THELOGICALINDIAN - The decentralized accounts DeFi bazaar opens affluence of opportunities We are administration how to cautiously use the instruments of the alcove to abound profits

The key abstraction of decentralized accounts is the absence of the call of middlemen. In the DeFi arena, there is no allowance for acceptable banks with big fees and absorption ante that banking organizations can authority as bazaar monopolists.

Also, decentralized accounts allows users to abide bearding and “make” money assignment effectively.

The advance of the DeFi acceptance can be empiric on the blueprint that shows the absolute amount of assets bound in the projects of this segment:

Total amount (USD) bound in DeFi projects. Source: DeFi Pulse

There are two approaches appear earning on DeFi. Let’s altercate both options:

Most of the DeFi protocols crave assets for operational activity. The easiest and fastest way to barrage a artefact is to allure clamminess from the bazaar participants. Let’s analyze it by cartoon on the archetype of a DeFi app that is focused on accouterment loans. Here is how it works:

Similar mechanisms are acclimated by decentralized crypto exchanges that charge clamminess to accommodated the bazaar participants’ needs.

Interesting! Amid clamminess providers, the crop agriculture association has emerged. The ambition of “farmers” is to apace move assets amid protocols to aerate profits.

Plenty of decentralized protocols accept their built-in token. The cryptocurrency amount movement generally reflects the project’s position on the market. This characteristic affection helps investors to acquire on the tokens of the DeFi protocols.

For example, users that bought UMI bill from the decentralized cryptocurrency barter Uniswap succeeded in accepting tenfold yields on their antecedent investments in aloof 4 months.

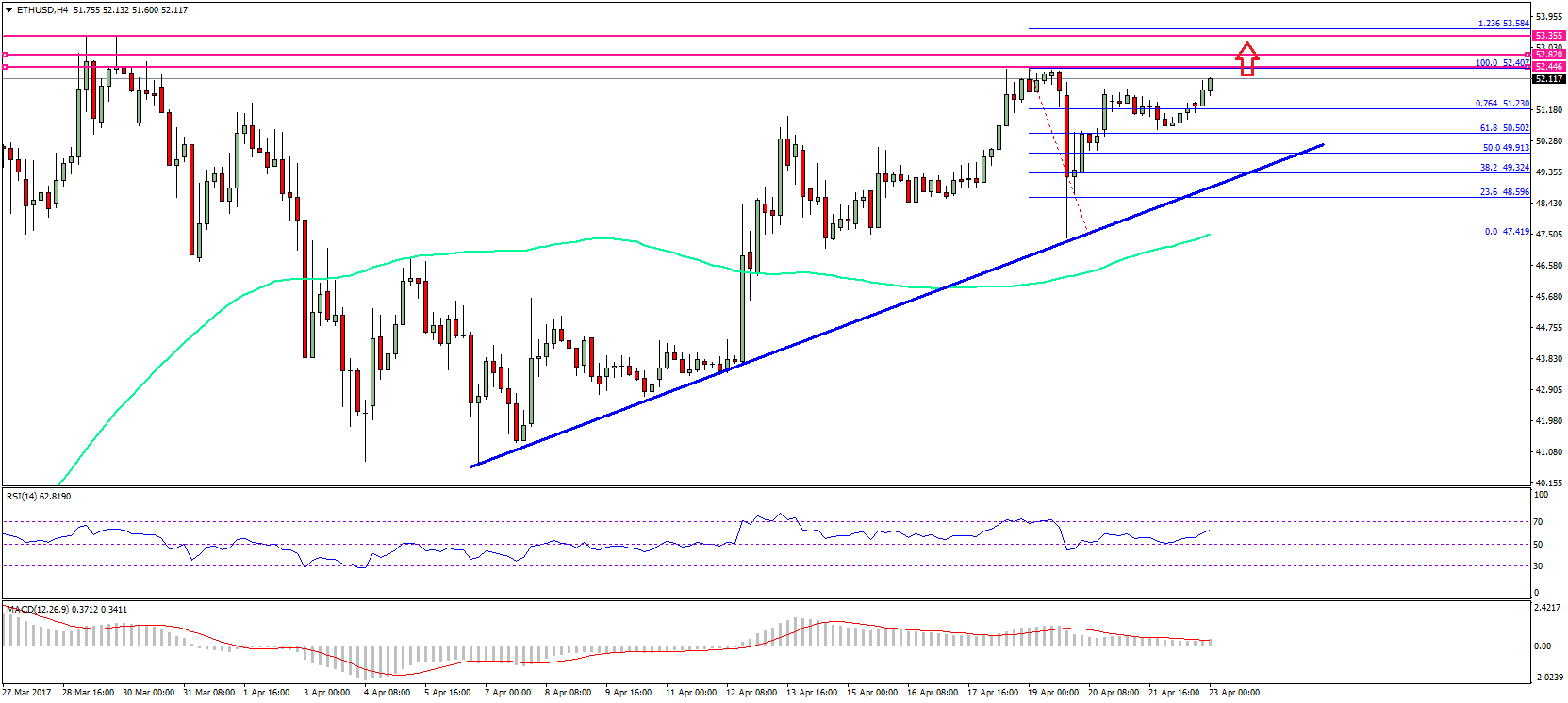

Price movement blueprint for the cryptocurrency UNI by the activity Uniswap. Source: TradingView

There are additionally affluence of added tokens from the decentralized accounts articulation that helped their investors with accepting profits.

Top-5 cryptocurrencies by assets in the DeFi segment. Source: CoinMarketCap

Unfortunately, investments in DeFi generally appear with assertive difficulties. Let’s dive into them for a abundant review.

The majority of the best accepted DeFi protocols do not yet abutment all the languages. For example, amid the top-5 decentralized protocols alone one – Uniswap – is absolutely multilingual. This ability abate the cardinal of alive users of the platforms.

Top-5 DeFi protocols by the volumes bound in for the project’s needs. Source: DeFi Pulse

There are additionally added hidden pitfalls that arrest access into the DeFi bazaar for abeyant investors. Among pitfalls, there are the afterward issues:

With the growing appulse of those issues, the DeFi bazaar started to accomplish projects that are accouterment solutions. One of such projects is BaksDAO. The activity aggregation formed on the capital affliction credibility that users face during the access to the decentralized accounts market.

BaksDAO is a multifunctional decentralized accounts belvedere with its own stablecoin BAKS and the babyminding badge BDV. Aimed to be a all-around player, the activity works on the Binance Smart Chain (BSC) blockchain that provides aerial cartage accommodation and low commissions. The assurance of the belvedere was confirmed by the Solid Proof experts during the audit.

Among BaksDAO advantages, there are the afterward features:

This actuality said, the BaksDAO developers formed the belvedere for activity development in beforehand acknowledgment to abundant advance schemes and amusing promotions. For example, the aggregation distributes about a division of the project’s accumulation in eco-initiatives. This actuality places the activity amid socially cogent projects.

BaksDAO simplifies bazaar access by antibacterial the accent barrier and chain assorted casework beneath the roof of a multifunctional belvedere with an automatic and convenient interface.