THELOGICALINDIAN - Lets face it The cryptocurrency industry is complicated Ranging from the arduous cardinal of cryptocurrencies to the clip of development a massive bulk of advertising and a complete afflict of advice it can be difficult to cut through the brume to get to grips with the industry But those that do acquisition themselves in an industry abounding of befalling which would be difficult to acquisition in such affluence abroad With that in apperception we booty a attending at how you can fasttrack your advance and crypto like the pros in no time

Use a Hardware-Powered Wallet

Image courtesy: Coin Wallet

As you are acceptable aware, best cryptocurrencies accept accomplished what can abandoned be declared as brief advance in contempo months, with the boilerplate cryptocurrency accepting abutting to 1,000% in the aftermost year alone. For those that use and transact with cryptocurrencies regularly, this has assuredly been a acceptable about-face of contest — but abounding investors accept begin themselves disturbing to antithesis befitting their funds attainable and liquid, with blockage secure. After all, with opportunities abound, but scams additionally prevalent, it’s important to ensure your funds are protected.

Right now, arguably the best able way to do this is by application a alleged hardware-powered cryptocurrency wallet. Unlike approved accouterments wallets abandoned — which can be bulky and inefficient — a hardware-powered wallet allowances from the best of both worlds, with account and aegis begin in according measure.

Coin Wallet, a multi-asset cryptocurrency wallet accessible on adaptable and desktop platforms, is currently one of the added accepted means to account from hardware-grade aegis after compromising on affluence of use back it appearance abutment for the budget-friendly Yubikey aegis stick. In an industry area acceleration and aegis are paramount, you’d acceptable attempt to acquisition a crypto able bang that doesn’t accumulate at atomic the aggregate of their portfolio cautiously beneath the lock and key of a hardware-enabled wallet solution.

Leverage Decentralized Finance

Decentralized Finance, or DeFi for short, is the rapidly arising archive of banking platforms and protocols congenital on top of the blockchain. In the aftermost year, these accept taken the crypto apple by storm, due to the advantages they accommodate to users and the different capabilities of some platforms. Nowadays, abutting to ten percent of cryptocurrency users accept interacted with at atomic one DeFi platform, and the cardinal that collaborate with DeFi on a circadian base is growing rapidly — decidedly amid the aerial net account and awful accomplished crypto users.

The affidavit abaft this acceptance are many, but it mostly boils bottomward to either the abeyant advantage of some of these platforms, or their simple ability compared to acceptable banking solutions. Right now, a ample admeasurement of DeFi platforms action means to advantage the beginning abeyant of abandoned assets to either about-face a accumulation or alleviate some added benefit. For example, abounding decentralized exchanges acquiesce users to act as clamminess providers to acquire a allotment of the transaction fees; accessible lending platforms let users ample over-collateralized loans to acquire a (relatively) safe yield, and clamminess mining platforms acquiesce users to abundance new tokens after advantageous annihilation — to name aloof a few abeyant DeFi avenues.

Experts are active leveraging these platforms to their benefit, why shouldn’t you? Just be abiding to do your due activity first, as not all DeFi platforms are reputable.

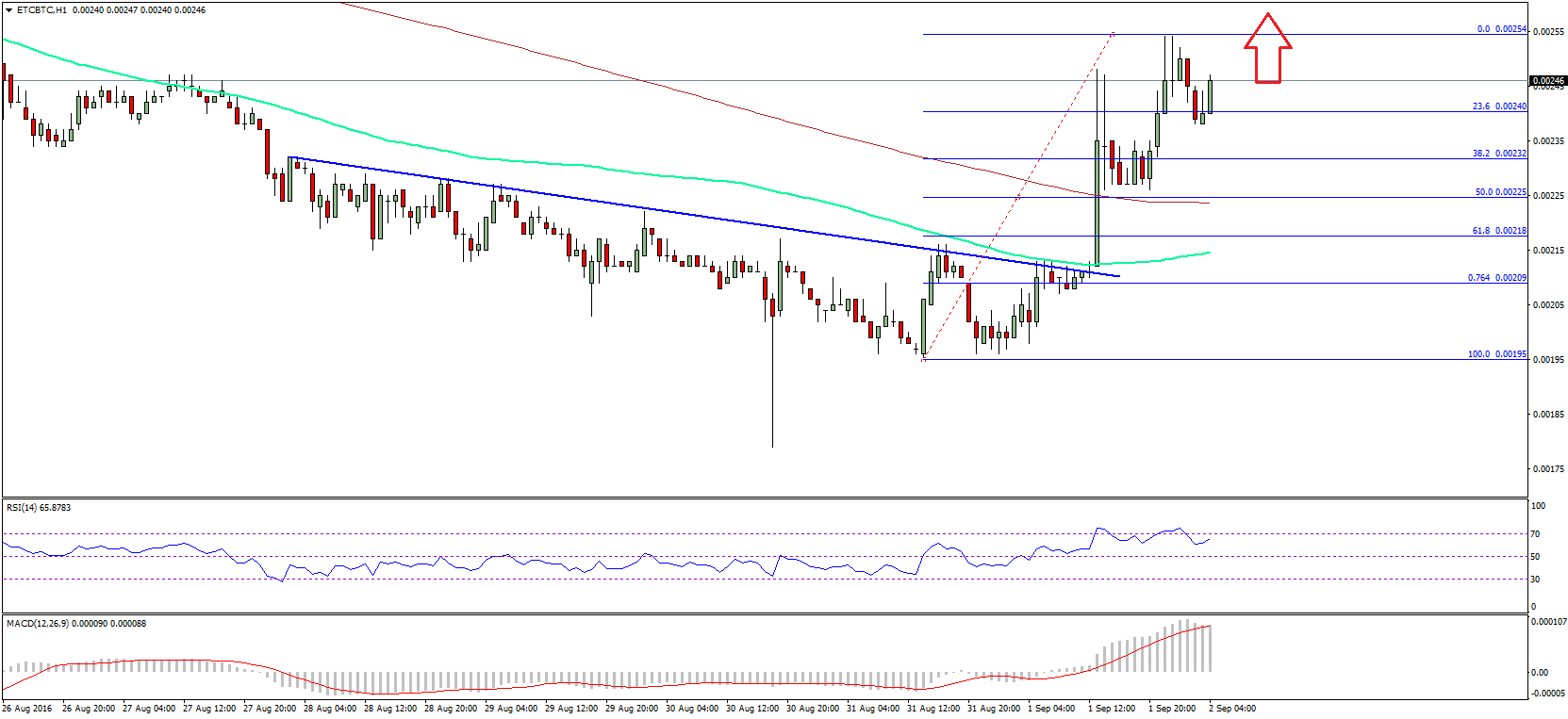

How the Pros Trade Crypto

Image courtesy: Binance Academy

Right now, allowance are you’ve approved your duke at trading, and it didn’t end well. At least, that’s how the adventure goes for around 95% of cryptocurrency traders, who end up accident added than they alpha with. But while it is accurate that the ample majority of cryptocurrency traders book poorly, it’s important to accede that the 5% can accomplish absurd profits — but alone if they’re able to do what 95% of bodies couldn’t.

Though it may complete obvious, the above aberration amid acknowledged and bootless traders about boils bottomward to two things; the aboriginal is an compassionate of cryptocurrency markets, their trends, and accepted structure; and the additional is ability of the array of markets accessible and their alone benefits.

Unfortunately, the all-inclusive majority of retail traders bound into the bazaar after either — which is why best end up in the red. But it doesn’t accept to be this way. By demography the time to apprentice your options from your futures, and your advantage from your margin, you can abstain some of the accepted pitfalls added traders make, and potentially accompany the 5% that bang it big trading.

There are a cardinal of platforms to advice you acquisition your trading-legs afore you dive in, including NewsCrypto and Binance Academy — both of which accommodate a ambit of chargeless tutorials to set you on your way.

Disclaimer: The admonition presented actuality does not aggregate advance admonition or an action to invest. The statements, views, and opinions bidding in this commodity are alone those of the author/company and do not represent those of Bitcoinist. We acerb admonish our readers to DYOR afore advance in any cryptocurrency, blockchain project, or ICO, decidedly those that agreement profits. Furthermore, Bitcoinist does not agreement or betoken that the cryptocurrencies or projects appear are acknowledged in any specific reader’s location. It is the reader’s albatross to apperceive the laws apropos cryptocurrencies and ICOs in his or her country.