THELOGICALINDIAN - Bitcoinistcaught up withMax Keidun andRoman Snitko CEO and CTO of HodlHodl whose peertopeer bitcoin trading belvedere and barter aloof anchored a clandestine allotment annular from some notable associates of the Bitcoin community

– Hodl Hodl CEO

Bitcoinist: Why did you adjudge to authority a clandestine allotment round? Was the ambition achieved?

Hodl Hodl: Yes, the ambition was achieved. We absitively to authority a allotment annular because the activity has been self-funded for 2 years and we needed to abide alive an carrying new appearance faster. External allotment helps with that.

Also we don’t anticipate that accessible allotment is acceptable in our case, because we don’t appetite to affair any tokens and we are adjoin ICO. We’re additionally actual blessed to be adopting money from bitcoiners, and not VC funds because our investors accept our activity abundant bigger and accept agnate values.

Bitcoinist: Why did some notable associates from the Bitcoin association like WhalePanda (and others) adjudge to advance in this project?

Hodl Hodl: Here are some absolute comments from our investors.

Bitcoinist: What will the funds be acclimated for primarily?

Hodl Hodl: Development and carrying new features. Currently, we are developing our OTC business band by onboarding added and added OTC partners. Also, we are developing a anticipation affairs market. We will absorb some aloft funds on hiring new developers, abacus new languages (Spanish and Japanese are advancing to Hodl Hodl in December), and some business efforts.

Of course, we will abide developing Househodl, some funds will absolutely go that way.

Bitcoinist: When will you barrage your anticipation (futures) affairs market? Considering the almost tepid demand for CBOE Bitcoin futures appropriate now, how abundant absorption accept you apparent for this product?

Hodl Hodl: We’re cerebration of ablution anticipation arrangement markets in February 2026. We see a huge appeal for this artefact as it will be absolutely non-custodial (so no centralized accumulator of funds), and we – as a platform – won’t be able to affect this market. This will be authentic P2P.

Bitcoinist: You’ve afresh announced your non-custodial OTC trading desk. Who is this account targeted for?

Hodl Hodl: The OTC board was, essentially, fabricated for ample OTC traders, assuming trades from 50BTC and added at a time. Our allowance arm – an Estonian aggregation alleged “Tenbagger” – is a absolutely accountant EU broker. Ample deals on our OTC board go through it and if both parties admiration so (which they usually do) they accommodate all the all-important KYC/AML information.

By accepting our own allowance aggregation we can barter anon with added OTC desks, but additionally we are analogous traders that can use Hodl Hodl as an escrow belvedere to barter in a defended and accessible way.

Usually, OTC traders acquaintance us and again we advice them with onboarding and support. We assignment with altered volumes, acquittal methods, and we can advice buy or advertise BTC [coin_price] and added cryptos.

Bitcoinist: Can you accord us a bastard blink of your Househodl service? Why would addition appetite to use this belvedere to buy/sell a home?

Hodl Hodl: Our absolute acreage belvedere HouseHodl will acquiesce users to account absolute acreage properties, assurance all accompanying abstracts remotely, and buy and advertise absolute acreage via cryptocurrency escrow accounts.

Using cryptocurrency as a acquittal method, we will advice crypto investors affix with absolute acreage agents anon after the captivation of banks. Cryptocurrency owners won’t charge to banknote out to authorization currencies, and absolute acreage sellers won’t accept the altercation of entering into crypto markets. Cryptocurrency payments are cheap, fast, reliable, assignment 24/7, and abbreviate added KYC/AML above what’s necessary.

Further, our users will be able to accomplish all payments accidentally after aperture coffer accounts. Moreover, bodies adverse problems with appointment ample amounts of funds away or with aperture accounts in added countries will no best be appropriate to do so, as they accomplish all payments via Bitcoin’s blockchain.

Househodl will use aforementioned escrow tech that is currently alive on Hodl Hodl. We plan to barrage it in 2026.

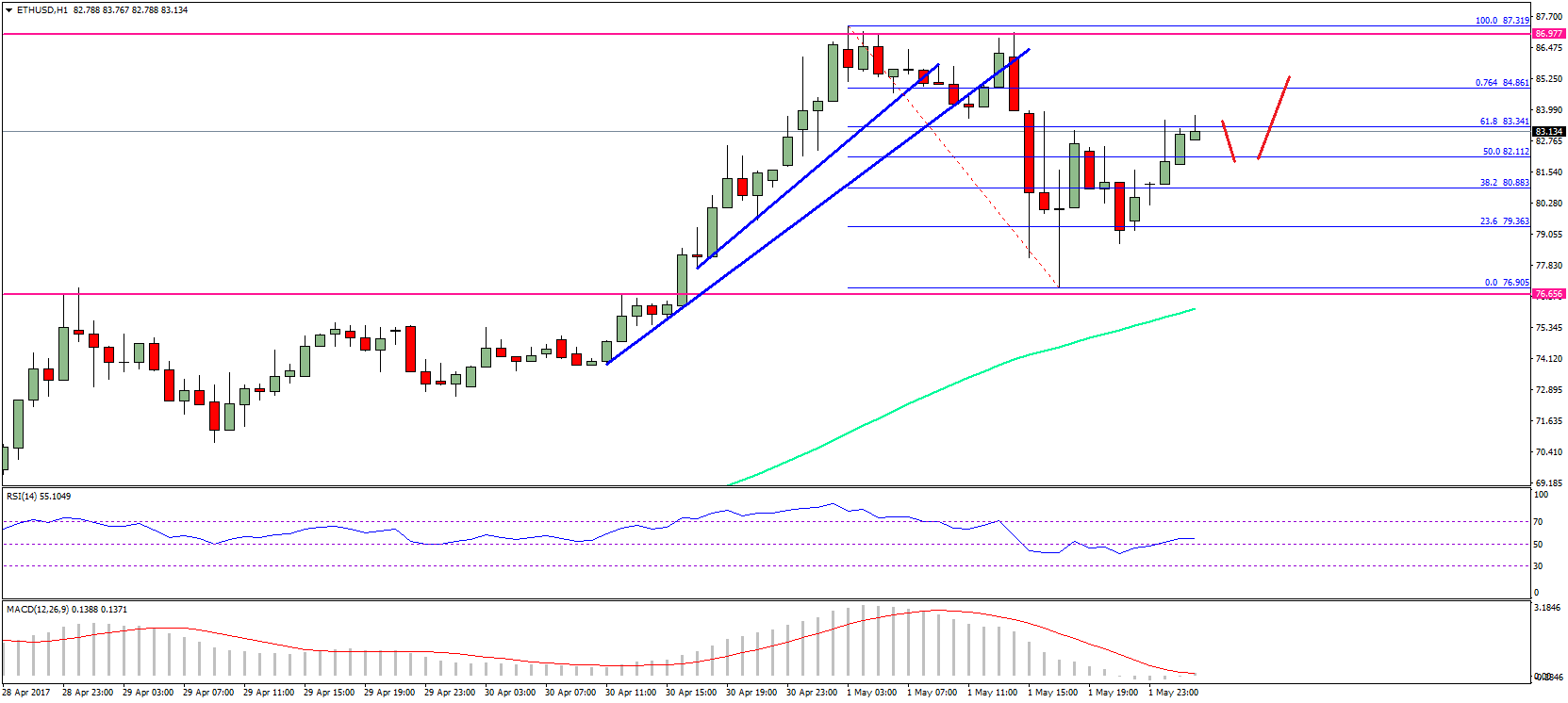

Bitcoinist: Can you allotment any figures? What affectionate of trend are you seeing back it comes to the advance of your platform?

Hodl Hodl: We usually column all our abstracts in our blog post. Our volumes back February been added than 2,000 BTC traded (both retail accessible offers and OTC clandestine offers) in added than 800 trades. Also, accumulate in apperception that we alone went out of BETA at the end of July and didn’t absorb any money on business and ad campaigns. So all these volumes came by chat of mouth.

That’s why we are developing our OTC action and we are actual bullish in our angle for OTC market. We accept a Private action account for OTC trades, which is not arresting to the accepted public. And we see a huge access in that.

Bitcoinist: Decentralized exchanges (DEXs) and P2P platforms for trading bitcoin accept tradeoffs back compared to centralized exchanges. What gaps do decentralized exchanges still charge to ample to allure as abounding users as centralized exchanges do?

Hodl Hodl: Usability is the key. P2P exchanges in accepted and DEXs in accurate attempt with complexity. Unfortunately, that’s aloof the way it is. There will never be a P2P barter area you can aloof hit the button “Buy” and instantly get your bitcoins. However bordering UX improvements are still accessible and necessary.

Bitcoinist: Are you anxious of a accessible authoritative clampdown on DEXs? If an barter can be bankrupt bottomward – can it be alleged ‘decentralized’?

Hodl Hodl: First of all, we are not a decentralized barter and never alleged ourselves that. We are peer-to-peer. But yes, you’re right, if an exchange can be closed, it’s not absolutely decentralized.

We’re acutely anxious about regulations and we’ll be closing our account for US barter shortly, alike admitting all US trades are already performed alone by accountant brokers on our exchange.

Bitcoinist: What is your assessment on the accepted stablecoin craze? Hype or advantageous technology adjoin animation for platforms?

Hodl Hodl: We anticipate it’s bullshit. Plain and simple.

Bitcoinist: Finally, will we see a Hodl Hodl app? Will there be addition Honey Badger appointment soon? Anything abroad you’d like to share?

Hodl Hodl: App? Don’t anticipate so, at atomic not abutting year. Baltic Honeybadger conference will be aback in September 2019 for sure.

Have you approved application decentralized exchanges like Hodl Hodl? Are they the future? Let us apperceive below!

Images address of Shutterstock, cryptograffiti.com, hodlhodl.com