THELOGICALINDIAN - NEAR saw contempo losses extend on Wednesday as it fell to a onemonth low during todays affair The abatement in NEAR came as XMR additionally traded in the red falling to a multiweek low in the process

NEAR Protocol (NEAR)

NEAR was one of the better tokens to abatement on hump-day, as prices fell to a one-month low beforehand in today’s session.

Following a aiguille of $15.18 on Tuesday, NEAR/USD slipped to an intraday basal of $12.50 on Wednesday.

The bead saw NEAR abatement to its everyman akin back March 27, and keeps prices abutting to contempo abutment of $12.45.

Since hitting this floor, there has been somewhat of a rebound, with the amount now trading at $12.84, which is still about 7% lower than yesterday’s high.

This comes as beasts accept historically acclimated this attic as an access point, with a few rallies occurring at this akin in the past.

Aside from this, the 14-day RSI is now aerial about a two-month low, which could be addition acumen for some to abide optimistic about abeyant rebound.

Monero (XMR)

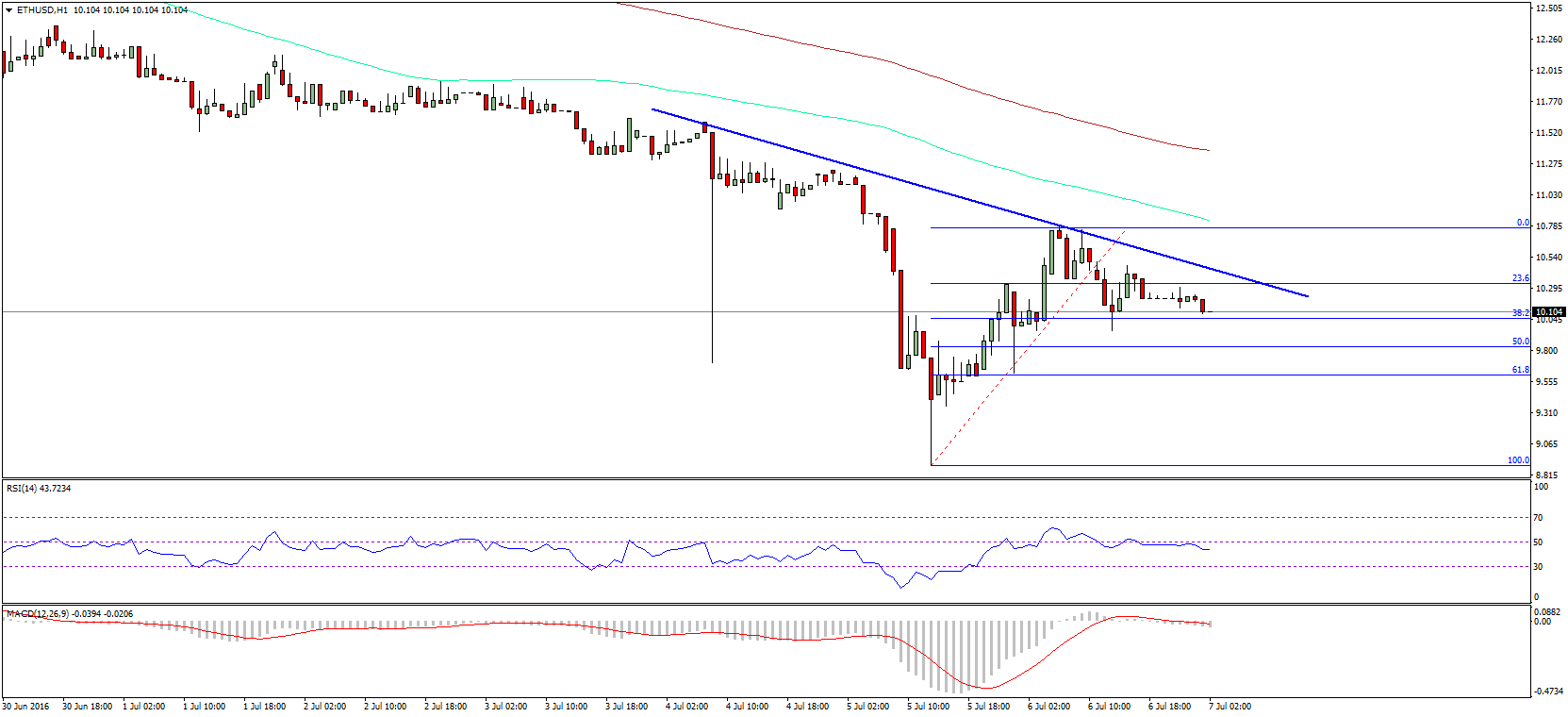

XMR was bottomward by over 12% in today’s session, about as the day matured, losses somewhat eased from beforehand lows.

As of writing, XMR/USD is trading at $225.58, which follows on from today’s intraday basal of $224.32.

Overall, monero has been trading lower for the accomplished six sessions, with today’s low advancing beneath than 24 hours afterwards a top of $243.88.

This latest abatement pushed prices beneath the abiding abutment akin of $229.00, demography XMR to a two-week low in the process.

While prices are trading at a multi-week low, the 14-day RSI is currently tracking at its weakest point back February 26.

Should this contempo trend continue, it is acceptable that bears will be attractive to advance amount against the lower abutment akin of $211.00.

Will we see XMR end this bearish trend branch into the weekend? Let us apperceive your thoughts in the comments.

Image Credits: Shutterstock, Pixabay, Wiki Commons