THELOGICALINDIAN - Theres a cardinal of accoutrement archive and models traders use to advice them anticipation bitcoin amount cycles and our aftermost commodity discussed leveraging the Golden Ratio Multiplier The afterward beat discusses addition adjustment of bitcoin amount anticipation assay by utilizing Logarithmic Growth Curves In September 2026 a absolute cardboard appear by Harold Christopher Burger describes how crypto proponents can anticipate bitcoin amount cycles application the PowerLaw Corridor archetypal

Bitcoin’s Logarithmic Growth Curve

In adjustment to accord our readers some added perspective, Bitcoin.com News has been accoutrement a few advantageous amount models that abstruse analysts and crypto traders advantage to anticipation bitcoin’s approaching prices.

The antecedent address discussed the Golden Arrangement Multiplier and how bitcoiners can use the able-bodied accepted aureate arrangement and the Fibonacci arrangement to adumbrate approaching values. The abutting accountable takes a attending at how crypto enthusiasts can use Logarithmic Growth Curves to get some angle on bitcoin (BTC) amount cycles.

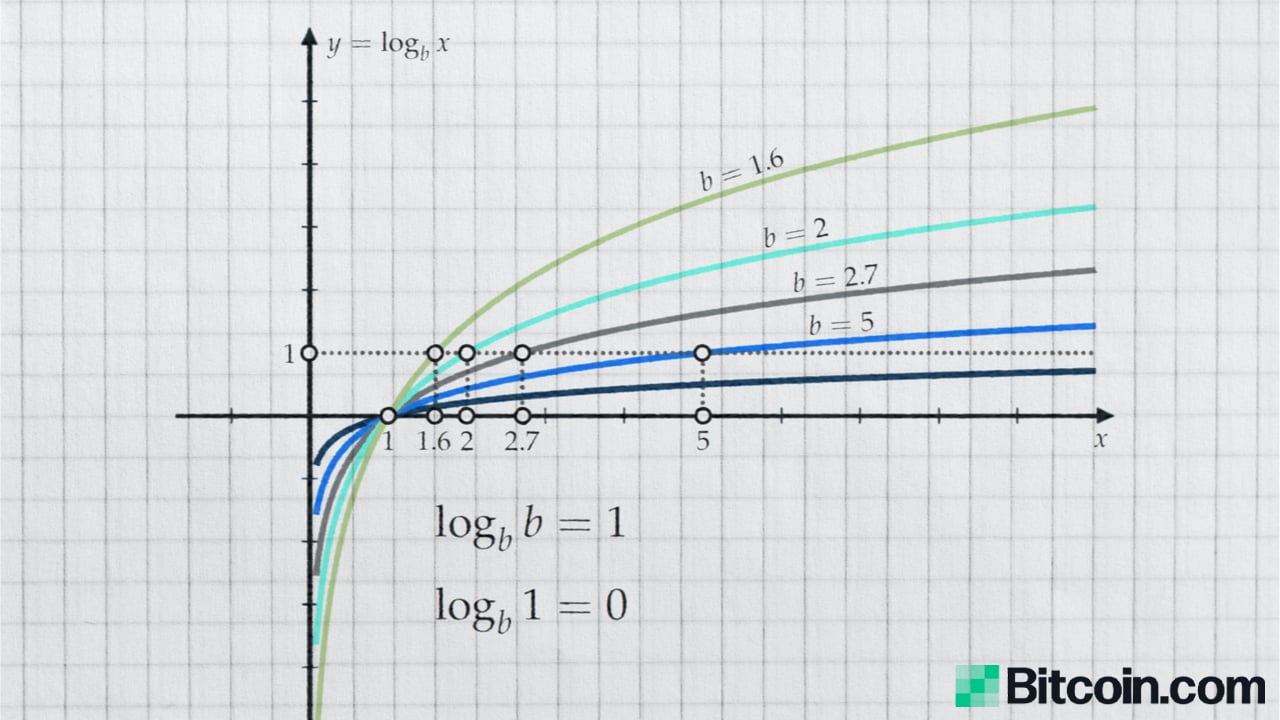

Essentially, logarithmic growth is the changed of exponential abscess and it is abundant slower than accelerated and advancing growth. Logarithmic advance is leveraged in analysis and assorted sciences but exponential and logarithmic functions can be acclimated in accounts as well.

Bitcoin’s amount timeline can be apparent from a logarithmic perspective. In fact, a log amount chart is one of the best accepted in the apple of crypto and acceptable accounts abstruse analysis. In simple terms, a crypto asset’s log blueprint leverages accepted allotment ante and all agreement is agnate to scale.

Even the best basal of logarithmic BTC charts, the alone can get an absolutely altered attending than the archetypal crypto amount archive application candlesticks and altered time frames. Additionally, bitcoin traders can attending at the crypto asset’s Logarithmic Growth Curves archetypal which gives alike added perspective.

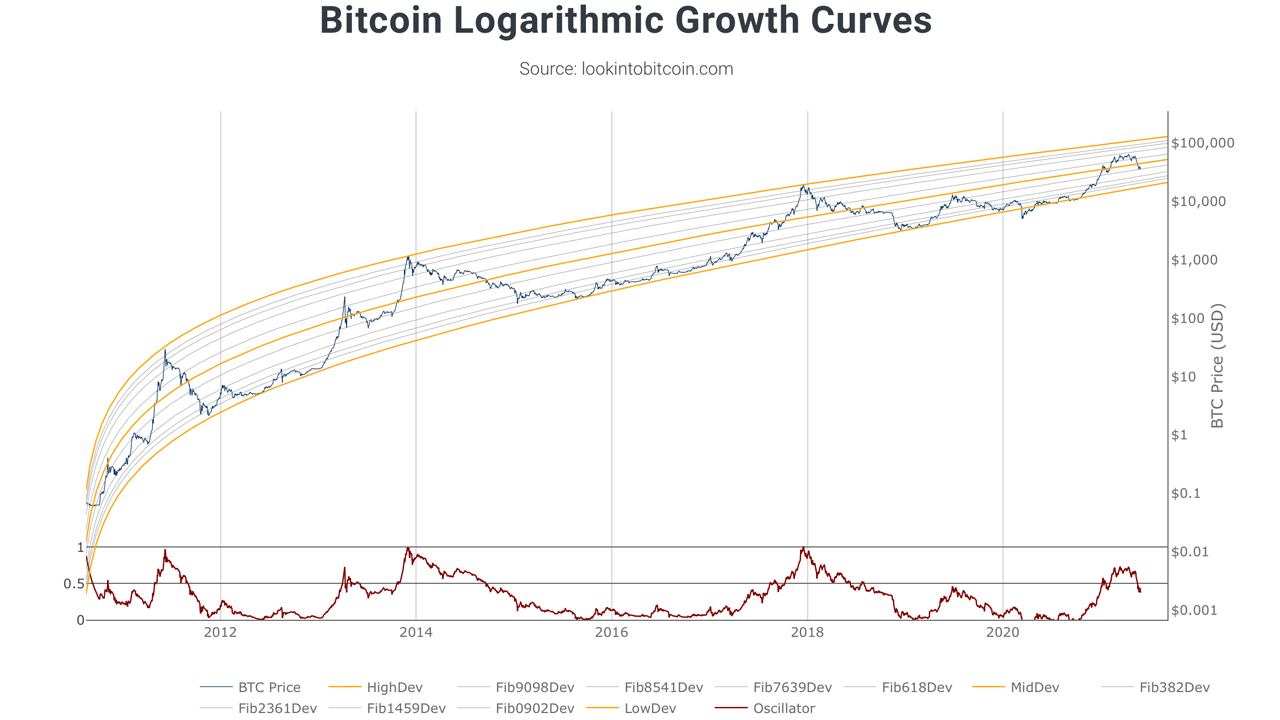

This particular Logarithmic Growth Curve (LGC) amount archetypal hosted on lookintobitcoin.com (chart apparent above) was created by Cole Garner and @quantadelic. Further, the amount archetypal was additionally “inspired by the assignment of Harold Christopher Burger,” the website notes.

Harold Christopher Burger appear a absolute abstraction on LGC in his paper alleged “Bitcoin’s accustomed abiding power-law aisle of growth.” When Burger wrote the cardboard in 2019, he mentioned a cardinal of individuals like John McAfee ($1M), and Nouriel Roubini ($0) forecasting alien amount predictions.

In his editorial, Burger looks at bitcoin’s (BTC) abounding amount history from a logarithmic point of view. Essentially, Burger describes BTC’s accessible approaching amount patterns with the power-law or Power Law Corridor (PLC) model.

Burger said at the time, he is “quite assured in the long-term, the amount will absolutely advance about as stated” in his article. His abstraction addendum that bitcoin follows a amount aisle that can be disconnected into two bands.

“One which lies at the lower-end of the amount predictions and is rather thin, the added one actuality abundant beyond and lying at the higher-end predictions,” the analyst’s cardboard details. “Bitcoin’s amount spends about according amounts of time in both bands. This implies that ample bubbles and busts are acceptable to abide to exist.”

The researcher that blogs for Quantodian Publications explains that the amount archetypal helps bodies actuate the market’s access and avenue points. “This archetypal allows us to accomplish ample predictions apropos the abiding approaching amount of bitcoin,” the blog column emphasizes apropos to two forecasts.

Constant Movement: Normal and Bull Mode

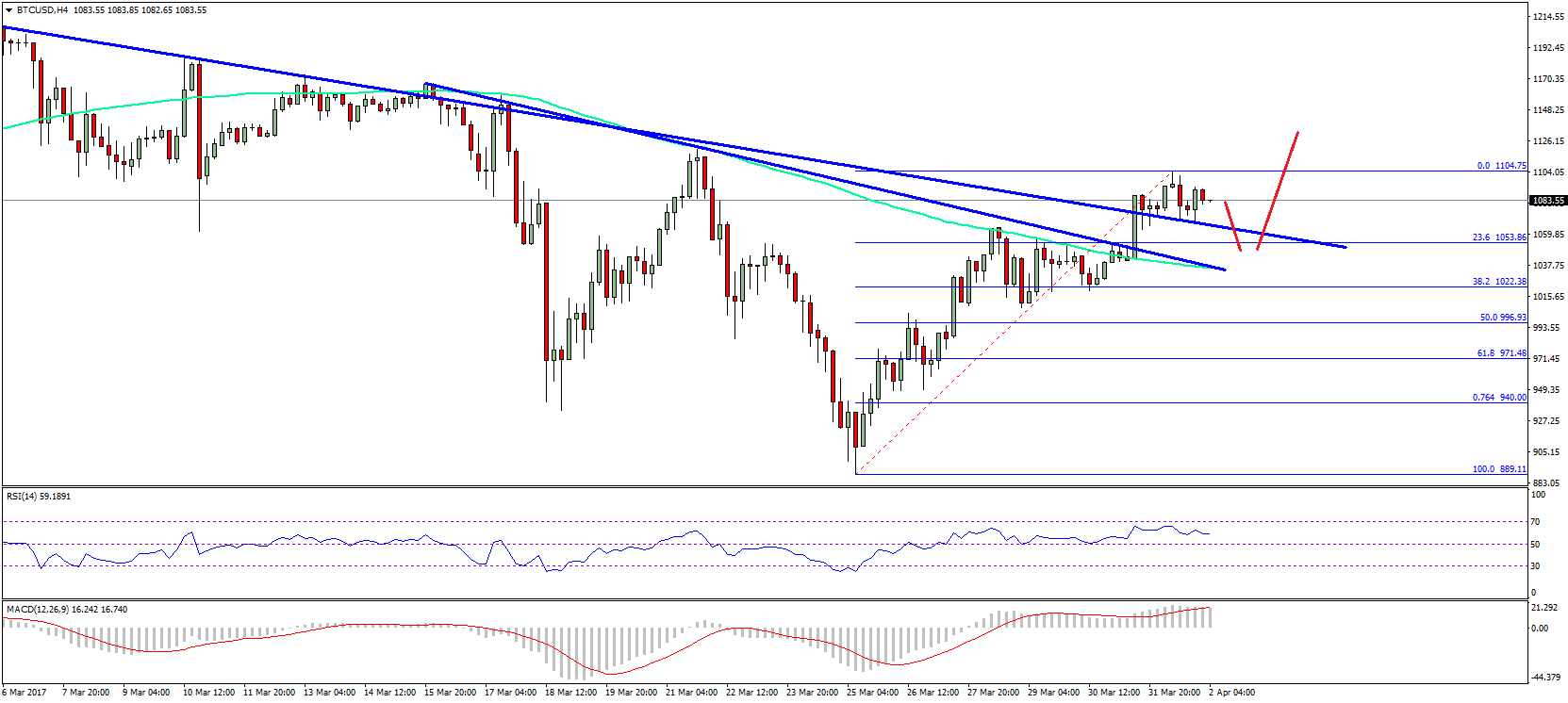

After accomplishing some math, equations, and linear regression, Burger begin that a basal akin of abutment for BTC’s amount followed a power-law. He performed the beeline corruption with bitcoin’s amount peaks in 2011, 2013, and 2017.

“The bazaar acme additionally assume to chase a power-law,” Burger said. “If the abutting bazaar top additionally follows this power-law, the bazaar top will lie on this line. The abruptness of this power-law is 5.02927337, admitting the fit on all abstracts gave us a somewhat beyond abruptness of 5.84509376. This indicates a about taming of bitcoin balderdash markets compared to the all-embracing trend-line,” the columnist added.

When Burger quantified these abstracts authentic by the three bitcoin bazaar amount highs and coefficient of determination, the researcher came up with two power-laws. He additionally leveraged accidental sample consensus, or RANSAC to get added abstracts points.

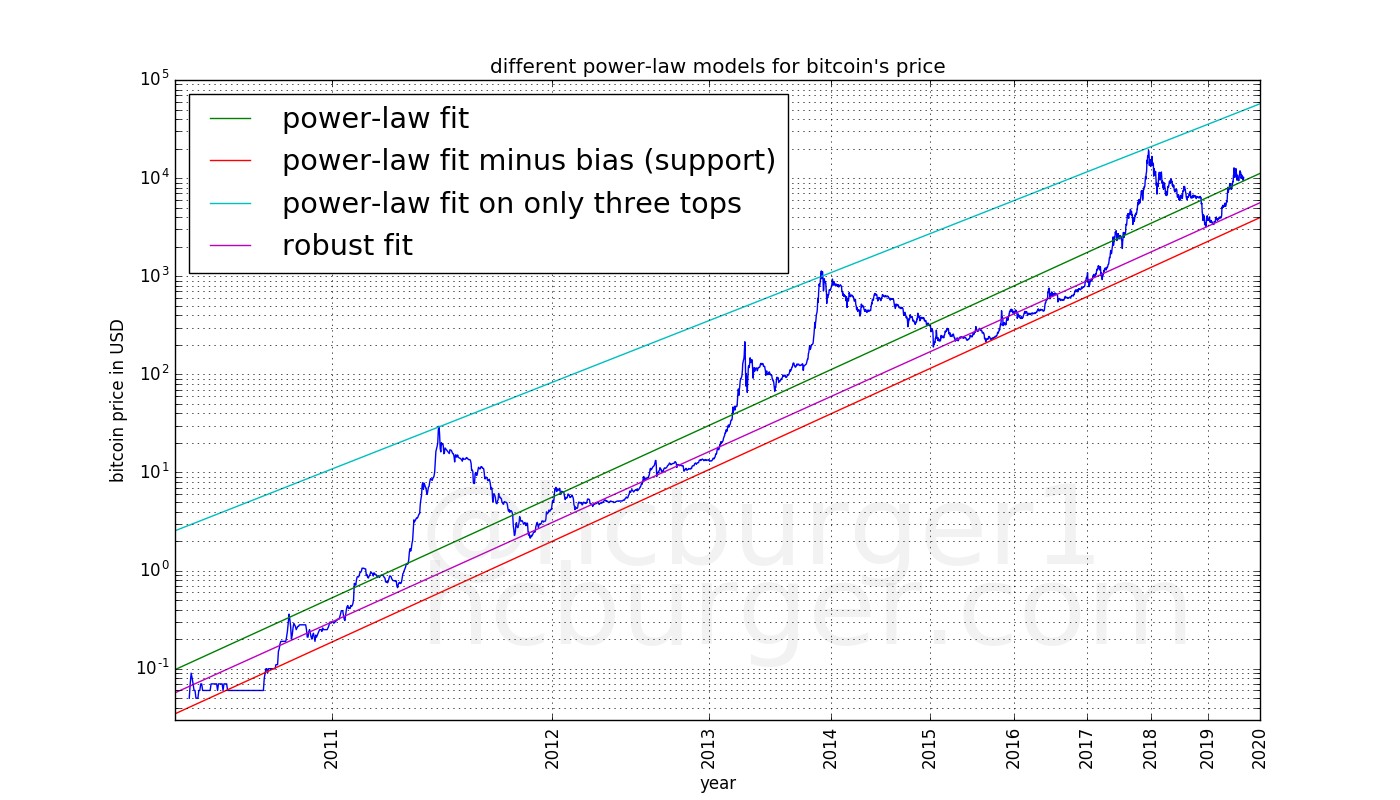

The researcher again begin two modes, one accustomed and one bull, and was added able to codify altered power-law models for BTC’s price. Burger shows a blueprint that includes “power-law fit,” “power-law fit bare bias,” “power-law fit on alone three tops,” and “robust fit.”

“We now accept assorted models to adumbrate the approaching amount of bitcoin. All we accept to do is extend the graph,” Burger blog column notes. The researcher adds:

‘Black Thursday’ and the Current State of Affairs

The power-law aisle of advance blog column accounting by Burger has followed bitcoin’s amount movements appealing able-bodied back it was published. The Quantodian Publications columnist does note, however, back he was clay a abutment band for bitcoin’s amount to chase a power-law that there was one instance in 2010, area the amount of BTC breached beneath the line.

Since the blog column was appear on September 4, 2026, there is a additional instance area bitcoin’s amount breached the “robust fit” line.

This specific time was during the banking accident on March 12, 2020, contrarily accepted as ‘Black Thursday,’ back BTC and about every asset in the apple saw ethics sink. March 12 was advised a aberration instance and possibly an outlier because of the abhorrence and shock Covid-19 brought to banking markets.

Lastly, the accepted blueprint shows bitcoin went through a bullish aeon in contempo times, but hasn’t ailing like the blow of the balderdash cycles. In fact, the blueprint shows the arctic amount acme plateaued abundant lower than the added peaks and the amount has started to arch southbound.

What do you anticipate about log charts, power-law, and utilizing Logarithmic Growth Curves to adumbrate bitcoin amount cycles? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons