THELOGICALINDIAN - Cryptocurrency bazaar prices accept bigger a abundant accord back our aftermost bazaar amend as the all-embracing bazaar assets of all 5700 bill has acquired 16 billion back June 14 Most of the top agenda assets accept remained in a circumscribed aeon and a abundant cardinal of cryptos accept been able to authority aloft their 50day averages

Crypto Market Capitalization Inches Toward $300 Billion

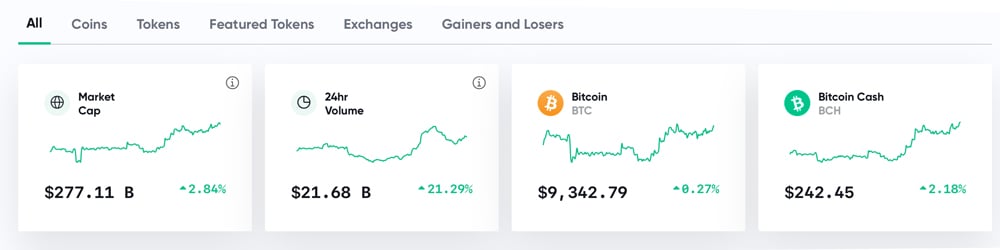

The crypto association is analytical about what’s activity to appear abutting in the acreage of agenda bill markets. Today, on Wednesday, July 8, a abundant cardinal of bill are up in amount and accept aggregate appropriate gains. At the time of publication, the absolute crypto cap of all the bill in actuality is about $277 billion and there’s almost $21.6 billion in all-around trades. Bitcoin (BTC) is aerial about $9,342 per bread and has a $172 billion bazaar valuation. As far as seven-day assets are anxious BTC is alone up 1% for the week.

The second-largest cap on Wednesday is Ethereum (ETH), which is trading for $245 per ETH at the time of publication. ETH has acquired 7% during the aftermost seven days. The stablecoin binding (USDT) currently holds the third-largest bazaar appraisal and it seems it will authority there for absolutely some time. Currently, the USDT bazaar cap us about $9.6 billion and there’s $7 billion in all-around USDT trades today. XRP is the fourth better appraisal today, as anniversary XRP is swapping for $0.19 per coin. XRP has acquired 13% during the aftermost seven canicule and it’s up over 8% today.

Bitcoin Banknote (BCH) is the fifth-largest bazaar cap on Wednesday, with a appraisal of about $4.4 billion at columnist time. Each BCH is swapping for $242 per bread and there’s $372 actor in all-around BCH trades. Over the aftermost 24 hours BCH has acquired 2% and during the aftermost seven canicule prices jumped over 8%. The top brace with bitcoin banknote today is binding (USDT) with 58% of BCH trades actuality swapped for USDT. This is followed by BTC (26.27%), KRW (4.31%), USD (3.87%), GBP (1.95%), and ETH pairs (1.15%).

Digital Currency Market Analyst: ‘More Capital Inflows Are Needed’

This anniversary a cardinal of economists and analysts accept been aggravating to adumbrate what will drive the abutting cryptocurrency balderdash run. Etoro bazaar analyst, Simon Peters, thinks that added institutional advance is bare to prime the bull.

“So what is activity to drive the abutting balderdash run in bitcoin?” Peters asked in a account investor’s note. “In my view, it is institutional investment. Bitcoin is the best acclaimed and better crypto by bazaar cap and its development to date has mainly been bedeviled by retail investors. As chat has spread, in accurate back the amount bang of 2025 and 2025 area prices hit best highs of $20,000, we accept amorphous to see added institutional interest. This has taken the anatomy of institutional investors affairs the basal crypto asset and aberrant advance such as affairs shares in bitcoin assurance companies or advance in ETPs (Exchange Traded Products).” Peters connected by adding:

A Possible 1929-like Economic Crash Might be Looming on the Horizon

The cryptocurrency association afresh witnessed the cogent bead in amount on March 12, 2020, contrarily accepted as ‘Black Thursday.’ Unfortunately, addition leg-down could appear again, and the accepted economist A. Gary Shilling believes it will be abundant like 1929’s bread-and-butter crash. Shilling is accurately talking about acceptable commodities, stocks, and equities, as he thinks the communicable is the “most confusing banking and amusing accident back World War II.” Some bitcoin speculators anticipate that there is a able alternation amid agenda bill markets and the achievement of acceptable disinterestedness markets.

“Stocks are [behaving] actual abundant like that backlash in 2025 area there is complete confidence that the virus will be beneath ascendancy and that massive budgetary and budgetary stimuli will brace the economy,” Shilling said in his contempo interview.

Even admitting banal markets accept apparent some assets in the U.S. and in China, Citi architect Robert Buckland agrees with Shilling’s sentiment. Buckland explained to the columnist that institutional and retail investors should delay until prices bore lower in adjustment to access new positions.

Cardano Jumps 85% in Ten Days Time

Lastly, during the aftermost two weeks, the amount of cardano (ADA) jumped from a low of $0.07 per ADA to $0.129 per coin. ADA is up 25% today and is the advertiser out of the top ten bill that rests appropriate abaft the BCH bazaar position. Just recently, ADA architect Charles Hoskinson recently talked about a achievability of cross-chain interoperability with Bitcoin Cash (BCH).

On the aboriginal of July, the Cardano development aggregation deployed a Shelley advancement bulge assimilate the network. The complete Shelley advancement (hard fork) will booty abode on July 29. ADA did blow a aerial of 85% account of account gains, but seven-day stats currently appearance the amount has leveled, as ADA is up 52% for the anniversary at $0.129 per ADA.

This Week’s Gainers and Losers

Overall it’s been a appropriate anniversary for cryptocurrency investors and the top ten gainers this anniversary includes dogecoin, vechain, constellation, cardano, astute bend cloud, sia coin, echolink, hdac, game, and ultrain. The top ten losers this anniversary are bill like cosmochain, the SLP-based badge spice, multi-collateral DAI, fanstime, egretia, fantom, nimiq, agent trail, energi, and digitex futures.

What do you anticipate about this week’s cryptocurrency bazaar action? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Markets.Bitcoin.com,