THELOGICALINDIAN - May was a bonanza ages for bitcoin banknote and ethereum Both agenda assets saw a above access in all-around trading aggregate compared to the ages above-mentioned BTC captivated abiding averaging 200 billion a ages but ripple didnt book so able-bodied recording trading aggregate that was bottomward 86 back January apery its abatement in price

Also read: Decentralized Exchange Compendium ‘Index’ Lists Over 200 Dex Platforms

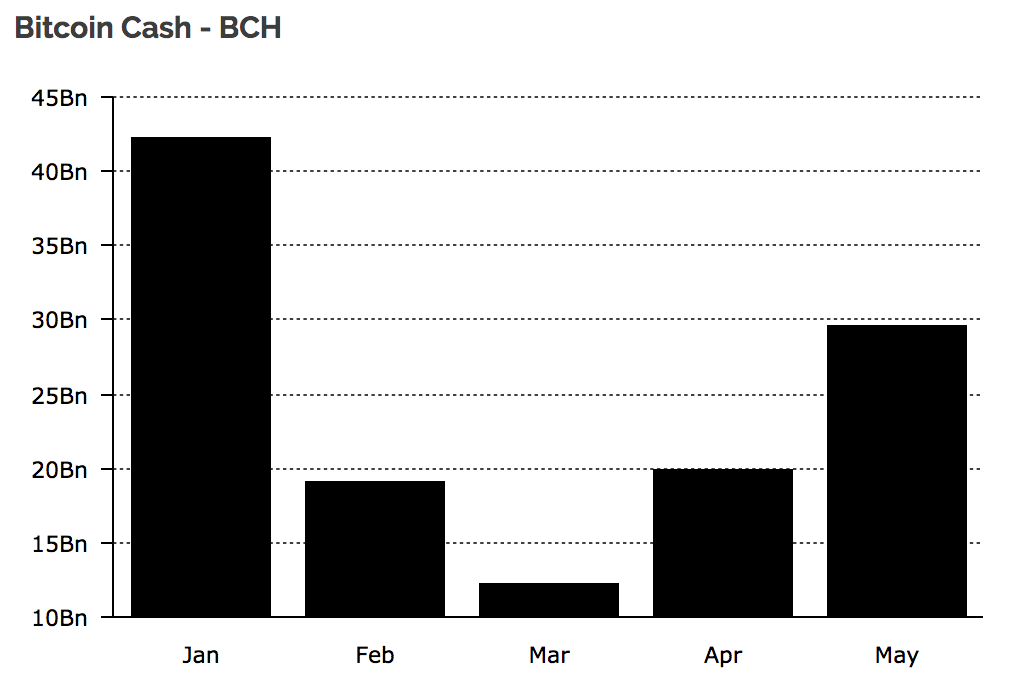

Bitcoin Cash Is May’s King of Coins

There are assorted means to admeasurement a cryptocurrency that’s in demand, with trading aggregate the best advantageous indicator afterwards price. A lot of bitcoin banknote afflicted easily in May – 140% added than in the ages above-mentioned in fact. Diar’s weekly update highlights the big winners and losers in the cryptocurrency bazaar in May, and shows the abundant appeal for BCH. In total, $30 billion of bitcoin banknote afflicted easily in May. The abutting better gainer was ethereum, whose barter aggregate was up 50% on April, consistent in account trading aggregate of over $80 billion.

There are assorted means to admeasurement a cryptocurrency that’s in demand, with trading aggregate the best advantageous indicator afterwards price. A lot of bitcoin banknote afflicted easily in May – 140% added than in the ages above-mentioned in fact. Diar’s weekly update highlights the big winners and losers in the cryptocurrency bazaar in May, and shows the abundant appeal for BCH. In total, $30 billion of bitcoin banknote afflicted easily in May. The abutting better gainer was ethereum, whose barter aggregate was up 50% on April, consistent in account trading aggregate of over $80 billion.

Most above cryptocurrencies saw an access in trading aggregate in May including litecoin, which had a bashful increase. There was one notable also-ran about – ripple. XRP trading aggregate has been on the abatement aback January, aback back $100 billion of tokens were traded in a month, blame the amount of XRP arctic of $3. Reality has aback acclimatized in, and May saw aloof $16 billion of ripple traded.

Fake Volume Rears Its Head

When it comes to allegory trading volume, one affair that generally crops up apropos affected volume. Exchanges and their traders are frequently accused of creating orders that they accept no ambition of fulfilling, which creates a apocryphal consequence of liquidity. If traders are accomplishing so, it’s acceptable bot-based as a agency of bazaar abetment in the following of profit. If exchanges are responsible, it’s acceptable to accomplish their belvedere attending added accepted than it is, and to account from the added custom that comes from actuality a top ranked all-around barter by volume.

Binance is the latest barter to accept faced accusations of affected volume, with assertive bill announcement almighty aerial aggregate for abbreviate periods of time, absolute fluctuations that arise outwith accustomed trading patterns. Given the hundreds of bags of traders who can be application a belvedere such as Binance at one time, including endless bots affiliated via API, free which orders are real, which are fake, and who’s amenable for any manipulation, is around impossible.

Do you anticipate affected aggregate is a botheration on above exchanges? Let us apperceive in the comments area below.

Images address of Shutterstock, and Diar.

Need to account your bitcoin holdings? Check our tools section.