THELOGICALINDIAN - In the aftermost 48 hours agenda bill markets accept rebounded afterwards some bearish amount dips aftermost anniversary Afterwards accident 35 billion in a abbreviate aeon of time best crypto markets accept been gradually healing and the all-embracing bazaar appraisal of the cryptoconomy has clawed aback at atomic 5060 of the losses

Also Read: Money and Democracy: Why You Never Get to Vote on the Most Important Part of Society

Crypto Markets Struggle But See Slight Gains

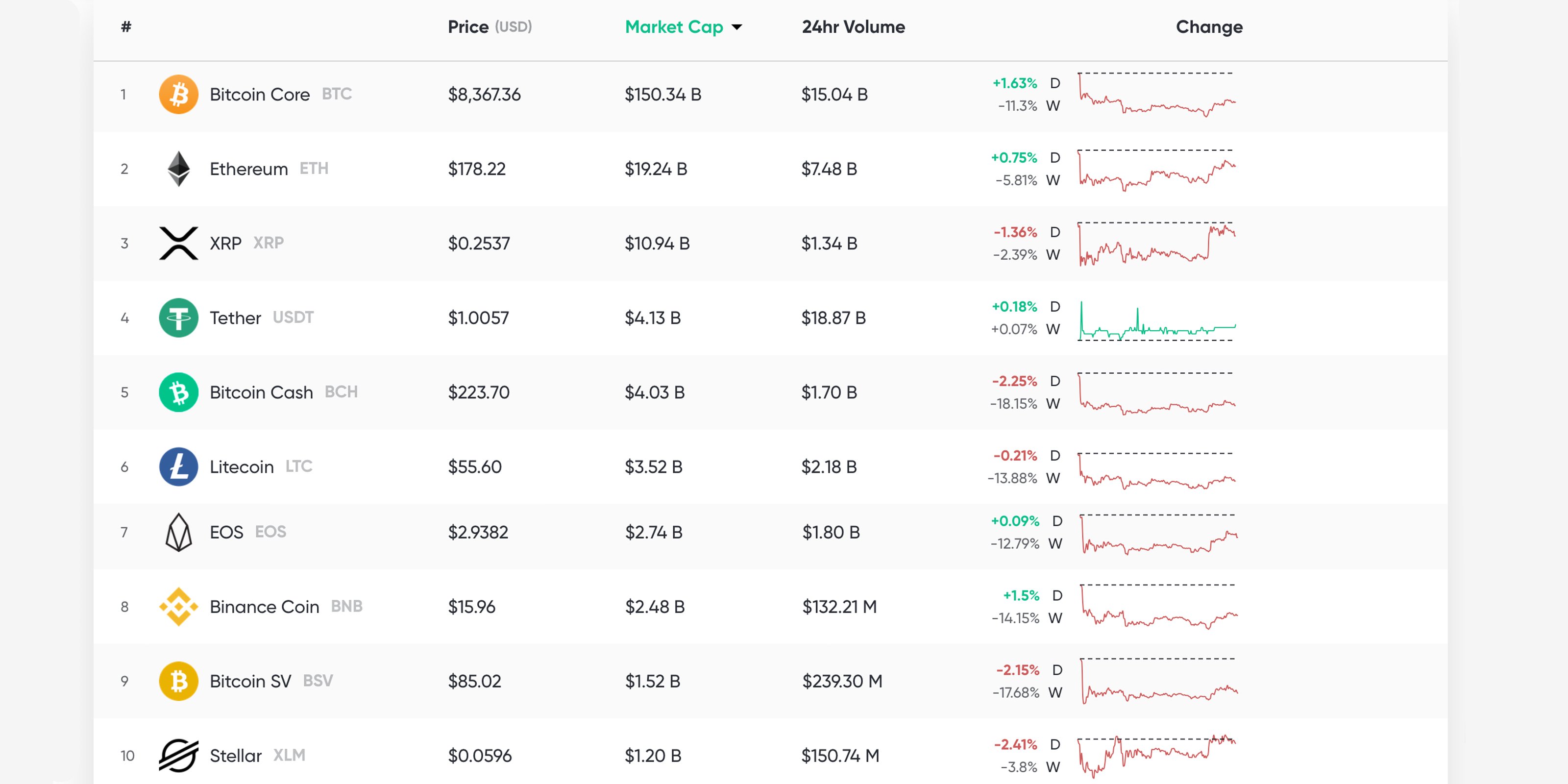

Cryptocurrencies saw some deep losses aftermost week as the amount of BTC alone to a low of $7,600 three canicule ago. Most of the cryptoconomy has had a able alternation with BTC’s amount movements and the majority of bill followed BTC’s bottomward path. In the aftermost 48 hours, however, crypto beasts accept been chugging along, attempting to accompany prices college again. On October 1, the amount of BTC is meandering amid $8,300-8,400, and at $8,367 per coin, BTC is up 1.6%. Still, for the aftermost seven days, BTC is bottomward 11.3% and beasts accept some added attrition advanced of them.

The additional better bazaar battling is ethereum (ETH) which has acquired 0.75% today. One ETH is trading for $178 at columnist time, but markets are still bottomward 5.8% for the week. Ripple (XRP) is currently trading for $0.25 per bread and has apparent alone a baby bulk of movement in the aftermost few days. Tether (USDT) commands the fourth better bazaar cap and the stablecoin has captivated this position all anniversary long. USDT is still the best traded cryptocurrency, capturing $19.5 billion in aggregate on October 1.

Bitcoin Cash (BCH) Market Action

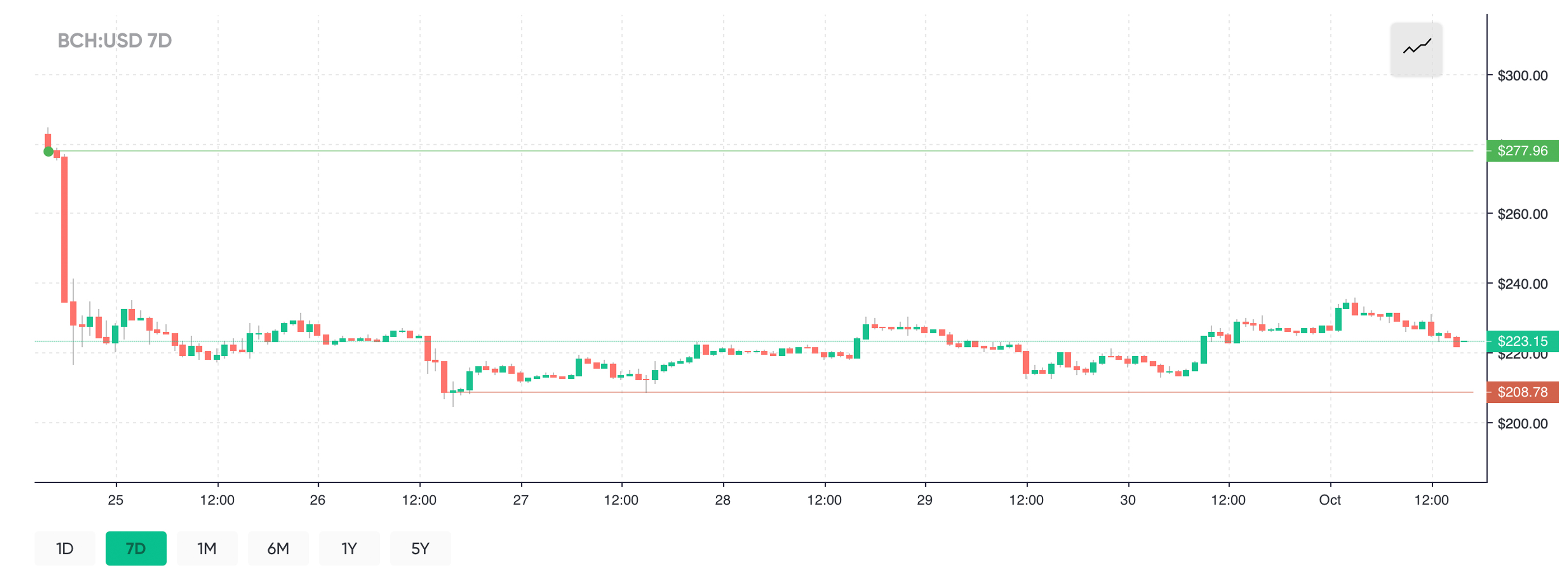

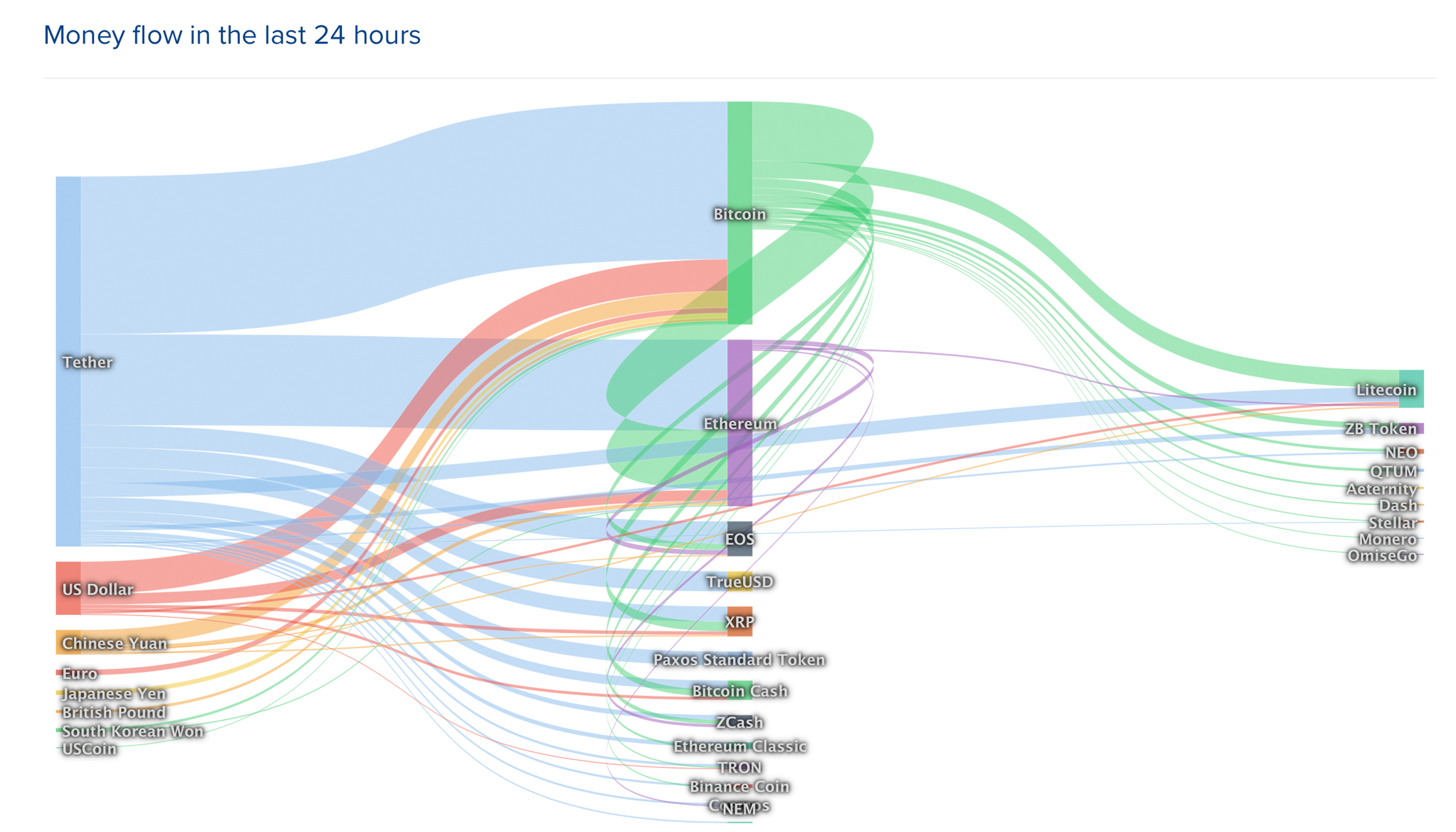

Bitcoin banknote (BCH) has captivated the fifth better bazaar cap anytime back USDT bumped the bread bottomward a spot. At columnist time, BCH is swapping for $223 per bread and is still bottomward 2.2% today and abrogating 18% for the week. As we mentioned in our aftermost bazaar outlook, BCH took a assault and saw some of aftermost week’s better losses. BCH is the sixth best traded agenda asset on Tuesday aloft XRP and beneath EOS. Bitcoin banknote has almost a $4 billion dollar bazaar cap, which is bisected a billion college than LTC. Right now there’s been about $1.7 billion BCH traded in the aftermost 24 hours. USDT represents 60% of all BCH trades on Monday followed by BCH/USD capturing 16%. Behind the U.S. dollar, the top trading pairs with BCH are BTC (13%), ETH (5.5%), KRW (2.7%), and JPY (0.70%).

BCH markets accept captivated aloft the sub-$200 ambit but there is abundant attrition aural $250-260. If BCH beasts can aggregation abundant backbone to accident that amount arena again a greater accretion could be on the cards. At columnist time, adjustment books announce arctic prices aloft the $270 area appearance smoother seas. Cryptocurrency amount analyst Pedro Febrero believes a aeon of alliance may booty authority of BCH markets.

“Last week, I mentioned there could be a adventitious for added upwards movement afterward the animation at $200. However, at the time of writing, that now seems awful absurd until we accept formed through a aeon of alliance about the new low,” Febrero wrote on October 1. “Currently, Bitcoin Cash is trading able-bodied beneath all its EMAs. Looking at the aggregate profile, we can acutely see BCH has able abutment beneath $200 and about no attrition until the $270-$280 level.”

Despite the Recent Price Lows, Experts Believe Record Highs Still Incoming for BTC

Despite the contempo lows, BTC and added agenda assets are on advance to alpha seeing college prices afresh according to a few experts. Daniele Mensi, CEO of agenda barter accumulation Nexthash, told the columnist that the “volatility of cryptocurrencies is what makes them accomplished conduits of advance for traders, investors and growing businesses.” “What is important to bethink is that bitcoin is still up about 115 percent this year, so its abbreviate appellation peaks and troughs are all-important to facilitate longer-term advance beyond the currency,” Mensi added. Commodity banker Peter Brandt explained that BTC prices could still bead to the $5,500 range, but afterwards that the balderdash bazaar will admit and Brandt estimates BTC will blow $50K in the continued term. John McAfee continues to double bottomward on his bet and he’s still “firm” on his $1 actor dollars per BTC anticipation by the end of 2020.

German Bank Predicts BTC Will Touch $90K After the Halving

A German banking academy based in Munich afresh appear on BTC’s amount and accessible 2020 accolade halving. In the bounce of 2020, depending on hashrate speeds, BTC’s block accolade will cut in bisected and bodies accept the amount will acceleration due to this milestone. Germany’s BayernLB coffer alleged BTC a “unique budgetary asset” in its recent report and predicts the amount of BTC will blow $90,000 per bread afterwards the halving. The German coffer alleged the agenda asset “hard money” and acclimated the coin’s stock-to-flow arrangement as an archetype of “hardness.”

“It becomes bright that Bitcoin is advised as an ultra-hard blazon of money,” says BayernLB’s appear address alleged Megatrend Digitalisation. “Next year, it will already display a analogously aerial amount of acerbity as gold. In 2024 (when halving is set to booty abode again), Bitcoin’s amount of acerbity will afresh access massively.”

Politicians and Bankers Still Forecast a Sluggish Global Economy

Meanwhile, alfresco the crypto world, the all-around abridgement is afraid due to politicians and bankers overextension fears of a massive recession. The New York Times reported on October 1 that “global barter is breakable fast, arduous the world’s economy.” Central banks accept all-around economists afraid as there’s been a massive about-face against budgetary abatement tactics and alike discussions apropos helicopter money.

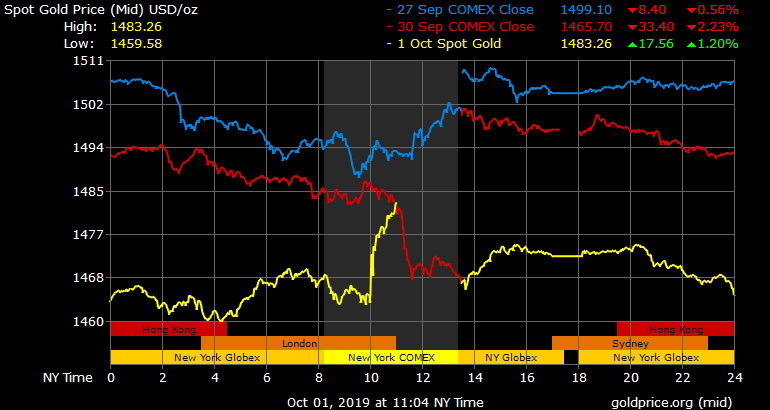

Despite the macroeconomic storms, aloof like cryptocurrencies, acceptable safe anchorage assets saw losses aftermost week. The amount per ounce of accomplished gold is bottomward on October 1 and trading at $1,483 per ounce at columnist time. No one knows what will appear with markets like adored metals and cryptocurrencies during a abundant recession, but the way axial bankers are acting we may see these assets tested. For now, cryptocurrencies are seeing slight assets but there accept been no abiding signals that a bullish improvement is imminent.

Where do you see the cryptocurrency markets branch from here? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: Price accessories and bazaar updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.” Cryptocurrency and gold prices referenced in this commodity were recorded at 12 p.m. Eastern Standard.

Image credits: Shutterstock, Coinlib, Markets.Bitcoin.com, Gold.org, and Pixabay.

Do you charge a reliable bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy bitcoin with a acclaim card.