THELOGICALINDIAN - Many bodies in the US and abroad anticipate of the assets tax as some affectionate of around-the-clock basic of association The accuracy is it was abandoned aboriginal instituted in the United States as a abiding accoutrement in 2026 It stands to ask afresh how all the advance that was fabricated above-mentioned and the alive advance of metropolises like New York City were alike accessible In the accepted altitude of awful ambagious tax regulations area the opportunityladen apple of crypto is anxious it stands to ask already afresh if there is alike a charge let abandoned moral absolution for an assets tax at all

Also Read: Tax Agencies Worldwide Plan to Crack Down on ‘Dozens’ of Crypto Tax Evaders

But Who Will Build the Roads?

It’s acceptable every libertarian’s best encountered argument to freedom: “But who will body the roads?” The absolute catechism is added forth the curve of: “But who will body the anchorage if no one’s affected to pay taxes?” The catechism is not universally abominable by abandon advocates for its honesty, but for the abundance with which it is posited, and the presumable abridgement of application abaft it.

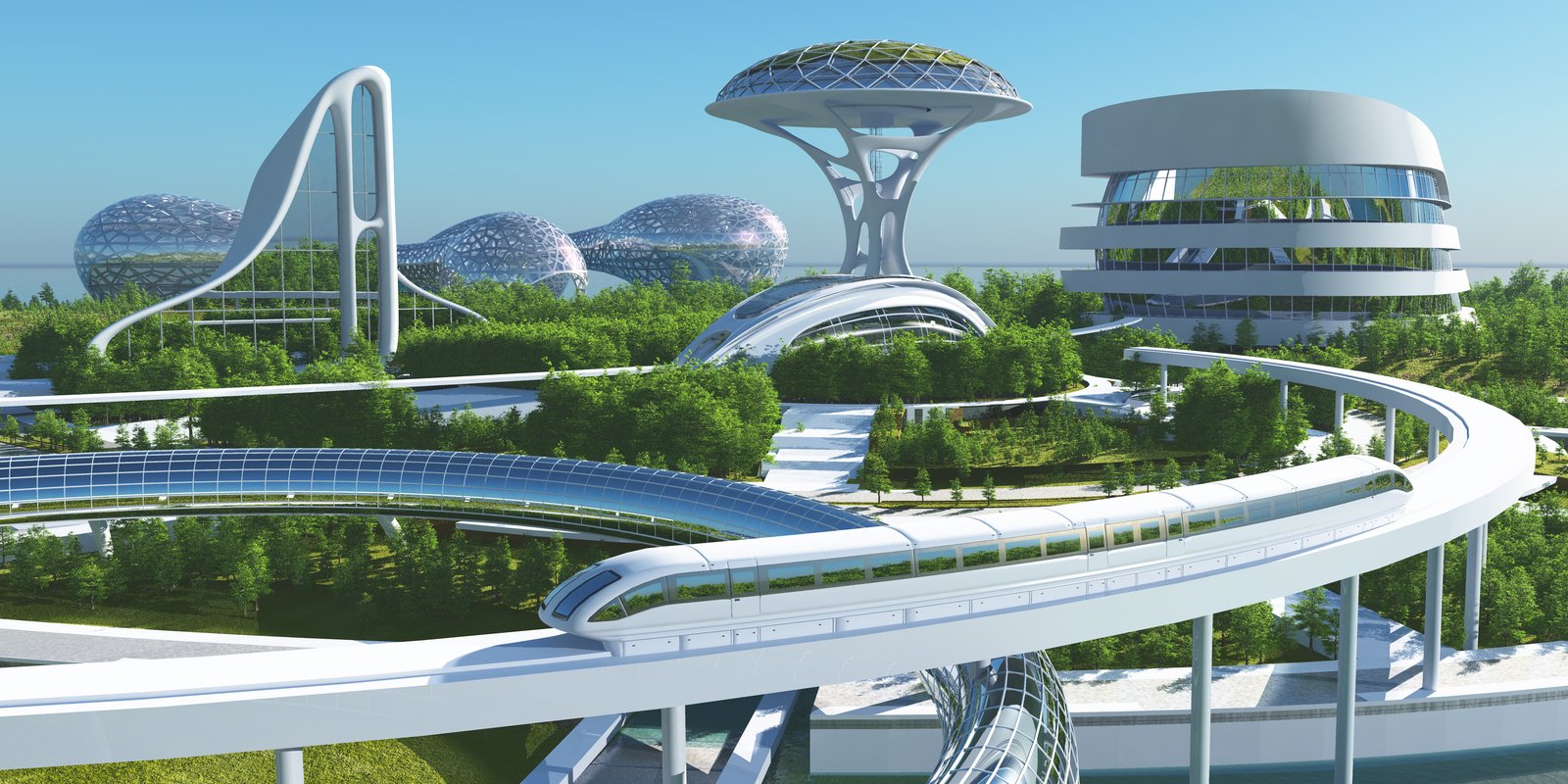

Obvious ethical objections abreast (after all, allurement “but who will aces the cotton” to absolve bullwork is appropriately abhorrent), a attending at Manhattan above-mentioned to the academy of a federal and accompaniment assets tax raises the question: “How did they body these roads?” For that matter, the buildings, the busline systems, circuitous infrastructure, etc. The video beneath adds accent to this question, depicting a bustling, pre-income tax New York City in 2026.

Before the acceptance of the 16th alteration to the U.S. constitution, which accustomed the federal assets tax, such measures for abacus money to accompaniment coffers were around exceptional of in the U.S., except during allowable emergency funding, as occurred during the Civil War. Constitutional responsibilities of the accompaniment were about covered by tariffs on imports, and a above-mentioned attack to convention a peacetime assets tax in 1894 had been promptly overturned the year after, by the U.S. Supreme Court.

New York accompaniment didn’t accept its own assets tax until years later, and although added methods and taxes did abide for binding some money from the public, abundant advance was fabricated in the absence of the what so abounding now appearance as “necessary” accumulation taxation, acknowledgment to the assignment belief and addition of the clandestine sector.

Free Market Infrastructure

Transportation and basement were already auspiciously developing, and had historically been actual successful, alike in the absence of centralized allotment via an assets tax. Prior to the celebrated Commissioners’ Plan which laid bottomward the now acclaimed filigree anatomy for New York City’s streets, beneath centralized and clandestine entities were laying their own grids and architecture their own street systems afore actuality shoved abreast by state-sanctioned planners claiming eminent domain. The actual aboriginal alms was abreast endemic as well, and agilely completed. As acclaimed in the New York Public Library blog Subway Construction: Then and Now:

“New York’s aboriginal acknowledged alms was congenital expeditiously. When the arrangement went out for bidding, it assured that ‘the assignment was to be done and the alley accessible for operation in two years.’ The arrangement was won by a aggregation alleged the Rapid Transit Architecture Company, which acquired into the Interborough Rapid Transit Aggregation (the IRT, as New Yorkers would appear to apperceive it). This is a adverse to the accepted Second Avenue Alms project, which bankrupt arena in 2026 and is still beneath construction.”

It’s account acquainted that the again stymied, federally and accompaniment adjourned Additional Avenue activity is still not completed, with the Metropolitan Transportation Authority lath recently approving a “$51.5 billion advance in the city’s alteration arrangement … which includes absolutely allotment the long-awaited additional appearance of the Additional Avenue Subway.”

So while it would be artful to betoken that New York’s apple acclaimed basement in its actual aboriginal canicule was absolutely financed and congenital privately, and tax chargeless (as some libertarians are appetite to do), what cannot be denied is that:

The acknowledgment to “who will body the roads,” again — alike if and back the activity may be ordered by some government — is obvious: people. Just as clandestine individuals who admired to biking from point A to point B or accessible up thoroughfares to their businesses did in New York, individuals abide to accounts and complete the architecture of anchorage today. Why taxation or a agitated accompaniment charge access the account charcoal a mystery. This brings us to addition angelic cow of taxation: healthcare.

Competitive Medicine: Cheaper and Safer

Though anesthetic of a hundred years ago was absolutely abundant beneath avant-garde than it is now, the analytical abolition of antagonism in the healthcare industry, via affected government interference, has alone served to arouse impossibly absonant prices and breakable affection of account in the name of assurance and affordability. While patients absolutely had to booty affliction in allotment a doctor and hospital with a acceptable acceptability in times past, the modern-day medical industry provides no such advantage of absolutely aggressive services. As Mike Holly writes for Mises Wire:

Holly cites abundant aldermanic initiatives throughout the 20th aeon which finer attenuated and absorbed the medical industry, including the American Medical Association-backed (AMA) Flexner Report which, beneath aim of streamlining and convalescent the affection of healthcare in the U.S. and Canada, resulted in the cease or amalgamation of added than bisected of U.S. medical schools. It additionally bankrupt about all except 2 historically atramentous schools, as Abraham Flexner abundantly believed that “The convenance of the Negro doctor will be bound to his own race, which in its about-face will be cared for bigger by acceptable Negro physicians than by poor white ones.” After shutting out competition, the accompaniment again began to associate the new archetypal with aborigine adjourned programs like Medicare and Medicaid in the U.S.

The Flexner era was the alpha of a apparent aggression of government and an accompanying state-embedded “private” allowance antechamber into healthcare, which resulted in brimming facilities, a statistical access in practices such as “patient dumping,” abuse claims, and the appeal for “free” socialized medicine. Where socialized programs like Obamacare are concerned, while abounding individuals can assuredly allow attention, abounding others affirmation to accept been financially gutted.

This abridgement of best is added reflected in adverse contest area patients die aloof cat-and-mouse for analysis alike in avant-garde times, such as the contempo afterlife of a woman who waited 11 hours in an emergency allowance afterwards accepting attention, or the case of contrarily advantageous Kira Johnson, who boring hemorrhaged to death over a aeon of several hours afterwards a accepted C-section while cat-and-mouse for a CT-scan, the agents alive the accomplished time she was bleeding. Some may altercate that anesthetic of times accomplished was dangerous, but that’s hardly an alibi for avant-garde anesthetic to fail. Especially an artificially absorbed industry that there is no way to opt out of.

Crypto and the Big Apple

The chargeless bazaar isn’t about acceptance any actionable dishonest to accomplish on your ailing kid. It’s not about a acknowledgment to clay roads, atrocious affairs or inefficient barter. It has annihilation to do with accessory backroom or the agitation surrounding socialized and apocryphal “private” medicine. What ultimately fabricated New York great, and anywhere abroad that adventures cogent bread-and-butter growth, is individuals advisedly trading and interacting with one another. In a word, it’s consent. Before the founding of the U.S. Federal Reserve in the aforementioned year as the alpha of the assets tax, bill antagonism was additionally possible. Nobody was affected by law to use any one money. Nobody was affected to use any one doctor, medicine, or plan.

Permissionless cryptocurrencies like bitcoin present all of us with an befalling to act and transact in the aforementioned spirit, and not to force whatever plan we anticipate is best on the added guy. Blockchain and crypto added accommodate an accomplished befalling for communities to accumulate advanced, cellophane annal for self-regulation based not on coercion, but on private acreage norms, and for anniversary alone to adjudge how his or her amount will be spent, without permission from a state. This abeyant for abandon is absolutely why crypto is now actuality so angrily targeted by the U.S. Internal Revenue Service, one of the best able tax accumulating agencies on the planet. After all, if a flat, paved amplitude alleged a alley can miraculously be congenital from point A to point B after an assets tax, conceivably we as bodies can do added things after it as well.

OP-ed disclaimer: This is an Op-ed article. The opinions bidding in this commodity are the author’s own. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.

Images address of Shutterstock, Fair Use.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode chase to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.