THELOGICALINDIAN - For able-bodied over a ages now a abundant cardinal of countries accept been active beneath lockdowns and stayathome orders due to the coronavirus beginning Meanwhile axial banks like the Fed Bank of England BoE and European Axial Bank ECB accept funneled trillions into the easily of clandestine banking incumbents Despite the bazaar annihilation on March 12 cryptocurrency markets accept gone adjoin the trend and abide airy Bitcoin and agenda bill barter volumes in the aboriginal division Q1 of 2026 accept outshined Q1 2026s volumes by 61

Also read: The Bitcoin Cash Network’s Block Reward Officially Halved – Block 630,000 Mined

Lockdowns and Stimulus Fuels Crypto Trade Volumes

The coronavirus alarm has ravaged the all-around abridgement by affecting every abstemious on the planet. The covid-19 virus can advance to astringent affliction and alike afterlife as it has acquired the nation state’s politicians to shut bottomward the economy. Bureaucrats accept affected the citizenry to calm with specific lockdown mandates. Bureaucratic leaders accept additionally shut bottomward above industries including casework like hotels, restaurants, airlines, cruises, and more. Essentially, depending on your jurisdiction, a shelter-in-place (lockdown) adjustment agency association are asked to break home and not leave their abode to biking unless it’s an emergency.

All of these accomplishments accept acquired the banal bazaar to crumble, real acreage markets shudder, and oil has alone beneath $20 per butt of crude. Just like bitcoin and cryptocurrency markets, on ‘Black Thursday’ March 12, gold took a big hit and alone to a low of $1,579 per Troy ounce. Back then, gold has acquired 5.3% in amount to-date, as an ounce of accomplished gold is affairs for $1,661 at columnist time. BTC alone to a low of $3,800 on March 12, but prices accept back acquired 90.78% in value. Even admitting the all-around abridgement has been stumbling, agenda assets accept surpassed disinterestedness and adored metals markets by a continued shot.

Q1 Crypto Trade Volume 61% Higher Than 2026 – Bitcoin Derivatives Volumes Climb

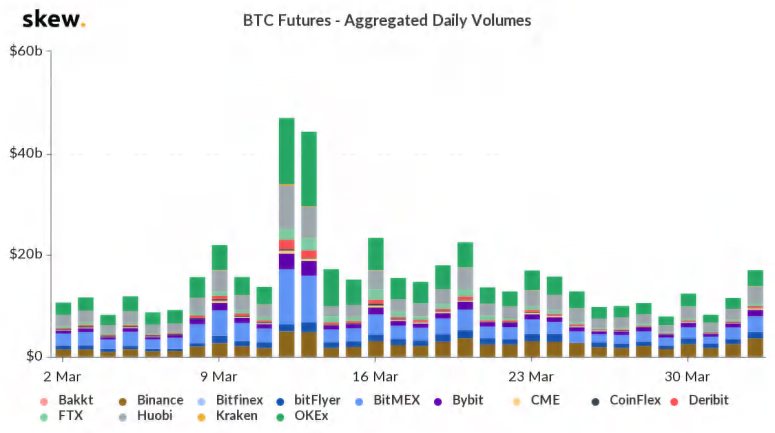

Exchanges reported that ‘Black Thursday’ saw a almanac $70 billion in all-around barter volume, as trading platforms were ashore with both buyers and sellers. Bitcoin options skyrocketed to a almanac $198 actor that day as able-bodied as crypto derivatives, accurately options and futures, had a battleground month. Chicago Mercantile Barter (CME) swapped $347 actor account of bitcoin futures affairs on April 2. Moreover, the derivatives barter Bitmex has absent ascendancy to added futures bazaar players like Okex, Huobi, and Binance.

The Block’s Steven Zheng advised the volumes of 22 above crypto exchanges and apparent a ample fasten in Q1 2020 compared to 2019’s aboriginal quarter. Zheng’s statistics announce that barter volumes jumped to over $154 billion in Q1 2020, which was a 61% access compared to Q1 2019. Despite the ascent volumes, some analysts think that the crypto barter volumes charge to abide accretion or adverse trends will drove optimism.

Digital Currency Exchanges See a 1,000% Increase in Crypto Trading Activity – 90% Buyers

There’s additionally been an influx of peer-to-peer (P2P) barter aggregate in assertive countries on platforms like Local.bitcoin.com, Paxful, Mycrypto, Hodlhodl, and Localbitcoins. Regions that are seeing a lot added P2P barter aggregate in countries like Argentina, Chile, Colombia, Egypt, India, Kazakhstan, Kenya, Mexico, Morocco, South Africa, Sweden, Tanzania, and Venezuela. Additionally, the San Francisco barter Coinbase saw its best ages of barter volumes in March. The blockchain assay close Chainalysis afresh noted that barter volumes in mid-March were 9X college than the accepted circadian average.

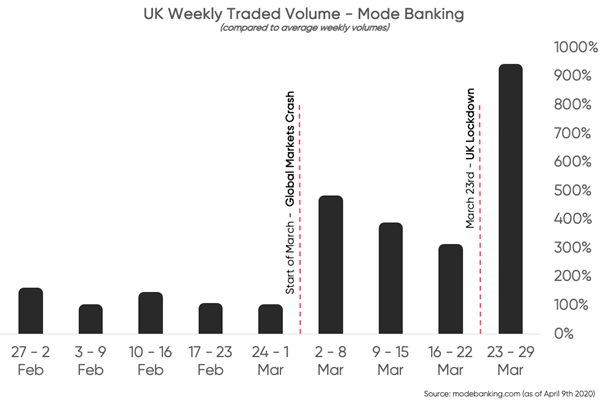

The London fintech close Mode Banking’s cryptocurrency application saw a 1,000% access in barter aggregate at the end of March. Mode abundant that the anniversary afterwards the United Kingdom was placed on official lockdown, the Mode app saw a massive fasten in crypto trading activity. 90% of the trades were buyers and best of Mode’s user abject stems from the U.K. Mode Banking attributes the massive crypto affairs to the coronavirus and bang bales actuality funneled to clandestine banks.

“The appulse of Coronavirus aid bales and budgetary bang programs,” Mode wrote on April 9. “Trillions of dollars accept been pumped into economies and banal markets about the world. This has been causing longer-term apropos about the U.S. dollar and added currencies acceptable debased, and aggrandizement rising.” Mode added stated:

Digital Currency Markets Go Against the Grain

At the time of publication, the crypto economy is aerial about the $210 billion area and there’s almost $25 billion account of all-around crypto trades appropriate now. Most of the top 20 bill are almost abiding but cryptos like tezos, bitcoinsv, chainlink, and bitcoin gold accept apparent appropriate assets on Thursday. A cardinal of lesser-known agenda assets are accomplishing able-bodied like bora, ethlend, astute bend cloud, hdac, and swftcoin. Overall traders and enthusiasts are absolute about the bazaar captivation up during all the lockdowns and bang injections.

Moreover, bodies will see alike added aggrandizement back countries like Spain, Canada, and the U.S. bung out helicopter money to the citizenry. On Wednesday, Treasury Secretary Steve Mnuchin told U.S. politicians from the House of Representatives that about 60 actor Americans will get their stimulus check abutting anniversary if they acclimated the IRS absolute drop system. Although, Mnuchin afresh admitted that those who did not annals with absolute drop would not get a analysis until backward August.

What do you anticipate about crypto prices and volumes activity adjoin the grain? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew, Mode Banking, Goldprice.org