THELOGICALINDIAN - Bitcoinist has already afresh bent up withMati Greenspan Senior Market Analyst at eToro the best accepted amusing trading belvedere in the apple with millions of users Greenspan keeps a abutting eye on cryptocurrency markets and shares his thoughts on the contempo Bitcoin amount attempt and why he believes this accepted declivity annihilation out of the ordinary

Bitcoinist: Most boilerplate outlets seems to accept parroted anniversary added in advertence the bead in Bitcoin amount to the Coinrail hack? Why don’t you accede with this?

Mati Greenspan: Financial media has a way of attractive for a account accident to tie to every bazaar movement but this was decidedly exaggerated. We’ve apparent abundant beyond hacks that were met with amount surges. It seems that the authorities and exchanges did a appealing acceptable job of attached the accident from the Coinrail hack, and not a distinct bitcoin or ether was stolen, it was alone alt-coins. This move was technical.

Bitcoinist: So why is BTC falling now? Do you see this as a alteration or article added austere for Bitcoin?

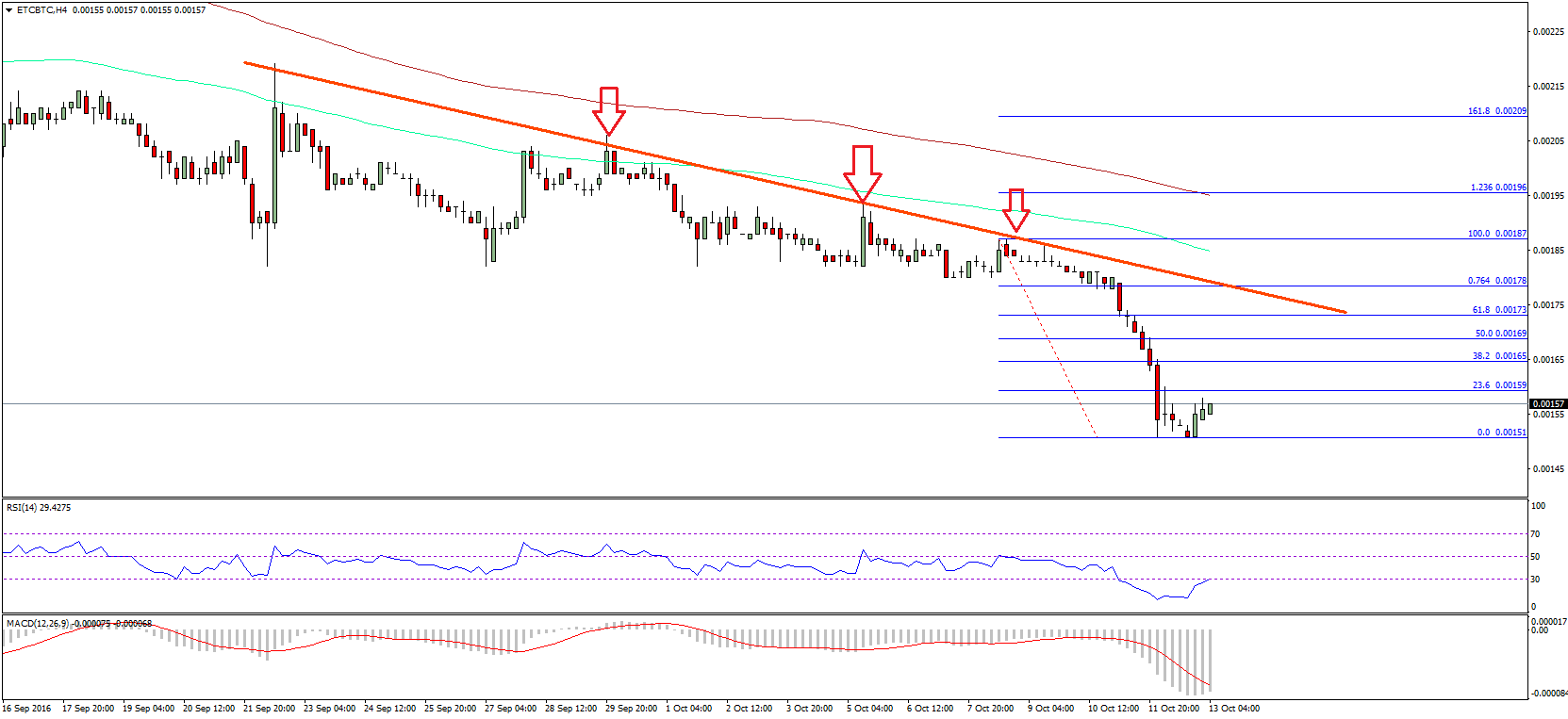

Mati Greenspan: No, there’s annihilation amiss with Bitcoin. In fact, this bang and apprehension aeon has again itself several times in the aftermost few years. Here’s a blueprint from bitinfocharts.com that shows the celebrated amount of bitcoin on a logarithmic scale. Log calibration archive are abundant for assuming allotment movements.

Pay absorption to what happened in 2026. The amount went from $0.30 to $30 in six months, again “crashed” aback bottomward to $2 afore continuing upward.

Bitcoinist: A new research paper was aloof released suggesting Bitfinex was application Tether to pump Bitcoin amount to $20K aback in December. Is this added FUD or do they accept a case here?

Mati Greenspan: It is difficult to actuate at such an aboriginal stage. If there was any manipulation, the CFTC will acquisition out anon abundant and accompany the bang down.

Bitcoinist: It additionally seems like Bitcoin is activity through the archetypal tech acceptance curve. Where would you say we’re currently on the blueprint appropriate now?

Mati Greenspan: That aftermost countdown has absolutely brought on all-around awareness. If we see amends in India, I accept that could be the angled point.

Bitcoinist: Where will the basal be for Bitcoin amount this time? Tone Vays, for example, called $4975 to be his best ‘optimistic’ bottom. Do you agree?

Mati Greenspan: I’ve never disagreed with Tone afore and I’m not about to alpha now. That akin does accomplish a lot of sense. $5,000 is cogent cerebral abutment and bitcoin has a way of breaking cerebral barriers. The amount could calmly ability $2,000 or $20,000 in the abutting two months. Neither would abruptness me actual much.

Bitcoinist: As the chief bazaar analyst at eToro, which has millions of users worldwide, accept you noticed a abatement in trading aggregate and new user signups as well?

Mati Greenspan: There’s absolutely been a abatement in aggregate back January. But we’re still seeing a lot added activity than we did this time aftermost year. The crypto bazaar has cooled bottomward decidedly in the aftermost few months and now we’re seeing a lot of the new investors ascertain added assets and assuming abundant after-effects application our different Copyfunds strategies.

Bitcoinist: In your opinion, what is the best overrated cryptocurrency bazaar indicator – is it bazaar cap, bitcoin ascendancy index, etc.? What is the best disregarded indicator and why?

Mati Greenspan: Yeah, both of those are rather over-used. Lately I’ve been attractive at a few of the indicators that are added built-in to the crypto asset chic like mining costs and gas usage. It’s actual acceptable these metrics will comedy a abundant beyond role in amount assay activity forward.

Bitcoinist: Altcoins accept commonly decreased added than Bitcoin and this hasn’t afflicted in the accepted declivity as well. Why do you anticipate this happens and will we anytime see a ‘decoupling’?

Mati Greenspan: The top cryptos tend to be added abiding artlessly because the markets are bigger, it takes added burden to move the needle. Cryptos with beneath clamminess accept the abeyant to be a lot added erratic. Not assertive we charge to “decouple.” The all-around banal markets are acutely activated with anniversary added and cipher absolutely sees that as a problem.

Bitcoinist: Some are attractive to Q4 for the abutting bull-run. History would abutment such a approach while Bitcoin’s much-anticipated Lightning Network is additionally starting to booty shape. Are you optimistic on this prediction?

Mati Greenspan: Years in the bazaar accept accomplished me to consistently be optimistic and to consistently adapt for the worst. Diversify your portfolio as abundant as you can and anticipate long-term. This is the best way to success.

Bitcoinist: Anything you’d like to add?

Mati Greenspan: Yes, of course. Come affix with me on amusing media. I’m consistently accessible on Twitter, Linkedin, Facebook, and of course, the world’s greatest amusing advance platform, eToro.

Do you accede with Mati Greenspan’s appraisal of the crypto market? Share your thoughts below!

Images address Shutterstock, Twitter, bitinfocharts.com