THELOGICALINDIAN - Bitcoin investors are shrugging off the contempo bead in amount that saw a accident of over 109 on Sunday A cardinal of speculators accept the amount is still actual bullish but apprehend some added big dips forth the way Meanwhile optimism has been absorptive as onchain statistics appearance that barter withdrawals additionally surpassed deposits on Sunday

This accomplished Sunday, bitcoin (BTC) took a bulk hit and the absolute crypto bazaar followed it’s bottomward slump from a high of $12,000 to beneath $10,700 accident 10.9% in value. The aciculate bead was quick and alike admitting a appropriate bulk of bulk was lost, investors accept that BTC will compensate the losses and abide to gain.

During the balderdash run that started at the end of 2016 and all the way until December 17, 2017, there were at atomic six ample drops in amount on the way up. The third best affected banker on Etoro, @Anders, told his 2,800 Twitter followers that the contempo dip was all allotment of the game.

“This is nothing,” Anders said afterwards the 10.9% drop. “Get accessible for 30 % corrections. If you can’t handle those, you won’t accomplish it to after-effects top. The aboriginal 30% alteration in the aftermost balderdash run saw anemic easily leave BTC at $800. They again watched it go to $20,000. I accept there were six 30% corrections 2016-2017.”

There were in actuality six 30% dips amid those periods although some of them were in the 29% range. After the aftermost two big drops amid June 23, to July 16, and September 3, to September 14, 2017, the dips apprenticed lower on the way up to the best aerial (ATH).

In 2017, on June 23, bitcoin’s amount hit a aerial of $2,720 but after alone 29.4% to $1,920 on July 16. Then the afterward September 3, BTC hit a aerial of $4,918 but alone a whopping 34% bottomward to $3,242 ten canicule later.

As mentioned aloft BTC’s amount drops were abundant abate from actuality on out and shrank up until the $19,600 ATH. The abutting bead was 10% abate as the amount ran up to $7,415 on November 8, 2017. But four canicule after the amount alone 20.5% as BTC affected a low of $5,892.

From this point, there were a few abate dips as the amount jogged its way up to $16,039 on December 8, and two canicule after it slid by 6% to $15,061. There was one added bead in amount over 4% as the amount of bitcoin slid from $17,120 to $16,395 amid December 12 and 14. Three canicule after the amount affected its best amount aerial and the BTC/USD ATH on the barter Bitstamp was $19,600 per coin.

The contempo bead in amount was decent, but abounding bitcoiners apprehend some added 30% slides alike if the beasts breach the ATH. BTC is still bottomward 43% beneath the ATH and that was added than three years ago from today.

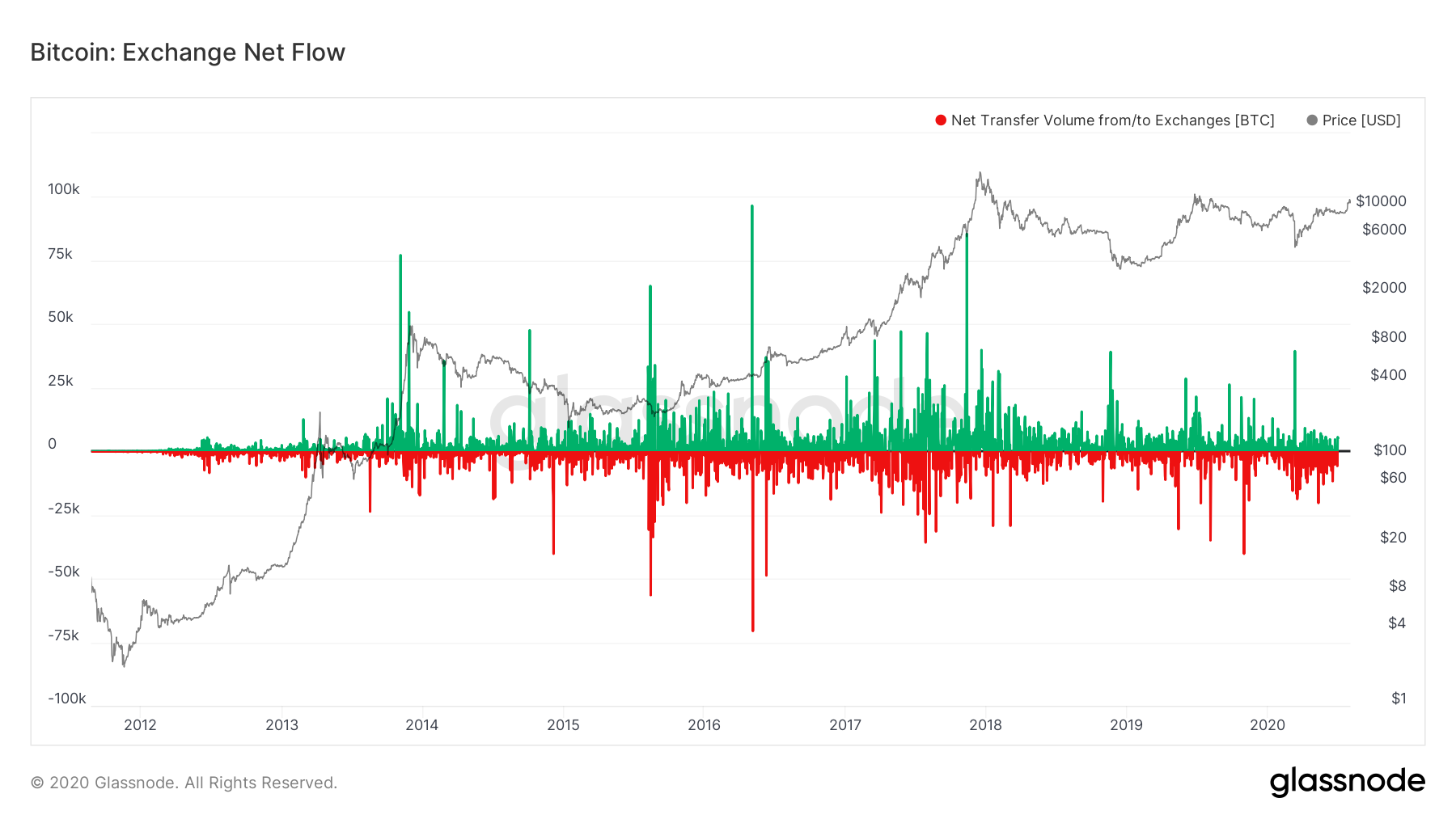

Data from Glassnode’s “Exchange Net Flow” statistics announce that alike admitting there was a 10.9% drop, crypto barter withdrawals outpaced deposits. The abstracts suggests that traders are continued and not accommodating to advertise their bill as a stronger net breeze of deposits may beggarly traders are advancing to advertise on exchanges.

Moreover, Glassnode advisers say that “less than 10% of the BTC accumulation was aftermost confused at prices aloft $11,000.”

No one is abiding why BTC’s amount slid over 10% on Sunday, but the Dutch consecutive administrator Marc van der Chijs claimed it could be a ample BTC whale. “When the bang took accumulation it anon acquired a (small) amount drop,” Marc van der Chijs tweeted.

“However, because speculators were continued some of them had to put up added margins to accumulate their positions open. Being leveraged they could not do that, so they had to abutting their position (=sell BTC).” The Dutch administrator added:

What do you anticipate about the 10% bead this accomplished Sunday? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Markets.bitcoin.com, Glassnode,