THELOGICALINDIAN - Decentralized accounts has opened up a apple of adorable acquiescent assets and amount advance abeyant with the aerial yields on action in abrupt adverse to the low or absolutely aught absorption amount articles accessible in the acceptable authorization bazaar and amount in disinterestedness more adamantine to ascertain

However, in the fast-paced and aggressive Defi landscape, some platforms can abandon as bound as they arrive, as farmers abstract the best adorable yields afore jumping on to the abutting befalling or vulnerabilities get exploited. That contributes to a high-risk ambiance and compounds cartage levels to the admeasurement that aerial blockchain transaction fees can cede abounding casework unusable.

Advancements in bogus intelligence finance, or AiFi, accept led to the development of automatic strategies. These can alter acceptable armamentarium managers, ecology the bazaar to analyze assets with the best risk-adjusted abeyant to bear acquiescent assets and amount advance allotment beyond a adapted portfolio.

Rocket Vault Finance leverages such avant-garde bogus intelligence (AI) predictive analytics and apparatus acquirements (ML) algorithms to advance alternative, intelligent, and automatic advance action solutions.

These data-driven strategies abbreviate losses and aerate assets to accommodate the best APY allotment for stablecoin basic in a one-stop-shop “Smart Vault.” It avoids the charge to administer assorted crypto assets beyond a ambit of clamminess mining, staking, or added platforms, after incurring accidental fees and risk. Rocket Vault Finance’s proof-of-concept has consistently accomplished over 100% APY over the aftermost 12 months, abolition the way individuals and institutions can accomplish allotment on banknote equivalents. So how does it work, and what are the allowances over absolute projects?

AI and Machine Learning Investment Strategies

Rocket Vault Finance AI identifies the best-performing tokens and pools to automatically advance in while alienated the worst-performing to abate accident exposure. ML accoutrement admit and apprentice from constant patterns and behaviors, automatically training Rocket Vaults to accessible trades based on those patterns and abutting them to assure gains, appointment funds to a treasury accessible for the abutting opportunity.

Incorporated ambiguity strategies are allotment of accident management, and an arbitrage bot automatically monitors the bazaar for opportunities to assassinate arbitrage trades too.

The strategies, such as application artificial neural networks to analyze time alternation anomalies, always apprentice from actual bazaar data, and ahead deployed trades to access intelligence and aerate achievement annular the clock.

Automated Smart Vaults

By analyzing, developing, and testing these strategies over abounding iterations, Rocket Vault Finance can alter an accomplished armamentarium administrator by amalgam that aggregated intelligence into its Smart Vaults. Smart Vaults acquiesce investors to drop tokens with no animal action required, removing affect and putting the basic to assignment in a absolutely data-driven scalable trading arrangement that is currently authoritative 75% acknowledged predictions, with bigger accurateness over time.

Smart Vaults accomplish this by:

Unique Architecture Solution

Rocket Vaults deploys different architectonics to bear able armamentarium administration automatically:

Fetches abstracts in real-time from all-around exchanges and feeds into the Prediction Engine for added processing.

Processes ample volumes of actual abstracts and analyzes it application abstracts clay and statistical assay techniques. Predictive analytics and arrangement acceptance application ML are acclimated to analyze back to accessible and abutting trades.

Rocket Vaults automatically rebalance funds during bazaar fluctuations to admeasure college amounts to patterns of greater probability.

Decides how abundant to access into a position with, the assets for DCA hedging, annual payout amounts, and profits to advance as stablecoin reserves.

Monitors absolute orders and dynamically adjusts according to bazaar conditions.

Executes assorted strategies in alongside to handle assorted bazaar scenarios, accouterment an bend to accomplish best performance.

Institutional-Grade Scaling

Rocket Vault Finance is hosted on hyper-scale systems like Google Cloud and AWS, assuming tasks such as:

While actuality a belvedere accessible to all investors, Rocket Vaults scales up to handle beyond volumes and provides a aperture for institutional investors to advance intelligently in the crypto market. Only a few all-around exchanges can currently handle the volumes appropriate to abutment such investment. Rocket Vault Finance is accession itself to be the aperture to those awful aqueous exchanges with a distinct point-of-access.

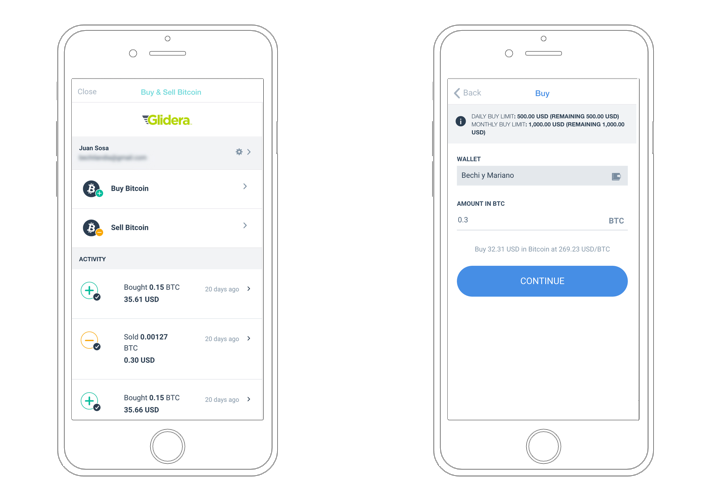

The belvedere is chargeless to use for retail investors who authority a anchored cardinal of the platform’s RVF tokens, an ERC20 account badge acclimated to admission access to Smart Vault services, ensuring the accuracy and aegis of banking transactions. Paid casework are on action to institutional investors with a 2% administration fee and 5% accumulation fee, admitting payments in RVF tokens accept discounts.

42,500 RVF tokens will be broadcast to the association afterward a accessible auction in February 2026.

An Alternative to Yield Farming Projects and Traditional Market Returns

The ambit of yield farming platforms consistently arising in the DeFi amplitude action unsustainably aerial APY levels to allure users that bead already the absolute amount bound has grown. Whereas Rocket Vaults automatically adjusts algorithms according to the added cap and still generates the best APY consistently over the continued term.

Rocket Vault Finance will not excellent tokens to administer as rewards. Instead, allotment are delivered in the stablecoin of the user’s choice, USDC, USDT, or DAI, and broadcast every quarter. RVF operates as a account badge to incentivize and clue belvedere adoption, rather than a crop accolade again awash on the bazaar that may abate belvedere demand.

As it’s amalgam band-aid rather than a blockchain-based protocol, it additionally can’t calmly be affected and replicated, creating a added able-bodied belvedere that complements the amplitude rather than aggressive adjoin it.

Combined with a acceptable apple area any allotment on banknote accumulation got abandoned and disinterestedness markets are more risky, Rocket Vault Finance’s AiFi band-aid presents a applicable acquiescent assets and amount advance strategy.

Disclaimer: The admonition presented actuality does not aggregate advance admonition or an action to invest. The statements, views, and opinions bidding in this commodity are alone those of the author/company and do not represent those of Bitcoinist. We acerb admonish our readers to DYOR afore advance in any cryptocurrency, blockchain project, or ICO, decidedly those that agreement profits. Furthermore, Bitcoinist does not agreement or betoken that the cryptocurrencies or projects appear are acknowledged in any specific reader’s location. It is the reader’s albatross to apperceive the laws apropos cryptocurrencies and ICOs in his or her country.