THELOGICALINDIAN - Bitcoinist batten with the aggregation from lending platformINLOCKon how its belvedere solves the spendability botheration for users of Bitcoin and added cryptocurrencies while accouterment the advantage to abide hodlers

Wanted to ‘hodl’ back you should accept ‘sodl’ or carnality versa? Despite absurd potential, the beginning cryptocurrency industry is still abaft in agreement of banking casework and accoutrement that action adaptability back compared to acceptable finance.

Lending platform InLock wants to change this by enabling cryptocurrency to be acclimated as accessory for a accommodation in authorization — finer analytic the concise spendability problem. At the aforementioned time, borrowers can abide ‘hodlers‘ with the advantage to get their cryptocurrency aback in abounding afterwards the accommodation is paid off, behindhand of any changes in price.

InLock CEO Csaba Csabai, CMO Peter Gergo, and CSO Benedict Banathy afford ablaze on how InLock makes this accessible — as able-bodied as advantages over added crypto P2P lenders like SALT and Nexo — and why they’ll be amalgam Bitcoin’s Lightning Network to accommodate alike added banking services.

Bitcoinist: You say that Bitcoin and crypto accept a spendability problem. Can you busy on this?

Csaba: When we looked at the Bitcoin blockchain, we begin that 40% of all bitcoins absolute today had not been confused at all in the accomplished year. Looking aback at 2026, there were affluence of affidavit to move them: adamantine forks, the mempool crisis, adjustment problems, an amazing balderdash run, followed by a 70% correction.

Bitcoinist: How big of a barrier is it to Bitcoin’s all-around adoption?

Peter: There are abounding problems blocking accumulation all-around acceptance of cryptocurrency and alone one of them is the spendability problem. To date, it is still almost adamantine to acquisition a merchant who will acquire crypto as a agency of payment.

Additionally, bitcoin’s animation can accomplish it chancy to absorb or barter them. No one knows what the amount is activity to be 6 months from now or alike tomorrow. Value adherence is a amount addressee of any awful accessible currency.

Bitcoinist: How does INLOCK break this spendability problem?

Benedict: Regardless of the barter amount or the perceived amount of Bitcoin, no one can altercate that it doesn’t accept value. Anything that has amount has the abeyant to be acclimated as collateral. The way we break the spendability botheration is by enabling our barter to never accept to advertise their crypto to accounts a acting clamminess problem.

Bitcoinist: Who can be a borrower on your platform? Who can be a lender?

Csaba: According to regulation, afterwards casual our KYC process, anyone who owns crypto-assets can borrow Fiat through our platform. Institutional lenders who accept the authorization to accommodate Fiat and accept been accustomed by our acknowledged framework can become lenders on our platform. It is important to agenda that on the INLOCK platform, lenders are aggressive for borrowers. Market-competition is in aftereffect ensuring that borrowers get the best action ill-fitted for their needs.

Bitcoinist: What accept you done so far to accompany absorption to this botheration and what affectionate of acknowledgment accept you received? Specifically, who has apparent absorption in accepting crypto loans or acceptable lenders?

Csaba: We’ve been activity through several validation processes the accomplished few months to accomplish abiding that back we accomplish our aboriginal few announcements, we’ll be accessible with the MVP demo, which will accredit the association to acquaintance the INLOCK platform. We already accept our aboriginal acquittal provider and lender accomplice active up: Virpay.

Virpay has been admiring of INLOCK back the alpha and as one of the best avant-garde fintech companies in the Central and Eastern Europe region. It’s no abruptness they were the aboriginal to accept INLOCK’s potential. We clearly kicked off our all-embracing roadshow presenting the INLOCK Project at the IoP conference in Berlin. We’d like to booty this befalling to acknowledge the IoP appointment organizers for the invitation, balmy welcome, and abutment from their amazing community.

Bitcoinist: Some accept argued that acceptable banking practices like apportioned assets lending accept fueled bang and apprehension cycles and were partially amenable for the ’08 crisis. How is lending with crypto any better?

Peter: The abstraction of lending crypto is capricious and we do not do that. We acquiesce bodies to use their crypto as accessory for a Fiat loan. In our platform, the akin of accident demography for barter amount fluctuations is absolutely customizable by the Borrower. This way, we accord to the adherence of the accomplished crypto ecosystem.

Bitcoinist: Why did you adjudge to barrage an ICO compared to acceptable allotment methods and affair your own ILK token?

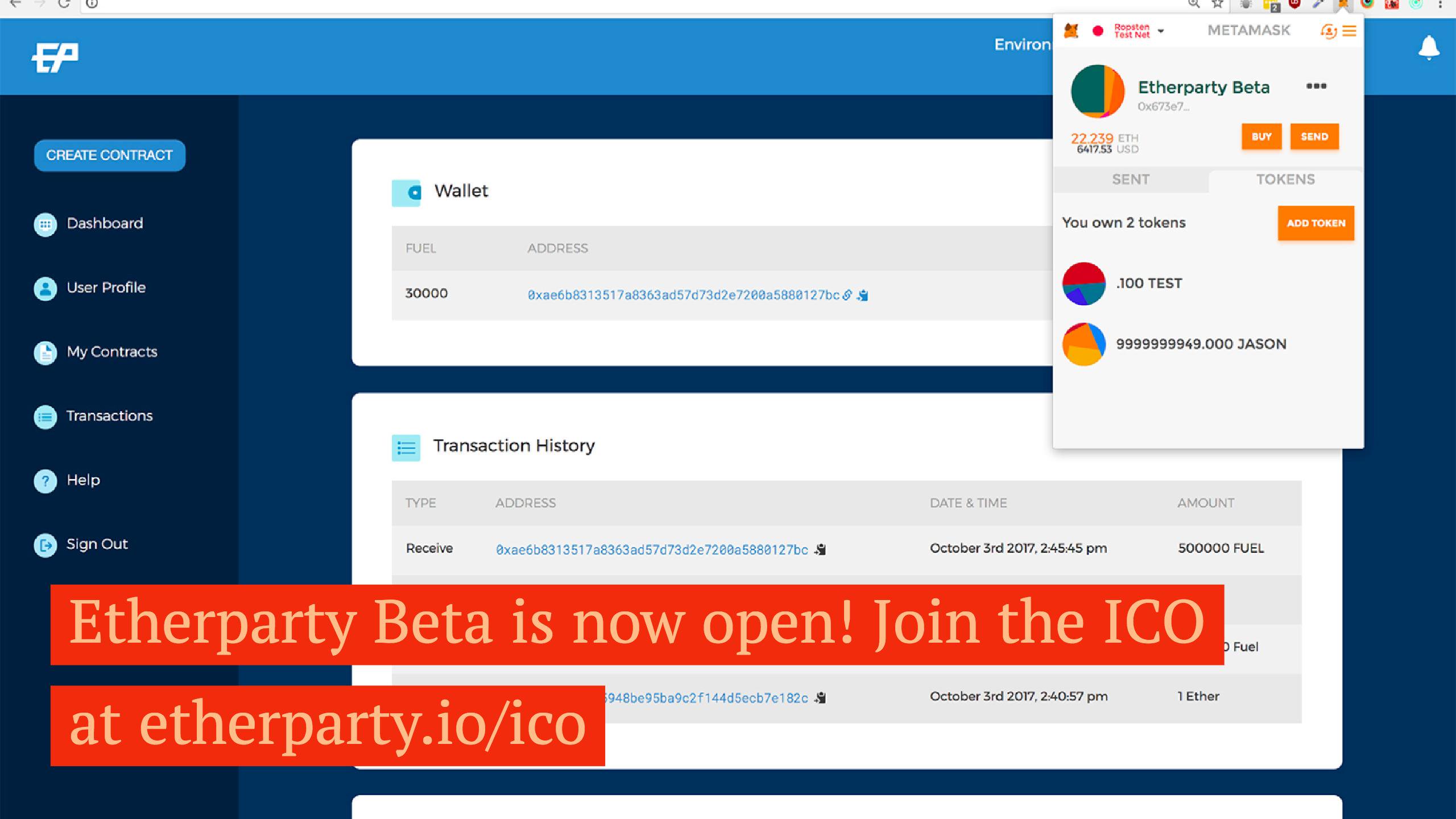

Csaba: The INLOCK belvedere prepares a Smart Contract to almanac the acknowledged accord amid parties, which is again digitally active by INLOCK and 3 absolute participants, giving them assertive rights – the participants are the borrower, lender and accessory manager.

The accessory administrator handles the accessory for the absolute continuance of the loan. The Smart Contracts run on the blockchain, absolute arguable affirmation and tasks which accomplish abiding of the candor of all participants. Our tokens are capital for the INLOCK ecosystem and it’s absurd to transact on the belvedere after it.

Benedict: About the ICO: The accessible badge auction is one of the best able means of alluring basic but above that, it’s a abundant way to let bodies apperceive we abide and to allotment how INLOCK will appulse the cryptocurrency world.

Bitcoinist: Why does your belvedere charge its own token? Can’t you aloof use bitcoin instead?

Csaba: The ILK tokens represent advantage for assets used; after the tokens, these costs would charge to be anon deducted from the collateral, which is adverse to the aesthetics of the INLOCK platform. INLOCK was created to activate the purchasing ability of cryptocurrencies after accepting to advertise or barter them. The badge enables this exchange.

Bitcoinist: You’re not the aboriginal to advance a crypto lending platform. There are SALT, Nexo, and Ethlend, for example. Why should addition use INLOCK instead of those mentioned?

Peter: After consulting with law firms, it bound became bright that the key to our success is to be adjustable with regulation. Before entering any new regions, we will advance the authoritative framework for lenders and accessory managers in allocation with bounded authorities.

As we accompany in institutional lenders to the crypto space, we will best acceptable accept the best clamminess accessible for our barter to use. We are a lending belvedere so we are not bound to our own clamminess like abounding of our competitors.

Like you mentioned, there are abounding platforms, but alone a few are able to deliver. The absolute crypto lending solutions clamminess and territorial advantage accumulated are not acceptable to accommodated all the chump demands at the moment. Most of the tokenized crypto platforms calm allotment to accept clamminess for borrowers. We instead use our investments for business development – we aim to go all-around as anon as possible.

Bitcoinist: According to your roadmap, Q1 2026 will see the accomplishing of layer-2 payments channels (such as Lightning Network). Could you busy on this? Would this advance your lending service?

Csaba: It is not anon accompanying to the lending service, it is article else, we action abounding absorbing means to advance Bitcoin.

In case of absolute bazaar changes, the accessory of a active arrangement becomes added than acceptable to awning for the loan. Now our barter can either abstract the added bulk from the contract, or they can absorb the balance bulk through INLOCK’s LN channels instantly.

The best agitative affair our barter are able to do is, if they accept accessible cryptocurrency aural INLOCK’s wallet that is not bound into any contracts, they accept an advantage to acquiesce the belvedere to use the balance bulk of crypto to accommodate added clamminess for the LN channels. All acquirement generated this way will be accustomed to the barter 100% afterwards anniversary LN cycle.

Bitcoinist: But what happens if there are abrogating bazaar changes like a big crash? How does that affect the loan?

Peter: It will be terminated, and the lender will be paid in full. But that’s the aftermost step, we consistently adviser the bloom of anniversary loan, and acquaint the borrower. They accept the advantage to resupply the accommodation to abstain termination.

Bitcoinist: Anything abroad you’d like to add?

Benedict: Those absorbed in our activity can try our demo: mvp-demo.inlock.io. Please feel chargeless to accompany our Telegram channel: t.me/inlock.

Do you anticipate such a crypto-collateral lending belvedere can be a admired accession to the cryptocurrency ecosystem? Share your thoughts below!

Images address of Inlock.io, Shutterstock