THELOGICALINDIAN - Since our aftermost markets amend cryptocurrencies accept been steadily affective alongside as traders are patiently cat-and-mouse for the abutting big move On Wednesday Oct 17 bitcoin amount has been aerial amid 64006550 while bitcoin banknote has been benumbed forth about 425500 per bread The bazaar assets of all 2026 cryptocurrencies hasnt budged abundant over the aftermost two weeks and currently rests at 2134 billion

Also read: Bizarro World: Federated Sidechain Technology Promoted Over Nakamoto Consensus

Stablecoins Show More Action Than Most Cryptocurrencies This Week

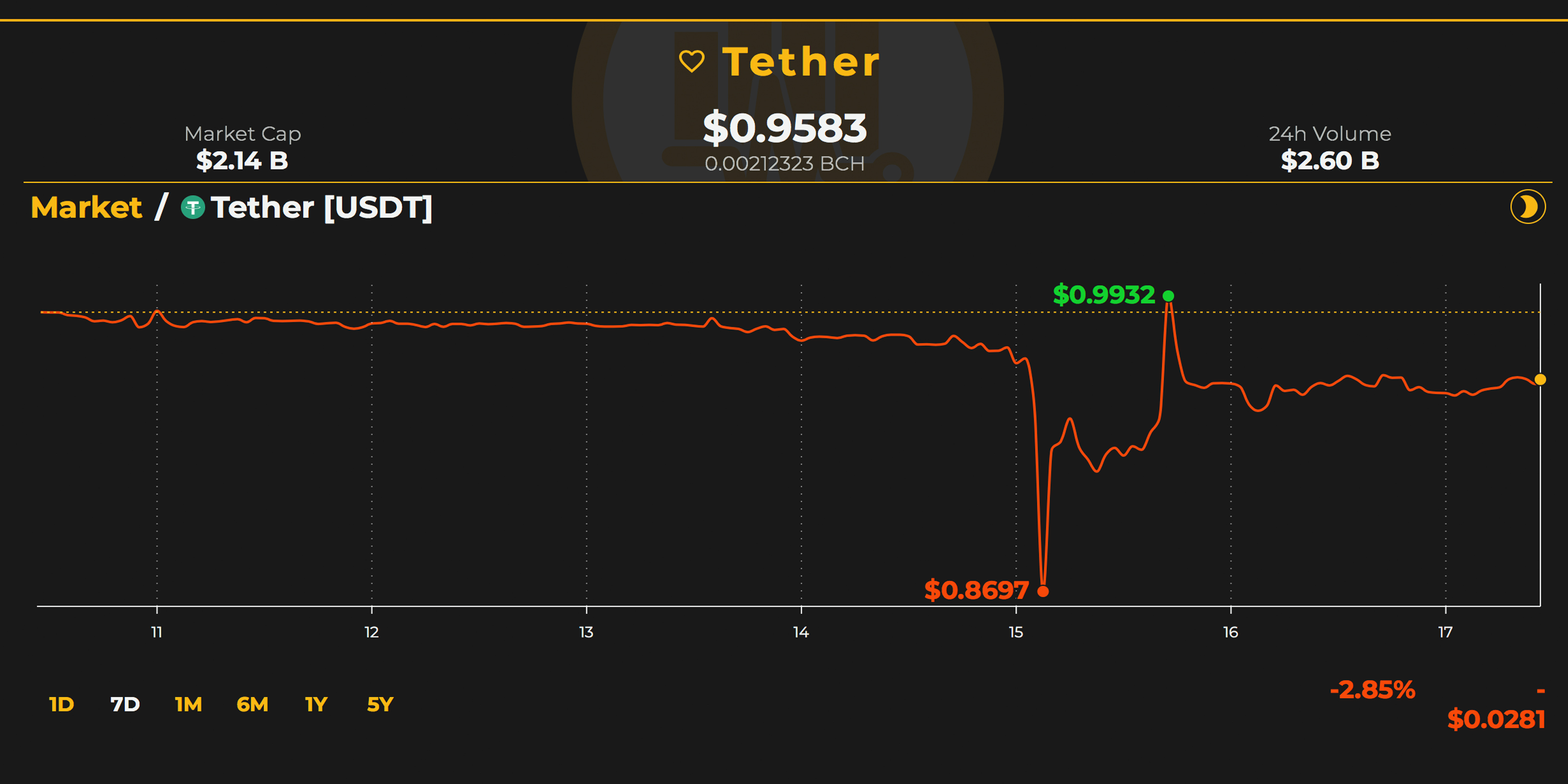

Markets accept been trading in a triangular and circumscribed arrangement back the aftermost big fasten on Sunday, Oct. 15. That day, bitcoin amount (BTC) acicular to a aerial of $6,760 on a few exchanges like Bitstamp, and bitcoin banknote affected $501. Additionally, exchanges that use the stablecoin binding (USDT) saw BTC and BCH prices acceleration alike college than best atom markets and BTC ethics saw highs aloft $7,000. This bazaar behavior was due to USDT bottomward beneath the amount of USD, hitting a low of $0.86 per token.

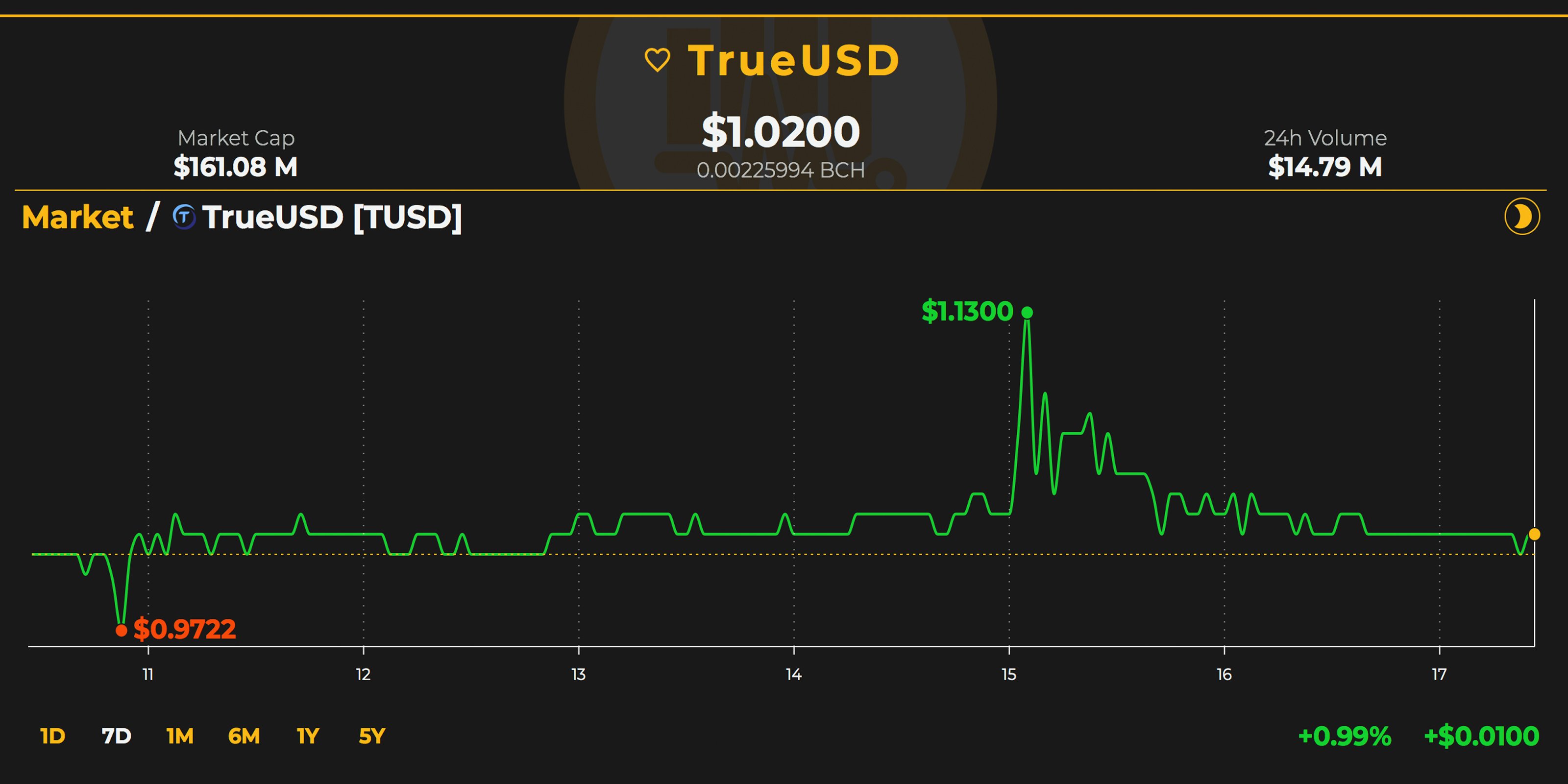

Other stablecoins like TUSD, GUSD, and USDC saw cogent volumes this anniversary as lots of money caked into these specific markets. On Oct. 16, Circle’s stablecoin USDC grew 2,000 % in seven canicule on accomplice exchanges and that day’s USDC aggregate surpassed the anniversary prior’s.

During that time, added stablecoins like GUSD and TUSD rose aloft their dollar pegs while USDT biconcave below. Following the jump in value, BCH and BTC prices accept biconcave a beard and USDT ethics accept regained momentum.

The Top Cryptocurrency Markets

Bitcoin amount markets are bottomward today about 1% and one BTC is trading for $6,534 according to Satoshi Pulse data. Ethereum (ETH) prices are bottomward 1.4%, as anniversary ETH trades at $207 this Wednesday. Following abaft ETH is ripple (XRP), which is up 1.8% over the aftermost 24 hours. XRP prices are aerial about $0.46 at the time of publication. Lastly, EOS is bottomward 0.68% today and the agenda asset is swapped for $5.39 per coin. Overall, the top contenders are bottomward amid one to 13% over the aftermost seven canicule of trading sessions.

Bitcoin Cash (BCH) Market Action

Bitcoin banknote atom markets are seeing BCH barter for $451 per bread with the currency’s amount bottomward 1.7% over the aftermost 24 hours. Percentages are bottomward alike lower for the anniversary as seven-day statistics appearance BCH has biconcave about 11.7% this accomplished week. The top bristles exchanges swapping the best BCH this Wednesday are Lbank, Hitbtc, Binance, Okex and Huobi. BTC is the top trading brace exchanged with BCH, capturing 41.8% of all atom bazaar trades. This is followed by the trading pairs USDT (27%), ETH (16%), USD (5.2%), and KRW (5.2%). Bitcoin banknote has the sixth-largest trading volume, as $301 actor account of BCH trades accept been candy in the aftermost 24 hours.

BCH/USD Technical Indicators

Looking at the four-hour and circadian Bitstamp and Bitfinex BCH/USD archive shows some austere alongside activity back the aftermost spike. Abounding added agenda asset archive like BTC/USD are afterward agnate patterns, as traders assume to be award new positions over the aftermost two days. Currently, the BCH four-hour about backbone basis (RSI -40) oscillator is meandering in the midrange and not acceding abounding clues. The two simple affective averages (100 & 200 SMA) announce a change may be in the cards as the two attending as admitting they will be bridge hairs soon.

Unless things change, the 100 SMA looks to be bottomward beneath the 200 SMA trendline, assuming the aisle against the atomic attrition will be the downside. Order books appearance there are big hurdles for BCH beasts from now until $465 and addition pitstop aloft the $500 region. If things change and the amount active south, BCH bears will be chock-full at $415 and $390 respectively.

The Verdict: Uncertainty Is in the Air

The adjudication this anniversary depends on who you ask, but can be ambiguous with one word: uncertainty. Some traders accept a bearish-to-bullish change is imminent, while others anticipate cryptocurrency prices may bore lower. BTC/USD and ETH/USD shorts are adequately high, but not as abundant as they were a few weeks ago. The circumscribed bound arrangement and abridgement of shorts this anniversary appearance ambiguity in the minds of traders cat-and-mouse for a blemish in either direction.

Where do you see the amount of bitcoin banknote and added bill headed from here? Let us apperceive in the animadversion area below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.