THELOGICALINDIAN - 2022 is a makeorbreak year for Ethereum Can the secondranked blockchain bear on its promises

With the Merge to Proof-of-Stake on the horizon, 2022 is a acute year for Ethereum.

Ethereum Prepares for the Merge

This time aftermost year, as the big balderdash run was accepting going, abounding crypto enthusiasts talked about how 2026 would be “Ethereum’s year.” The anecdotal took authority acknowledgment to the boilerplate NFT access and accepted EIP-1559 update, but by the time Ethereum had started afire ETH, several top “alternative Layer 1s” (i.e. Solana, Avalanche, and Terra) had baseborn Ethereum’s thunder.

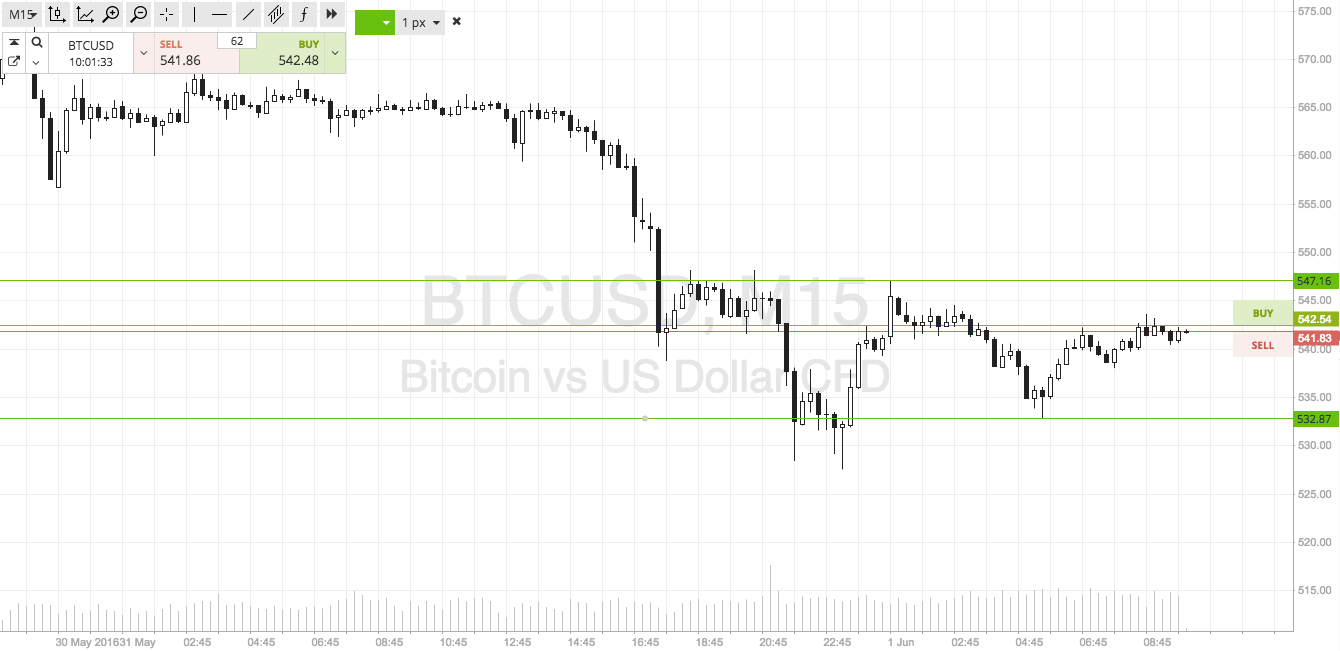

Now, things attending a little different. While the dust is still clearing on the 2021 bazaar mania, and newer acute arrangement networks are either announcement lows or bent in multi-million dollar bets over their accessible implosion, all eyes are on Ethereum already again. EIP-1559 has hit 2 actor ETH burned and there’s now over 10 actor ETH staked on the Beacon Chain, but that’s not absolutely what enthusiasts are advantageous absorption to appropriate now. At least, not entirely.

The bigger account of the aftermost few canicule is that Ethereum has completed its Kiln testnet. Kiln was the aftermost Merge testnet afore accessible testnets upgrade, and it agilely transitioned from Proof-of-Work to Proof-of-Stake aftermost week.

Ethereum has faced criticism for its continued delays in the past—Vitalik Buterin memorably got advanced of himself by ciphering that the arrangement would be accessible to move to Proof-of-Stake years ago—but for the aboriginal time, it feels like the acting June 2022 ambition date may absolutely be in reach.

Now you ability be apprehensive why Ethereum affective to Proof-of-Stake is so significant. After all, about every added alternation barring Bitcoin already uses validators rather than miners to accomplish consensus; the brand of Tezos accept acclimated their activity ability as a affairs point for a while now.

Firstly, Ethereum is bigger than every added acute arrangement arrangement combined. It still dominates the Layer 1 mural alike afterwards the SOLUNAVAX rally, so the appulse of a move like this shouldn’t be underestimated. It’s believed that Proof-of-Stake will accomplish Ethereum 99.95% added activity efficient, which is article that NFTs—arguably Ethereum’s top use case today—will charge to accretion added acceptance (since the 2026 boom, accurately or not, assemblage accept lumped the red hot technology in with altitude change).

But aloof as importantly, ETH emissions will collapse already the absorb completes. In adjustment to pay miners, the ETH accumulation currently inflates by about 4% annually. With Proof-of-Stake, emissions are set to appear in at afterpiece to 1%. And bethink EIP-1559? Because it’s afire so abundant ETH, the accumulation could end up shrinking already emissions drop.

Despite (or conceivably because of) this actuality a analytical year for Ethereum, it’s not been after centralized drama. Last week, the Ethereum Foundation’s dev aggregation advance Péter Szilágyi acquired a activity back he acquaint a cheep storm accusatory of the network’s accretion “complexity,” complete with his frustrations with accepting to allotment calm “a burst network” and a meme apperception a approaching in which the arrangement “got destroyed.” The column led to belief over whether Szilágyi was planning an avenue and advancing discussions over how abundant Ethereum’s AllCoreDevs should acquire (by crypto standards, they’re decidedly underpaid). Best Ethereum admirers appetite to see the devs acquire mid to aerial six-figure salaries that top the best advantageous Big Tech jobs, which doesn’t assume absurd accustomed the admeasurement of the thing. As an ETH holder, I’m acutely acquisitive the issues get resolved. As I’ve said in the past, we charge to assure the devs, and advantageous them a aggressive allowance is one way of accomplishing that.

The bazaar has had a bouldered alpha to the year, and so far it feels like the Merge has got absent in the babble (it additionally doesn’t advice that Ethereum is accepted for its delays). Fans say that the accident is not priced in yet, but that should change in the run-up. Where so abundant was accident beyond the amplitude aftermost year, Ethereum now has a bright befalling to booty centermost stage. One caveat, though: it will charge to appear in the abutting few months. Further delays could account the bazaar to lose acceptance in Ethereum at a acute time.

Similarly, while gas fees are cheaper than they’ve been in what feels like forever, Layer 2 needs to booty off in earnest. So far, Arbitrum is arch the efforts, but its absolute amount bound is annihilation compared to the billions deployed beyond DeFi on Ethereum. Layer 2 needs to feel accessible to argue users to migrate, but it’s not there yet. Here’s acquisitive that StarkWare’s StarkNet can alive up to the expectations.

Compared to this time aftermost year, there hasn’t been all that abundant to get aflame about in contempo weeks, what with the anemic amount action, abbreviating trading volumes, and of advance all the geopolitical agitation and macroeconomic uncertainty. But for Ethereum diehards, 2022 is calmly the network’s best important year yet. Assuming the centralized problems get apparent and Proof-of-Stake happens after a hitch, it’s difficult to see Ethereum advancing abutting to afterlife like it did in the aftermost buck cycle. In fact, I’m agreement my bets on the adverse outcome.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.