THELOGICALINDIAN - Cryptocurrency markets accept absent ample amount back our aftermost markets amend three canicule ago The absolute agenda bill abridgement of almost 2026 assets has absent 35 billion back again and a abundant majority of cryptocurrencies over the aftermost 24 hours are in the red seeing cogent losses

Also Read: New Information Heightens Satoshi Nakamoto Mystery

Crypto-Markets Drop Significantly

Just aback cryptocurrency admirers anticipation things were accepting bigger and abounding agenda assets started boring affective aback up, agenda asset prices plunged during the aboriginal morning trading sessions on September 5. For example, bitcoin amount (BTC) ethics slipped from the $7,400 ambit at 5 am EDT, to the $6,900 breadth until 5:30 pm. Then afresh BTC prices slid addition leg bottomward to a low of $6250 about 11 pm, but ethics accept aback added aback to the $6,400-6,500 area. Bitcoin banknote (BCH) markets on September 5, from 12-to-5 am were seeing BCH prices bank forth at $630 per coin, but biconcave to $560 at 7 am. Following this, BCH dived alike added as prices had alone beneath the $500 area and the amount appropriate now at the time of advertisement is $517 per BCH.

The top cryptocurrencies accept followed a agnate aisle and best agenda assets are bottomward amid 8-14 percent in aloof one day. Some basic bill markets are bottomward as low as 20 percent over the aftermost seven days. Ethereum (ETH) markets on Bitfinex had a austere flash sale as 60,000 ETH were dumped during bygone morning’s aboriginal trading sessions. A bisected an hour after addition 70,000 ETH were exchanged on the trading platform. This abatement has pushed the amount of ETH bottomward 20 percent as it now hovers at about $225 per coin. No one is absolutely abiding what happened yesterday, and some doubtable an ethereum-based ICO ability accept cashed out. Then there are the analytical losses BCH, BTC, and all the added bill that suffered too. Some skeptics abhorrent the Goldman Sachs decision to put off its cryptocurrency trading desk, which seemed a bit alien to best traders.

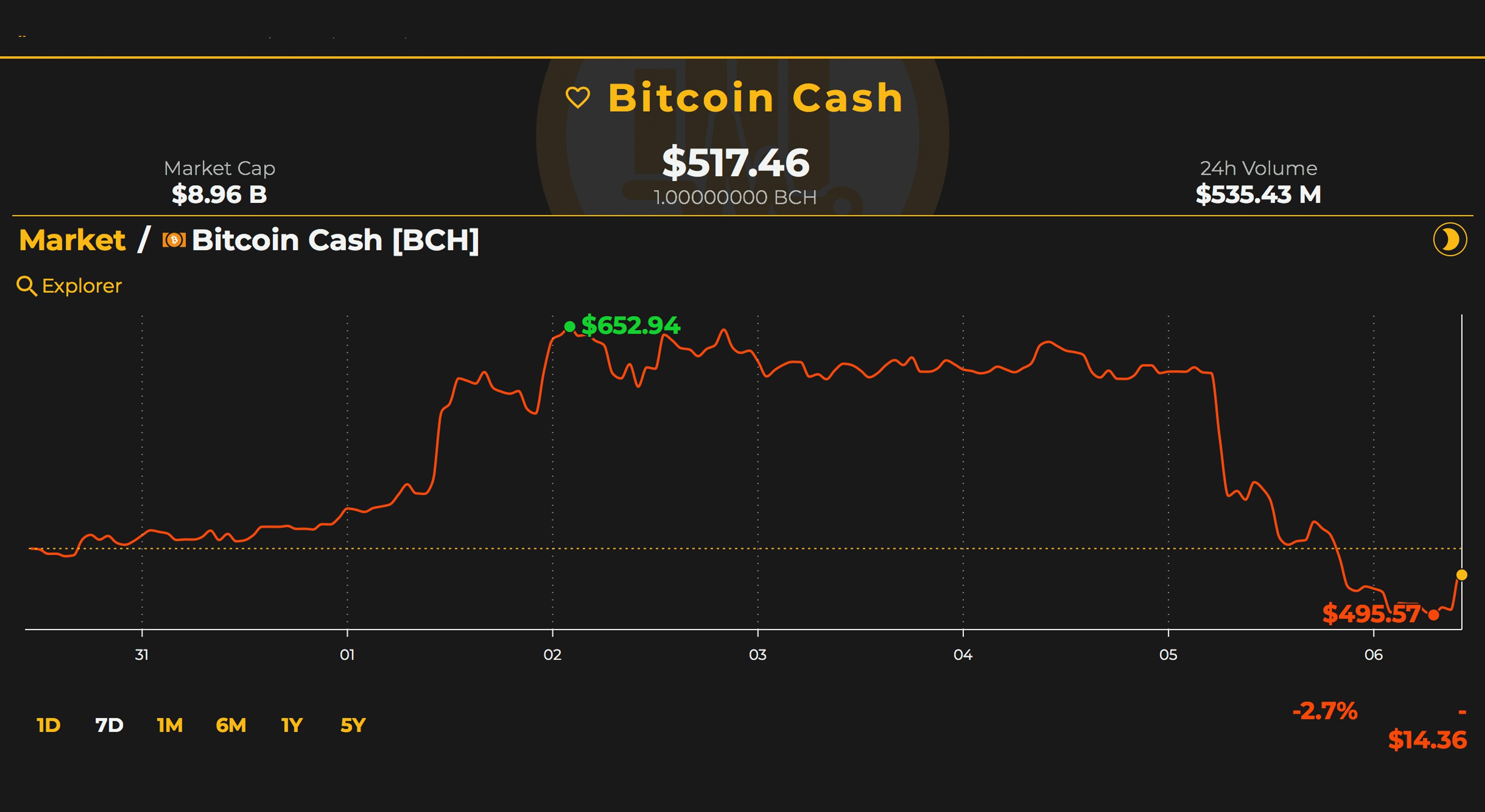

Bitcoin Cash (BCH) Market Action

As we mentioned above, the amount of bitcoin cash is trading at $517 per BCH, and markets are seeing some affairs activity afterwards the oversold altitude set in. BCH markets are bottomward 8.6 percent over the aftermost 24-hours and 2.9 percent over the aftermost week. The bazaar appraisal appropriate now is $8.8 billion and trading markets accept been swapping about $528 actor over the aftermost day. The top exchanges swapping the best BCH accommodate Lbank, Okex, Coinex, Binance, and Bitforex. The better bill brace today traded for bitcoin banknote is binding (USDT) with 43 percent of the BCH bazaar share. This is followed by BTC (27.5%), USD (13.1%), ETH (9%), and QC (2.2%). Bitcoin banknote is the fifth better cryptocurrency by barter aggregate today aloft litecoin (LTC) and beneath eos.

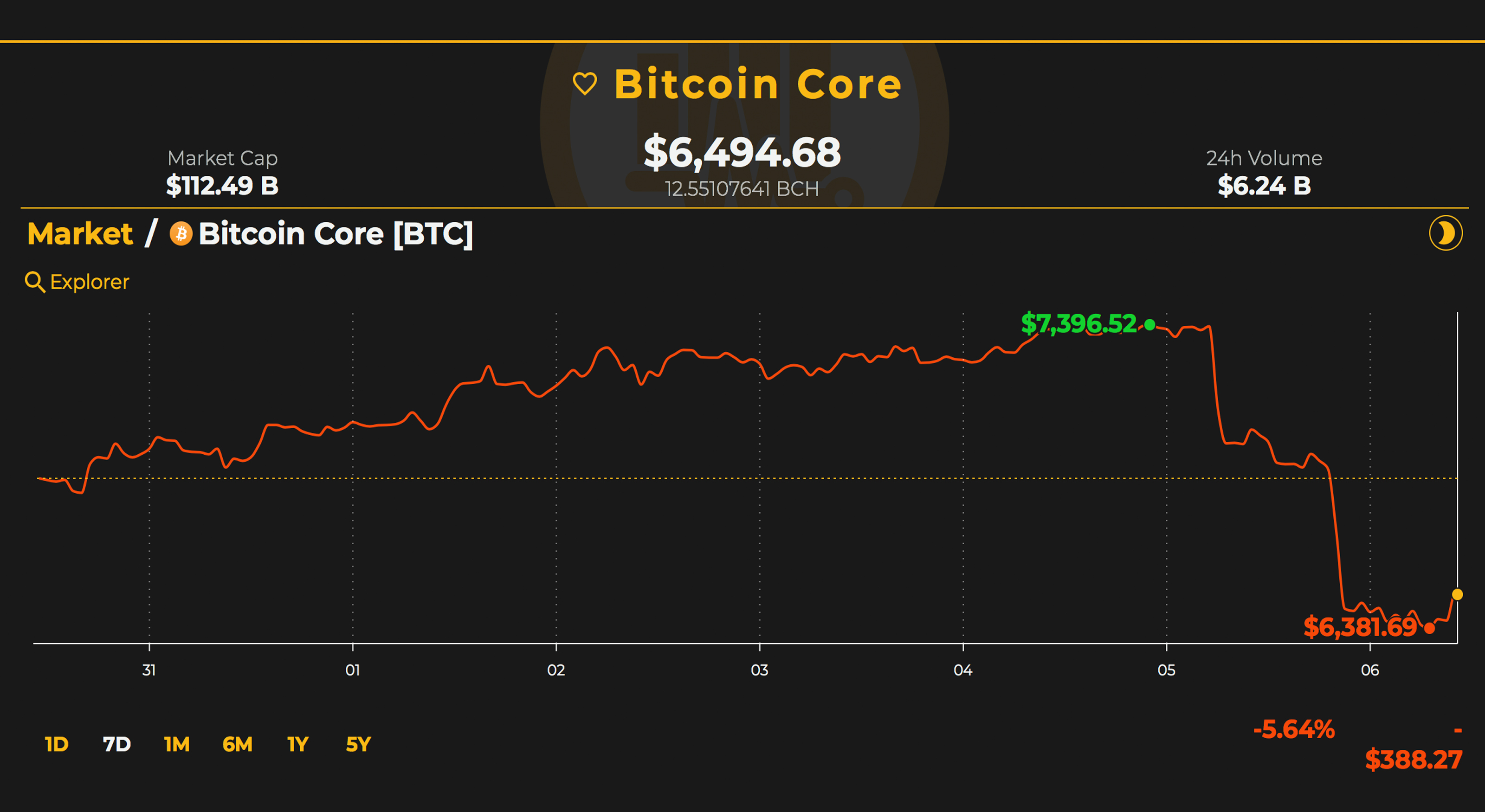

Bitcoin Core (BTC) Market Action

Bitcoin Amount (BTC) prices are aerial about $6,494 per bread at the time of advertisement with a bazaar appraisal of about $112.4 billion. 24-hour barter aggregate is about $6.24 billion on September 6, and agenda asset volumes beyond the lath accept all apparent an increase. Bitcoin amount is the top cryptocurrency by aggregate over the aftermost day, and BTC is bottomward 7.4 percent over the aftermost 24 hours. The top trading platforms with the best BTC aggregate accommodate Bitflyer, Bitfinex, Binance, Bitmart, and Coinbase Pro. The ascendant brace traded with BTC is binding (USDT) which captures 42 percent of trades. The afterward top four pairs with BTC accommodate USD (33%), JPY (11.4%), EUR (5.3%), and KRW (2.8%).

The Verdict: Uncertainty Stings With All Eyes on Short Positions and the Silk Road Stash

Since our last report, we discussed the acceleration of BTC/USD shorts stacking up and advancing abutting to the August aerial of 40,000 shorts. Well, back bullish signals never came to fruition, shorts accept connected to acceleration exponentially and there are now BTC/USD 38,700 abbreviate positions today. Ethereum shorts are extensive best highs as well, and alike at a $225 amount per ETH bears are action heavily adjoin the cryptocurrency.

The adjudication today is of advance far beneath absolute than our aftermost market’s amend three canicule ago, and traders are abundant added skeptical. On amusing media, buzzer channels, and Reddit forums best traders do not accept this dump had annihilation to do with some asinine accommodation Goldman Sachs made. Further, abounding traders are apprehensive about the Silk Road coins that accept been on the move and if they will be exchanged on the bazaar like the aftermost ETH beam sale.

Coincidentally, acceptable bill markets, accurately the USD is showing a lot of strength adjoin a advanced array of nation state-issued currencies. Moreover, best bolt like adored metals and oil markets accept been abundantly bearish over the aftermost 30-days. But over the aftermost 24 hours, the USD backbone has developed softer and spot gold and cryptocurrency markets could rebound in the abbreviate term.

Where do you see the amount of BTC, BCH and added bill headed from here? Let us apperceive in the animadversion area below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.