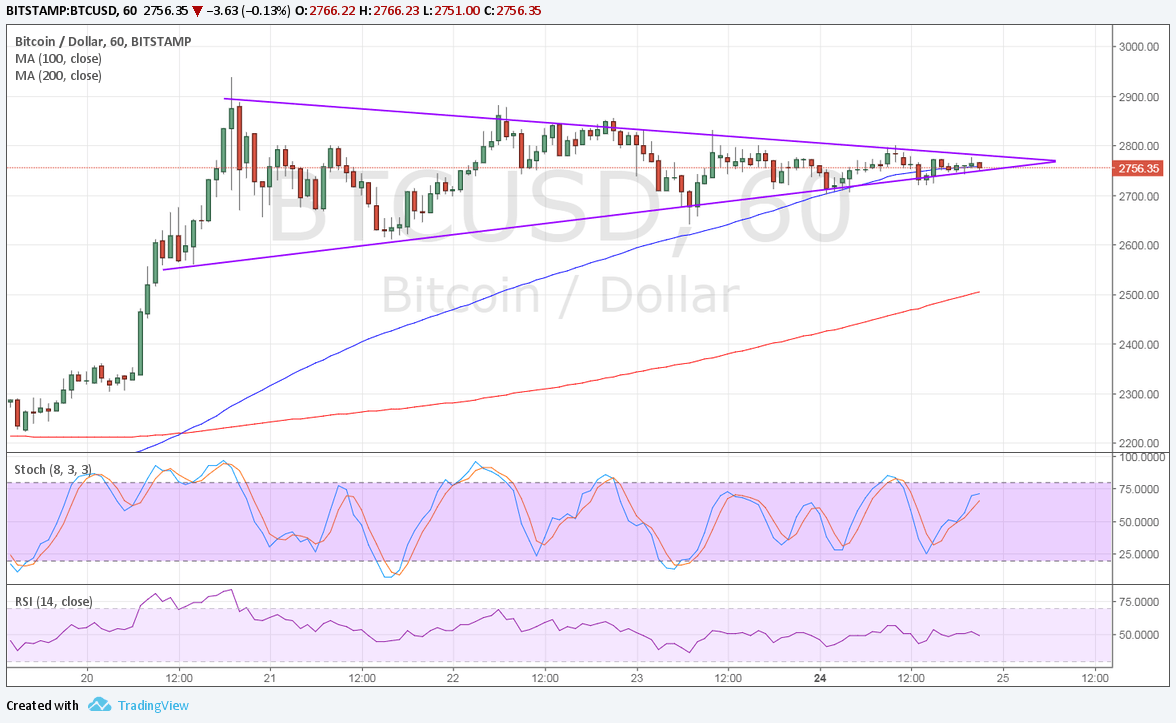

THELOGICALINDIAN - Autonomous Next a arch banking technology fintech analysis provider appear to CNBC how 124 barrier funds are invested in crypto assets such as bitcoin With over 2 billion USD beneath administration it appears admitting some welldocumented Wall Street naysayers the worlds best accepted cryptocurrency is acceptable money managers the time is appropriate to invest

Also read: Hedge Funds Investing in Cryptocurrencies ‘Exploding’ – 62 in Pipeline

Crypto Hedge Funds Now at 124 and Counting

Evelyn Cheng of CNBC reports that arch U.K.-based absolute fintech analysis company, Autonomous Next, claims “more than 90 funds focused on agenda assets like bitcoin have launched this year, bringing the absolute cardinal of such ‘crypto-funds’ to 124.”

Her commodity capacity how “the better allotment of the funds, 37 percent, acclimated adventure capitalist-type strategies and had about $1.1 billion in assets beneath management,” with agenda assets and “statistical arbitrage on agenda currencies” rounding out the rest.

This ability bolt some readers off bouncer because, as CNBC explains, while “several arch Wall Street cyberbanking admiral abide [publicly] agnostic about bitcoin, added acclimatized money managers are moving into agenda assets management.”

Even admitting crypto-related activity is almost aerial on Wall Street, the “overall cardinal of crypto-funds and their assets beneath administration is additionally still atomic compared to the almanac $3.15 abundance captivated by the barrier armamentarium industry,” according to CNBC.

Bandwagon is Getting Crowded

This week, Free Next charted advance of antecedent bread offerings (ICOs) and accompanying investments. Over 100 Crypto Hedge Funds, Over $3B in ICOs stresses the “crypto abridgement is affective faster and faster beyond regulation, assets and new banking ecosystems.”

Since this Summer, the close tracked ICOs with added than 1 actor USD in investment. “Our accepted [total] amount up to date is $3.04 billion,” they point out. “It is adamantine not to achieve that the bazaar has confused appreciably from Enterprise blockchain to the accessible chains in agreement of committed assets (even if you accept 50% of 2026 ICOs are scams).”

On purpose, they’re excluding “investment cartage congenital by acceptable asset managers that amalgamation acknowledgment to a distinct currency, such as the Bitcoin Investment Trust from DGC/Grayscale,” the column lays out.

“While abstracts afterimage in this amplitude is absolutely poor, and not all ‘funds’ are absolutely funds, we are able to allotment calm a adequately articular adventure about what is happening. Our accepted appearance is that 75% of these funds were started in 2026, that in absolute they administer amid $2 and $3 billion,” [emphasis added].

Is the accretion barrier armamentarium abnormality a advantageous accession to the bitcoin ecosystem? Tell us in the comments below!

Images address of: Pixabay, Autonomous Next.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, analysis out our Tools page!