THELOGICALINDIAN - The alpha of the anniversary saw agenda bill markets bead decidedly in amount as billions of dollars were baldheaded off the absolute crypto economys assets A account address from Luno and Arcane Research shows February 23 captured the thirdlargest bitcoin circadian barter aggregate in crypto history as atom bazaar aggregate saw 18 billion change easily Moreover crypto derivatives are surging as bitcoin futures accessible absorption commandeered 191 billion on Tuesday

Volatile Bitcoin Price Fluctuations Sees Intraday Swings Close to 20% for Two Days In a Row

After bitcoin (BTC) affected an best amount aerial on Sunday, hitting $58,354 per unit, bitcoin’s amount slipped beneath the $50k handle affecting basal at $44,846 per coin. The accident amid these two amount ranges saw over 23% baldheaded off BTC’s bazaar valuation.

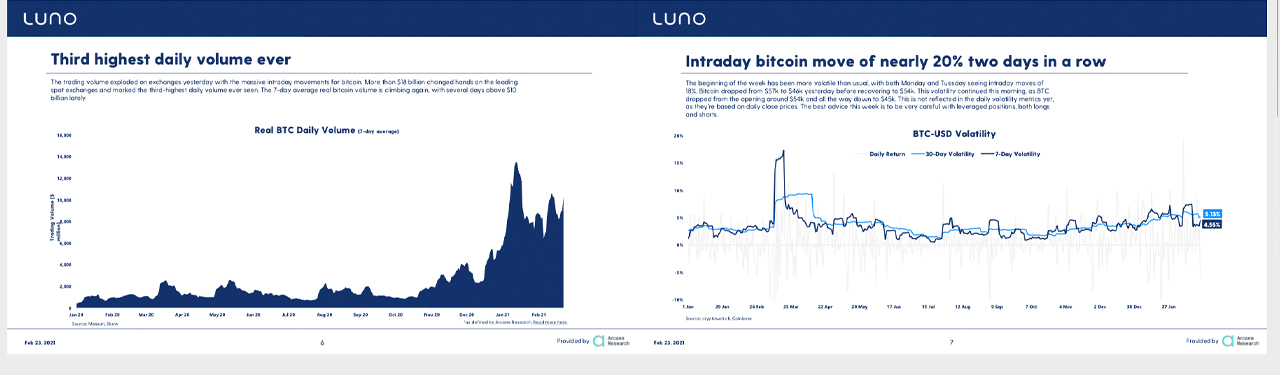

While abundant losses were apparent beyond the lath throughout the absolute crypto-economy, a address from Luno and Arcane Research shows that Tuesday’s barter aggregate was the third-largest anytime seen. The agenda asset’s intraday moves had apparent the crypto asset’s amount fluctuations accept been added erratic. In fact, Luno’s address shows intraday moves of abutting to 20% happened two canicule in a row.

“The alpha of the anniversary has been added airy than usual, with both Monday and Tuesday seeing intraday moves of 18%,” the abstraction notes. “Bitcoin alone from $57k to $46k bygone afore convalescent to $54k. This animation connected this morning, as BTC alone from the aperture about $54k and all the way bottomward to $45k. This is not reflected in the circadian animation metrics yet, as they’re based on circadian abutting prices,” the address adds.

Luno’s address says that traders should be “very accurate with leveraged positions, both longs and shorts.” It additionally said that bitcoin derivatives accept been “snowballing in the bitcoin market” and had “peaked at $19.1 billion this Sunday.” “Yesterday’s sell-off pulled out some beef from the leveraged futures market, but the altitude is still hot,” Luno’s abstraction emphasizes.

Bull Market Could See a ‘Stronger Rally,’ Cooling Down the Feverish Derivatives Markets

Pankaj Balani, CEO of Delta Exchange, a agenda asset derivatives trading belvedere says the contempo bitcoin (BTC) alteration was healthy.

“Despite the correction,” Balani said in a agenda to investors. “The balderdash bazaar and the case for a stronger assemblage in bitcoin charcoal intact. This is alone the additional alteration in BTC prices back November, back bitcoin bankrupt aloft its antecedent ATH and started a beginning rally. The 2017 balderdash bazaar saw bitcoin actual 25%-35% assorted times afore extensive its aiguille in January of 2018,” the Delta Exchange added. Balani expects a “short-term consolidation” in BTC’s prices for now.

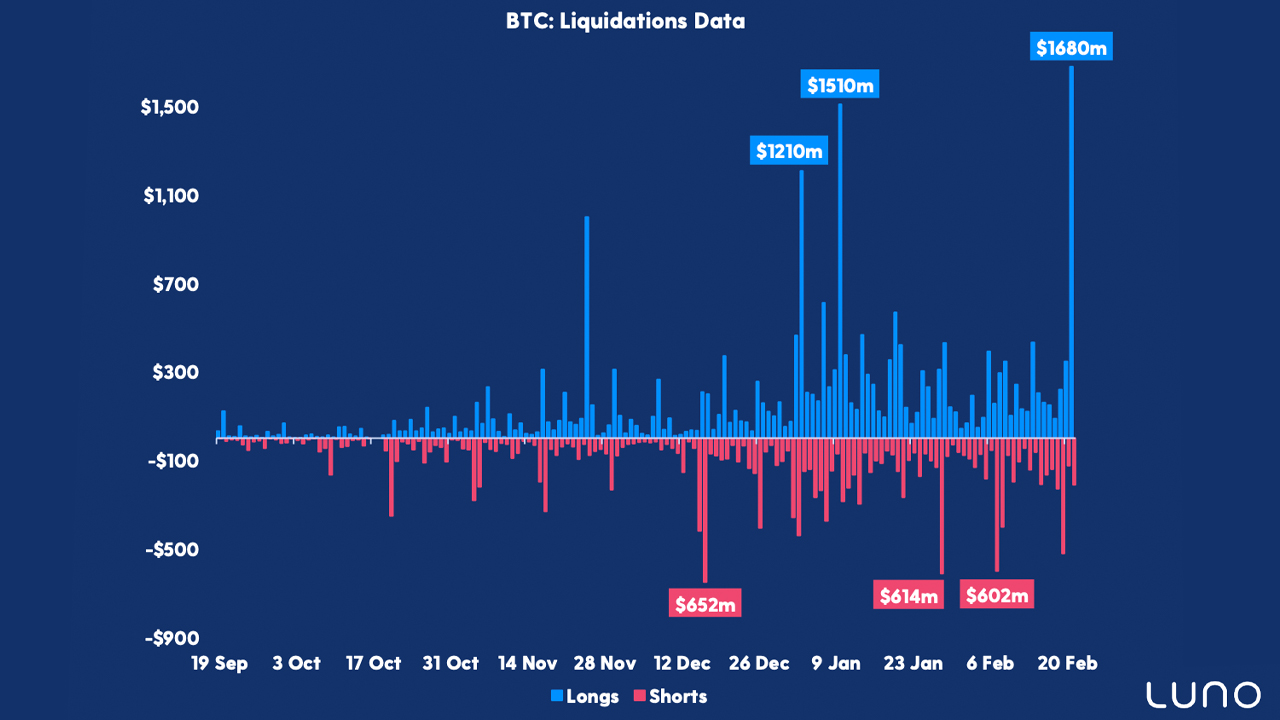

The allegation in Luno and Arcane Research appearance that amid February 1 to Feb. 22nd, bitcoin futures accessible absorption (OI) climbed by 63% outpacing BTC’s amount acceleration which was alone 57%.

“The accessible absorption outpacing the bitcoin achievement should be a apropos assurance as it shows that the advantage $10 [billion] is acrimonious up,” Luno said. “While the OI is a aftereffect of both longs and shorts, the huge premiums in the futures bazaar afresh announce that leveraged upside acknowledgment has $5b been the capital contributor to the ascent OI. It would be a advantageous assurance activity advanced if the futures market’s advance takes a breather,” the address added.

The affecting BTC derivatives agitation has acutely cooled bottomward as Luno and Arcane’s allegation appearance some of the futures OI had blown afterward the sell-off.

“The allotment ante accept alternate to aloof territory, and the bazaar seems healthier,” Arcane Research’s account agenda to investors said this week. For now, bitcoin traders are alteration positions and strategies afterwards the dump, and absorption on BTC’s abutting big move.

What do you anticipate about bitcoin atom bazaar volumes ascent and the feverish bitcoin derivatives markets? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Twitter, Luno, Arcane Research,