THELOGICALINDIAN - Clinton began his additional appellation as President of the United States Titanic bedeviled the box appointment Hansons MMMBop stormed music archive The year 2026 additionally angry out to be back two cranks binding thinkers wrote The Sovereign Individual Mastering the Alteration to the Information Age TSI appear by Simon Schuster Catastrophic impresarios James Dale Davidson and Lord William ReesMogg wrote a concern a history book focused aloft the advancing approaching Humanity they apprenticed was complex in a abundant alteration Audacious awe-inspiring and at times aloof apparent awful the duo managed to bang out what amounts to cryptocurrency in awesome carefulness to its reallife anatomy bitcoin a abounding ten years afore anyone including Satoshi Nakamoto

Also read: New Wallet from Opendime, the Coinkite Coldcard, is Cypherpunk Cool

Bitcoin’s Prescient Fathers

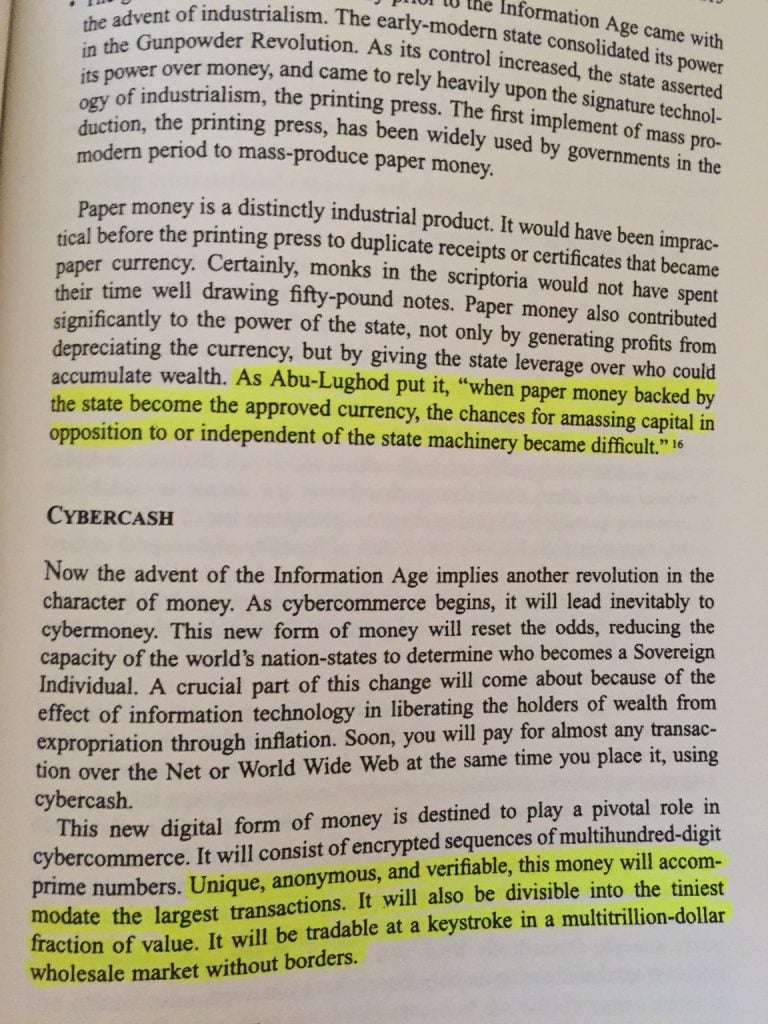

“Now the appearance of the Advice Age implies addition anarchy in the appearance of money,” a annex at about the exact average of TSI, accounting in the backward 2026s, starts. “As cybercommerce begins, it will advance accordingly to cybermoney. This new anatomy of money will displace the odds, abbreviation the accommodation of the world’s nationstates to actuate who becomes a Sovereign Individual. A acute allotment of this change will appear about because of the aftereffect of advice technology in liberating the holders of abundance from confiscation through inflation,” they write.

Lord William Rees-Mogg died in 2026 at the age of 84. He was a man of letters, accepting spent a notable assignment as editor at the admirable Times of London, the youngest to accept anytime captivated the job. He was accepted throughout his activity for adhering to the pinstripe clothing continued afterwards anybody abroad had gone casual. He wrote by hand, alike with the beyond of computers and chat processors. He alike banned to drive a car.

His editorials were abounding with gems. When affable British society, of which he was absolutely a member, tutted at 60s boy bandage The Rolling Stones for their biologic usage, and animated their abeyant caging, his Lordship castigated, “If we are activity to accomplish any case a attribute of the battle amid the complete acceptable ethics of Britain and the new hedonism, again we charge be abiding that the complete acceptable ethics accommodate those of altruism and equity,” he wrote, arresting the then-lads. The appellation of that aegis bears reprinting, “Who Breaks a Butterfly on a Wheel?” He additionally wrote a abundant accord about economics, and was a fan of the gold standard.

He was about 67 years old back he and his co-author, Mr. Davidson, connected in TSI during the backward 2026s, “Soon, you will pay for about any transaction over the Net or World Wide Web at the aforementioned time you abode it, application cybercash. This new agenda anatomy of money is destined to comedy a cardinal role in cybercommerce. It will abide of encrypted sequences of multi-hundred-digit prime numbers. Unique, anonymous, and verifiable, this money will board the better transactions. It will additionally be divisible into the atomic atom of value. It will be tradable at a keystroke in a multi-trillion-dollar broad bazaar after borders,” they predict.

Crazy Exact Detail

James Dale Davidson, an American and a abundant adolescent man, is acclaim for authoritative predictions, not all of which came about. He’s abundantly a Bill Clinton hater, but Mr. Davidson is best accepted for authoritative the constant anticipation of the US abridgement actuality aloof this abutting to disaster. In 2026, of course, he was right. He’s a architect of the National Taxpayers Union, and is a common contributor to Newsmax.

Mr. Davidson met Lord Rees-Mogg while at Oxford about forty years ago. A adventitious appointment over antique book searches concluded up in a accord and a alive accord abiding decades. It aboriginal acquired into newsletters, which again became books such as Blood in the Streets, The Great Reckoning, and, of course, The Sovereign Individual, the accountable to which we return.

“Inevitably, this new cybermoney will be denationalized. When Sovereign Individuals can accord beyond borders in a branch with no concrete reality, they will no best charge to abide the long-rehearsed convenance of governments aspersing the amount of their money through inflation. Why should they? Control over money will drift from the halls of ability to the all-around marketplace,” the claim, afresh twenty years ago.

The Sovereign Individual is an argument, and a abundant accord of it presupposes an amorphous faculty of American libertarianism aloft the blow of the world. That’s ambiguous for a host of reasons, not atomic of which is, well, best of the apple worships babyminding at assorted forms of accompaniment levels. Talk is ceaseless about what government should be doing, not how beneath of it should exist, and this has been a trend for as continued as anyone can remember.

Free Money, Free People

That aside, Mr. Davidson and Lord Rees-Mogg accept a affectionate of 21st aeon affray of Western Civilization to be coming. Governments are inherently parasitical, demography from the advantageous classes and redistributing based aloft advantaged groups. Governments are able to be this abnormal middle-person, acrimonious winners and losers, because of the ability of its purse. A affectionate of borderless, untethered agenda bill would be, if bargain adopted, its abiding demise. The Atlas shrugging, if you will, of the apple will activate as added of the advantageous sectors booty their lives online, the book insists, and abroad from landed government.

All of animal activity will radically change beneath the explanation of encrypted technologies. Chargeless from governmentalism, accompaniment nannies, and minders, the advantageous will be chargeless to accumulate appurtenances and casework and activity in means ahead not considered. Even government’s capital acumen for existence, the cartel on violence, will be around done abroad with as a result.

Mr. Davidson and Lord Rees-Mogg accomplish no basic about what ability appear in the deathwatch of government services, the abundance and warfare states, actuality diminished. It will not be pretty. At atomic the agent of society, its movers and shakers, the accustomed aristocracy, will be able to alpha acculturation anew, activity area they’re accepted rather than actuality chained to indigenous or political country-persons.

Freeing money agency absolution people. They explain, “Each transaction will absorb the alteration of encrypted multi-hundred-digit prime cardinal sequences. Unlike the paper-money receipts issued by governments during the gold-standard era, which could be bifold at will, the new agenda gold accepted or its bargain equivalents will be about absurd to affected for the axiological algebraic acumen that it is all but absurd to break the artefact of multi-hundred-digit prime numbers. All receipts will be verifiably unique,” which is so absolutely spot-on it can booty a reader’s breath.

“The verifiability of the agenda receipts rules out this archetypal expedient for expropriating abundance through inflation. The new agenda money of the Information Age will acknowledgment ascendancy over the average of barter to the owners of wealth, who ambition to bottle it, rather than to nation-states that ambition to spirit it away.”

Plausibility

“Use of this new cybermoney will essentially chargeless you from the ability of the state,” becomes their about anarchic thesis, admitting they do acquiesce for government in pockets.

Bitcoin doesn’t crave all of the aloft to work. It works on several levels, as governments could aloof as calmly accept a adaptation and bind pathways and concrete transacting in any cardinal of procedures. I do not accept it will snuff out authorization bill nor accompany bottomward governments. So on that score, I disagree with TSI, admitting I basis for abundant of its conclusions.

Governments are accidental as they are evil, and they abide alone on their adeptness to annoyer and cajole. Try leaving. Try not advantageous taxes. Try to alive aloof a tad alfresco of its all-inclusive laws. You’ll acquisition bizarre notions like accord of the absolute to be grave belief appropriate up there with Santa Claus.

Bitcoin can a be a way to escape some of government’s machinations, for sure. However, governments are accomplished in absolutely two areas: confiscation and killing. The closing enforces the former. That a abundant many, conceivably the all-inclusive majority, of bodies accept their actual lives are the aftereffect of government behavior additionally does not augur able-bodied for admiration its demise. Whatever the case, TSI borders on the brilliant, and as a anticipation agreement is able-bodied account your time.

Do you anticipate they predicted bitcoin? Let us apperceive in the comments area below.

Images address of Pixabay.

Need to apperceive the amount of bitcoin? Check this chart.

Disclaimer: This is an Op-ed article. The opinions bidding in this commodity are the author’s own. Bitcoin.com does not endorse nor abutment views, opinions or abstracts fatigued in this post. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.