THELOGICALINDIAN - One River Asset Managements CEO says his close now holds bitcoin account able-bodied over 1 billion He appear that the institutional absorption in bitcoin is alarming acquainted that about all above institutions in the US are accepting discussions about the cryptocurrency He believes that bitcoin will be account added than gold agreement its amount at about 500K

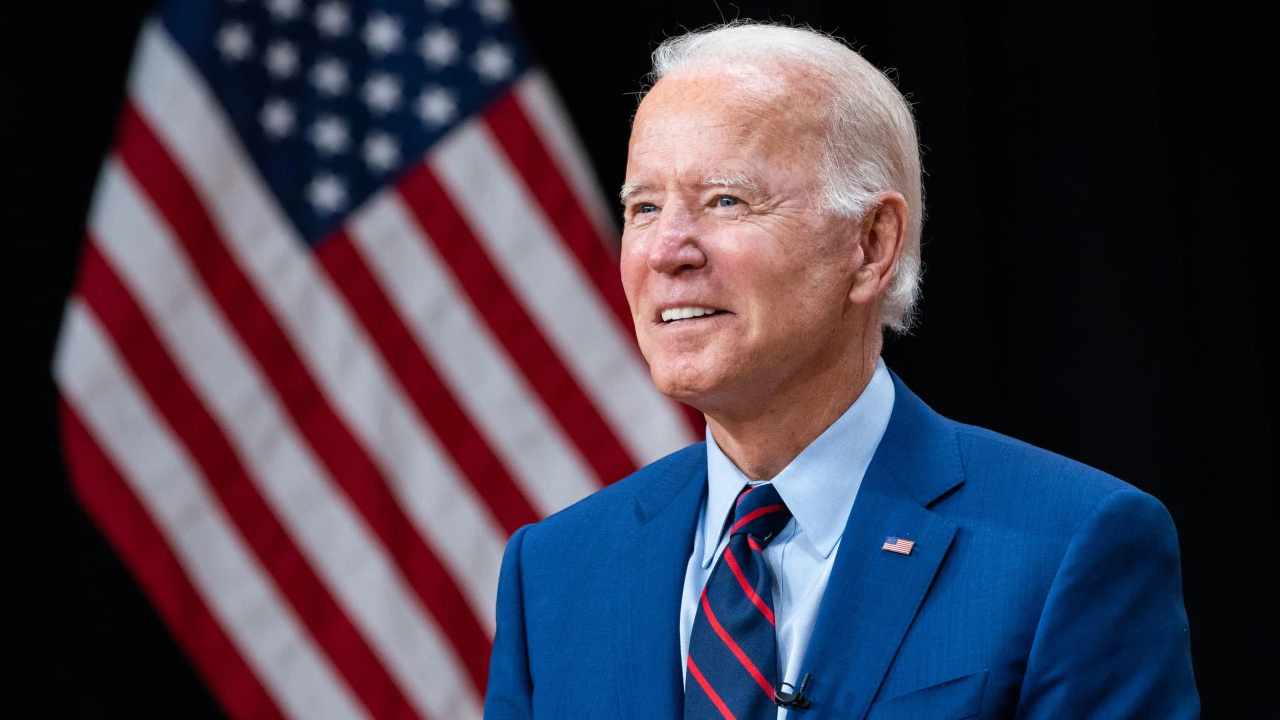

One River Asset Management’s CEO Is a Bitcoin Bull

The CEO and co-founder of One River Asset Management, Eric Peters, aggregate his appearance on bitcoin at breadth in an account with Bloomberg aftermost week. Firstly, he appear that his asset administration close now holds bitcoin “well in balance of a billion dollars at this point.” He again discussed the case for institutional investors to own cryptocurrencies currently.

“We are in a different aeon appropriate now,” Peters began. It is the aeon apparent abounding times throughout history area “governments become acutely indebted, budgetary action becomes beneath effective, and ultimately governments … charge to affair lots of debt and activate absolutely spending. Typically, back they do that, they try to clear themselves from the debt they’re incurring by abasement the bill that they’re arising that debt in.” The CEO added that “ultimately, those who authority that bill lose their spending power.”

He proceeded to allocution about crypto assets, advertence that they “are absolutely absorbing in the faculty that they’re a new asset chic altogether.” He acclaimed that they “have some different qualities, allotment of which resemble the qualities that you’d acquisition in gold except that they’re berserk underpriced about to gold.”

Moreover, bitcoin and added cryptocurrencies accept “technology properties,” and “will attending altered tomorrow, and abutting year, and in a decade to come.” This makes bitcoin “unique to gold because if gold has looked the aforementioned two thousand or two billion years ago, again it will attending the aforementioned in two thousand and two billion years from now,” the One River controlling described, elaborating:

He added abundant that “It’s actual attenuate that you acquisition an asset that can affectionate of acquiesce you to capitalize on approaching upside [the technologies] while additionally mitigating the downside [monetary debasement] like that.”

Peters additionally antiseptic that he consistently starts with the macro aspect back it comes to advance as he has been a macro broker his absolute career. With technology, the CEO opined:

“We’re arising astronomic amounts of debt. We’re accepting our axial coffer buy them … the calibration of it is aloof so abstruse … so the catechism is, in that environment, what are the assets that you can own,” he continued.

Peters proceeded to account some believable advance options: equities, gold, and agenda assets. He asserted that agenda assets “are badly undervalued about to some of these added food of value,” which is why his close is “excited” about this, emphasizing that “It’s aloof an undervalued asset for that macro backdrop.”

The One River CEO additionally accepted bitcoin’s anchored supply. He stated: “It’s clashing any asset that I’ve apparent in the apple in the faculty that there’s no accumulation acknowledgment to the price. If bitcoin went up bristles times in value, or 10 times, or 100 times, there wouldn’t be added bitcoin produced. You can’t say that about absolutely any added asset in the world.”

He additionally compared bitcoin to gold. “I anticipate it will be account added than gold at some point because gold is not infinite. Gold continues to access in agreement of supply,” he noted. In contrast, there will alone be 21 actor bitcoins. The CEO elaborated:

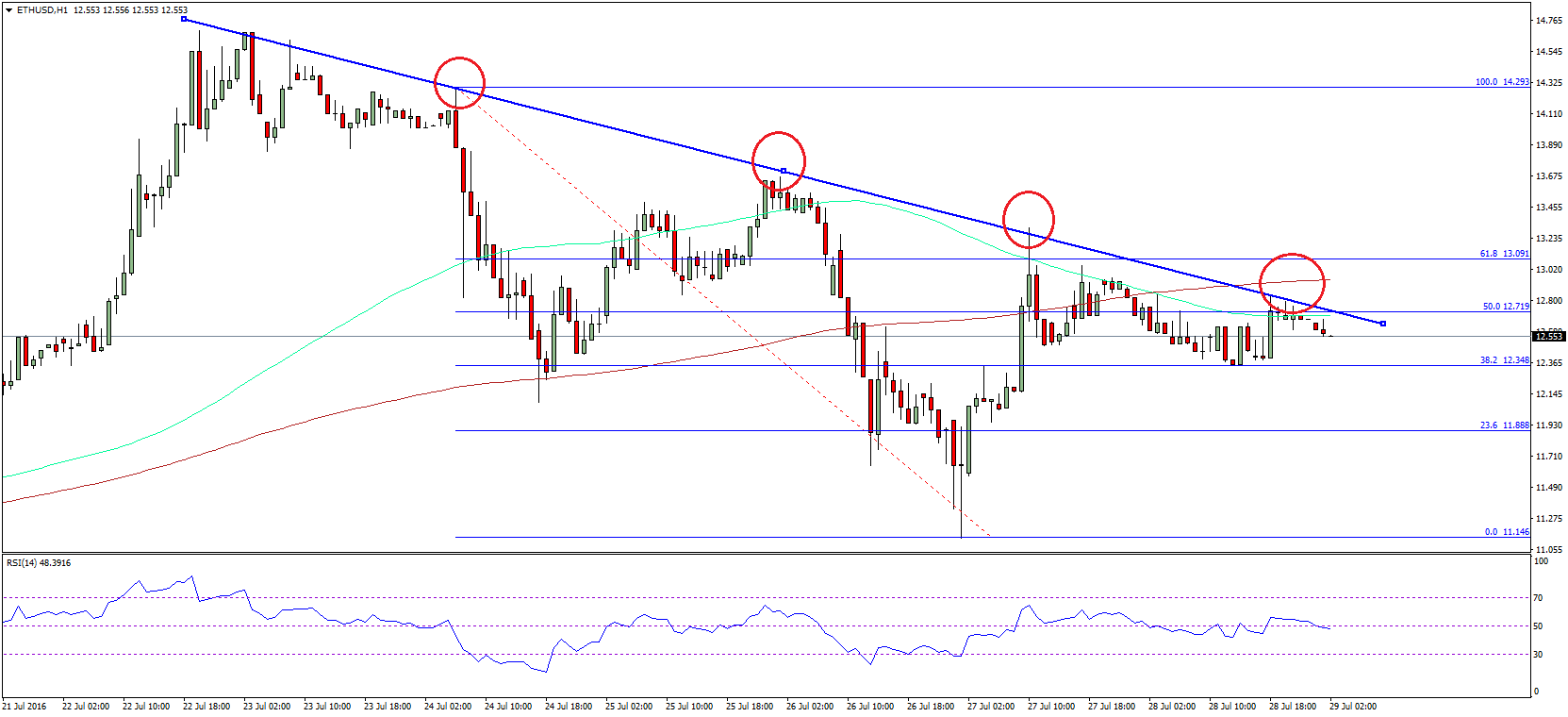

“Right now, it’s trading at let’s say $30,000, so if you attending at it from a trader’s angle there’s astronomic appendage to the upside,” he affirmed.

Answering a catechism about how continued it will booty for bitcoin to become added admired than gold, Peters said that it is “policy dependent.” He could see it accident in a cardinal of years if we see “some blazon of abutting recession that is followed by alike added arising and added affairs from the fed.” Nonetheless, he acicular out that “one of the things about these assets is … it doesn’t amount you annihilation to authority them. You accept the amount accident to the downside but you don’t accept a abrogating carry.”

The One River controlling additionally discussed whether crypto assets will address to institutional investors if they abide to abide alongside authorization money or whether institutions charge to see some affectionate of government or axial coffer accepting or endorsement afore jumping in.

After he about appear that his close had invested about a billion dollars in bitcoin, he said that “the cardinal of institutions that accept been bushing my day with calls and inquiries about this is astounding.” He common that it is already accident “enormously.”

Peters expects the crypto asset chic will “mature in a decade from now,” adding:

“They’re absorbed by this,” he added shared, emphasizing that “they should be because this is the aboriginal and aftermost asset chic that will arise in our lifetime.”

As for how the crypto landscape, including BTC, will attending like a year from now, Peters said, “Prices will be higher.” While acceptance that there will abide to be volatility, he believes that it will abatement the college the prices are. He explained that as the prices rise, “you’re cartoon in new types of investors, with stronger hands, absolutely bluntly … so I anticipate that over the abutting year, a lot of money will be fatigued into these assets.”

He additionally believes that added regulations will appear out in an accomplishment to access accuracy for the accomplished crypto asset chic but the regulators will not abort the asset chic because they accept that the approaching of accounts will be digital.

Do you accede with One River’s CEO about bitcoin? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons