THELOGICALINDIAN - On Friday the Valkyrie Bitcoin Strategy ExchangeTraded Fund ETF launched on Nasdaq beneath the ticker BTF and alone in amount not too continued afterwards the ETF aboriginal came out of the aboideau The additional bitcoin ETF to barrage in the United States followed bitcoins atom amount movements on Friday as BTF started the day aloft 25 and alone to aloof over the 24 mark

Initial Market Performance of Valkyrie’s Bitcoin ETF Lackluster Compared to the First Bitcoin ETF Debut

Valkyrie’s bitcoin futures ETF clearly launched on Friday and accomplished a aerial of $25.60 per assemblage at about 9:00 a.m. (EDT). The chief ETF analyst for Bloomberg Intelligence, Eric Balchunas, tweeted about Valkyrie’s ETF afterwards the aboriginal few account of trading.

“BTF up and active with a advantageous $10m traded in [the] aboriginal [five minutes], BITO is at $30m. You accept to be blessed with that advance if you are BTF, [it] will be boxy to accumulate up [though],” Balchunas said.

The banal after fell in amount as it followed the atom amount of bitcoin’s bead afore the weekend. BTF broke a low of $23.96 per assemblage and as the day progressed it inched aloft the $24 handle.

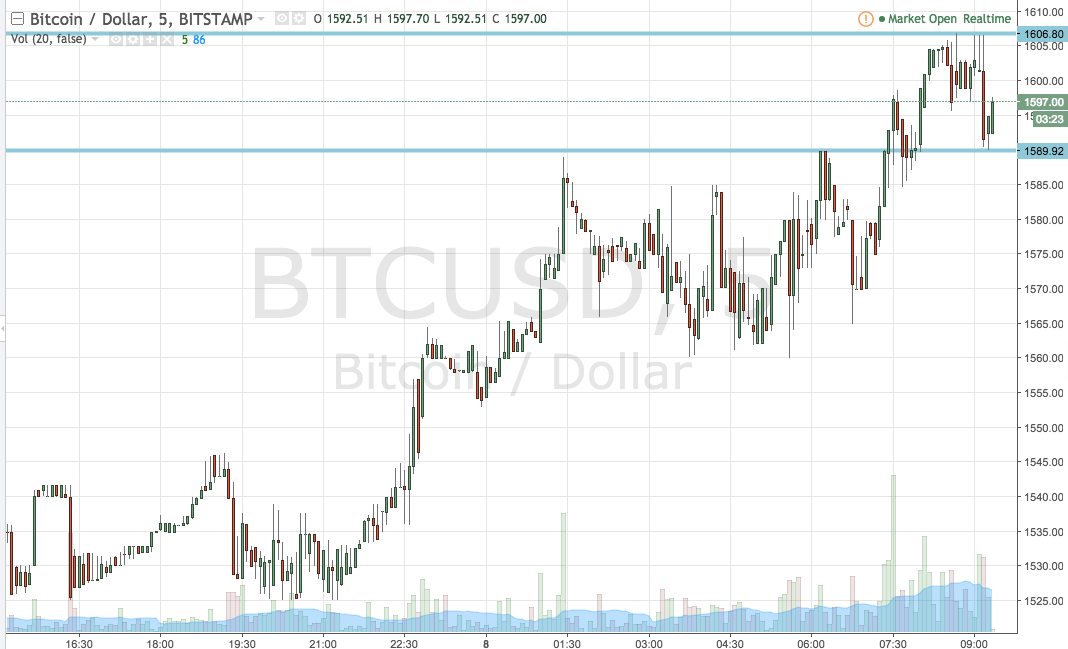

The Proshares ETF BITO additionally followed bitcoin’s atom bazaar amount and biconcave beneath the $40 handle to $39.39 bottomward 3.5%. BTC atom markets fell from $63,735 per assemblage in the morning (EDT) to a low of $59,954 on Bitstamp at 12:15 p.m. in the afternoon.

Vaneck Bitcoin Exchange Traded Fund Expected to Drop on Monday

BTC managed to jump aback aloft the mid-$60K per assemblage position during the trading sessions on Friday afternoon. A abundant cardinal of bitcoin enthusiasts were aflame to see Valkyrie’s bitcoin futures ETF barrage afterwards the Proshares ETF saw a astounding bazaar achievement this accomplished week.

“Valkyrie… the attic is yours,” the Twitter annual dubbed ‘British HODL’ said on Friday. “2 Bitcoin ETF’s at trading accessible today. Let the accumulated ache amateur for bitcoin allocations begin,” he added.

After the weekend ends, abutting anniversary the crypto association expects the Vaneck bitcoin futures exchange-traded armamentarium (ETF) to barrage on Monday. After years of rejections from the U.S. Securities and Exchange Commission (SEC), there will be three bitcoin-related ETFs on Wall Street.

With Vaneck’s fund, two ETFs will be listed on the New York Stock Exchange (NYSE) and Valkyrie’s bitcoin futures ETF is listed on Nasdaq. Just afore the closing alarm on Friday, Valkyrie’s BTC managed to ascend aloft the $24.30 region. BTF’s acceleration at the end of the trading day on Friday followed bitcoin’s atom amount jump, afterwards BTC went from $60,600 to $61,150 per unit.

What do you anticipate about Valkyrie’s ETF barrage on Friday? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Nasdaq, NYSE,