THELOGICALINDIAN - During the end of 2026 and into 2026 a abundant cardinal of agenda assets accept apparent cogent assets and the bearish division that followed 2026 has angry its advance Bitcoin affected an alltime amount aerial on February 11 2026 extensive 49k per bread and threemonth stats appearance bitcoin is up 198 Despite the astounding 90day assets abundant another crypto assets accept apparent abundant beyond increases The abominable dogecoin for instance has acicular 2322 during the aftermost three months

Crypto Asset Market Performances in 2026

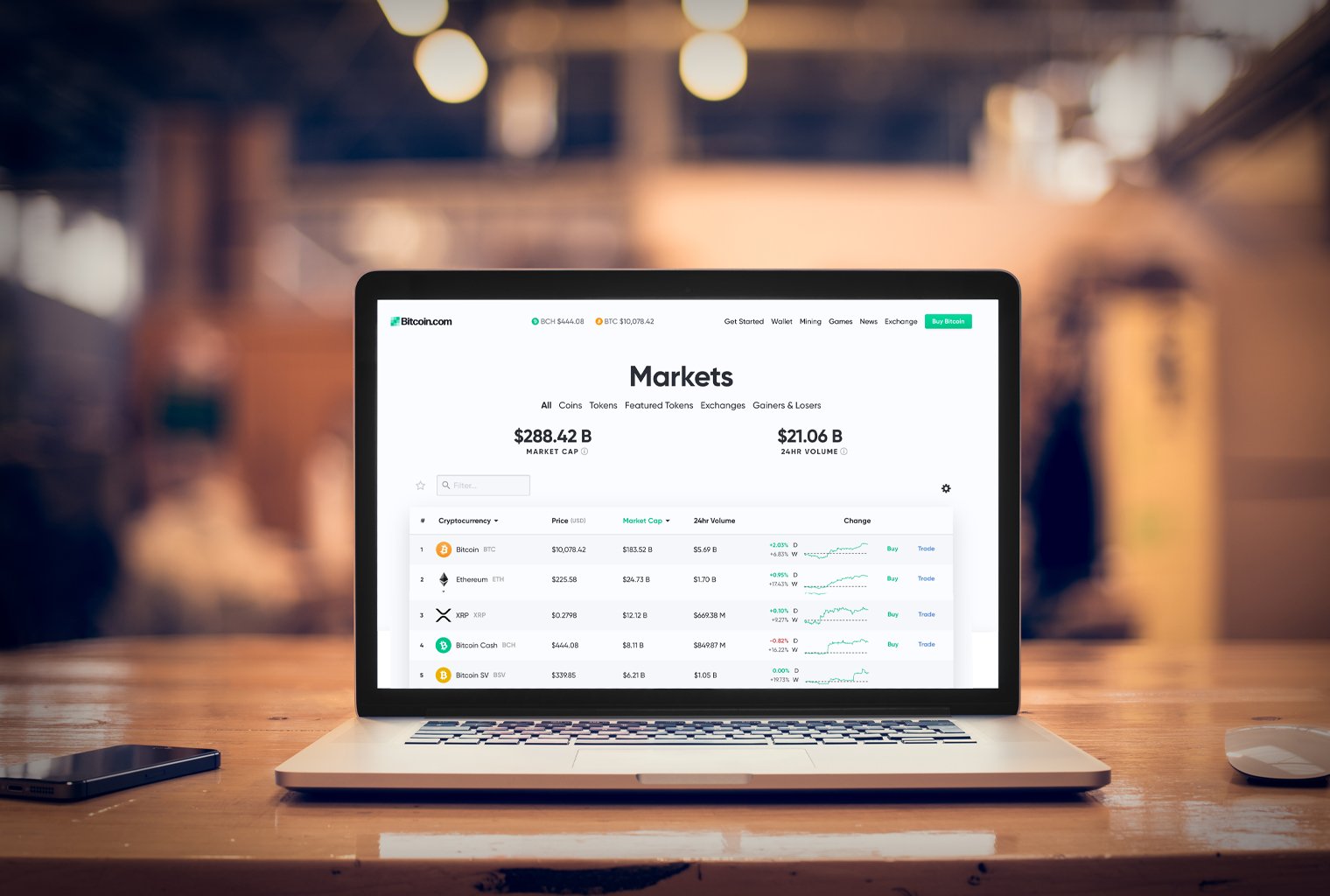

Bitcoin and the crypto abridgement has steadily surpassed the $1 abundance appraisal mark and on Friday, February 12, 2021, the crypto bazaar assets of all the bill in actuality is account $1.41 trillion. The day prior, bitcoin (BTC) accomplished addition best aerial (ATH) on Thursday affecting about $49,000 per unit.

BTC has apparent some cogent assets this year, and the crypto asset has added 149.16% back the ATH in 2017. Bitcoin has captured 198% in assets during the aftermost 90 canicule and bitcoin’s ascendancy basis is 61.1% on Friday. This agency that alike admitting BTC has jumped massively in value, another crypto assets accept apparent bigger amount increases.

As mentioned above, dogecoin (DOGE) has apparent absurd assets during the aftermost three months jumping 2,322.09% in amount during that time frame. DOGE is the additional better gainer over the aftermost 90 days, but the orion agreement badge (ORN) has added by a whopping 50,641.88% to date.

It would be difficult for any crypto assets to bout ORN’s jump, but there’s a bulk of added another assets that accept apparent actual ample 90-day gains. Below the meme-token dogecoin is telcoin (TEL), which has acquired 2,281.63% in 90 days.

A cardinal of added notable badge assets aggressive the ranks accommodate sushiswap (SUSHI 1,446.24%), barrage (AVAX 1,285.09%), and cardano (ADA 1,226.06%). The better losers during the aftermost three months accommodate bill like aced (ACED -98.85%), wavesgo (WGO -84.75%), and digitex futures (DGTX -79.86%).

As far as the changes against the U.S. dollar from 2020 until now, bitcoin (BTC) has acquired 301.46%. The better top ten positioned badge that has apparent the better USD assets back the alpha of 2020 is ethereum (ETH) which has jumped 463.55% back then.

But during the advance of 2026 up until now, a cardinal of added bill accept apparent way bigger gains. For example, messari.io abstracts shows back the alpha of 2026, bold stars (GST) added by 68,928.03%, and the badge zap (ZAP) has acquired 5,716.86%.

Some bill accept absent over 90% of their ethics back 2026, as tokens like jibrel arrangement (JNT), thore banknote (TCH), educare (EKT), absoluteness (ECOM), and ors accumulation (ORS) has absent amid -94.98% to -98.49% in value.

Analysts Expect ‘More Uptake as a Result of Mainstream Attention’

The crypto abridgement jumped in amount decidedly afterwards Elon Musk’s Tesla revealed it had purchased $1.5 billion in bitcoin (BTC). Additionally, Musk has been discussing the meme-based crypto-asset dogecoin (DOGE) on a approved basis.

Optimistic account that proponents are additionally discussing is Mastercard’s recent crypto support announcement, Jay Z, Lil Wayne, and Jack Dorsey donating 500 BTC to armamentarium bitcoin development teams in Africa and India. Moreover, the oldest banking academy in America BNY Mellon will be offering cryptocurrency services.

“A game-changing anniversary for cryptos’, David Mercer, CEO of LMAX Group told news.Bitcoin.com. “Musk has aloof ripped up the old roadmap for accumulated treasurers everywhere. Financial institutions are now advancing to chase their clients. We’re starting to see institutions drive disruption, which is the alpha of an agitative journey. What’s actual is that cryptos are now acceptable an accustomed destination.”

Broctagon Fintech Group feels the aforementioned way, as the CEO Don Guo additionally discussed all the absolute announcements this week.

“BNY Mellon’s and Mastercard’s addition to the cryptocurrency space, afterward the contempo Tesla news, signals addition amount bang for bitcoin,” the Broctagon Fintech Group controlling wrote. “Such a big institutional endorsement will actuate agenda assets alike added into the capital date this year, and we apprehend added uptake as a aftereffect of the boilerplate attention.”

What do you anticipate about the accomplished three months of crypto-asset amount changes? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tesla, BNY Mellon, Mastercard, City of Miami, Messari.io, Bitcoinwisdom.io,