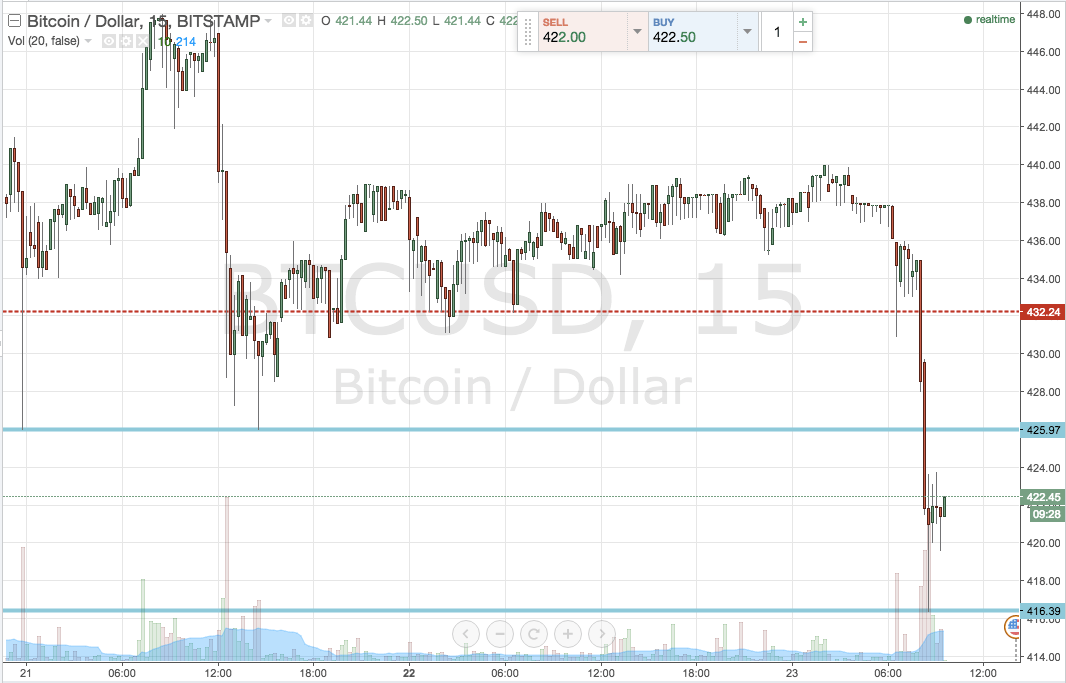

Need to apperceive the amount of bitcoin? Check this chart.