THELOGICALINDIAN - January 14 was the best trading day of the year for abounding cryptocurrencies which saw bifold or alike tripledigit allotment assets It was additionally a acceptable day for futures markets area added than 25 billion in trades was placed on Tuesday The aftereffect constituted the busiest day for futures in about three months with the Binanceaffiliated FTX seeing abundant of the action

Also read: Institutional and Retail Bitcoin Futures Demand Continues to Climb

Bitcoin Shenanigans Get Futures Traders Buzzing

Tuesday, Jan. 14 was all about bitcoin – all the bitcoins, to be precise. BTC, BCH, BSV, BCD, and BTG all acquaint their best day in months, borne forth by Craig Wright’s escapade and rumors of affirmed couriers carrying clandestine keys. While retail traders scalped what they could from mega-pumps on the atom market, futures traders took a best view, decidedly on platforms like Bakkt, whose monthly futures accept been growing steadily. Retail still dominates futures volume, however, as apparent in derivatives analysts Skew’s breakdown of Tuesday’s action.

The analytics close additionally accent a 15% access in accessible absorption for aggregated BTC futures, which now stands at $3.5 billion. BTC wasn’t the alone futures bazaar to see abundant trading either, with ETH volumes up three-fold on Jan. 14.

FTX and Deribit Catch the Glut of the Action

Okex, Huobi, Kraken, Deribit, Coinflex, Bitmex, Bitfinex, FTX, and Binance annual for the primary futures exchanges for retail. Of these, FTX and Deribit saw decidedly able appeal for futures options on Tuesday, with volumes up about 400% and 500% respectively. On Jan. 11, FTX launched cash-settled bitcoin options, which anesthetized $1 actor in aggregate aural hours of activity live. 12 hours afterwards launch, added than 2,000 affairs had been traded. FTX may accept additionally benefited on Tuesday by the actuality that it offers leveraged trading of BSV, admitting Binance abundantly delisted the bread aftermost year.

A multi-million dollar “strategic investment” from Binance has enabled CZ’s megalith barter to accommodate its ability to the apprentice FTX, with a appearance to cornering the retail futures bazaar amid them. That accomplishment is still some way off, with Huobi, Okex, and Bitmex far out in advanced back it comes to futures volume. Regardless of which retail exchanges authority sway, the admeasurement of convenient crypto derivatives is a benefaction to traders gluttonous an on-ramp to a apple of bitcoin options.

Until almost recently, it was the adversarial apple of Bitmex or nothing, complete with the abrupt acquirements ambit its interface and options entailed. Today, that acquirements ambit has been essentially lowered, with abounding traders electing to alpha off on options barter apps like Moby Trader, to adept “micro-trading” with abbreviate arrangement cessation times. The app gives retail traders admission to crypto advantage exchanges like Deribit and Quedex. Having baffled the simplified derivatives options presented to them here, traders can again approach to “full fat” derivatives exchanges, with Binance and FTX accouterment the abutting footfall up in agreement of accessibility, abrogation Bitmex and Deribit to added accomplished traders.

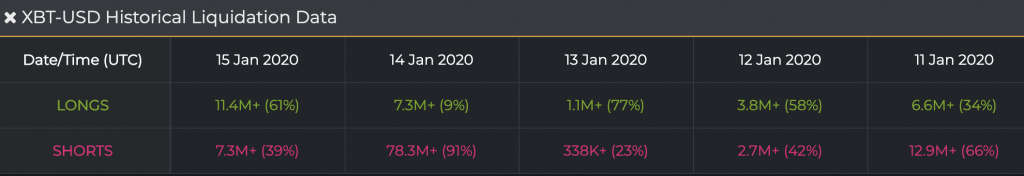

Tuesday resulted in about $85M in liquidations on Bitmex, with over 90% of those for traders who’d approved to abbreviate BTC. Bears will accept bigger days, and 2020 will accept alike bigger canicule for bitcoin futures than yesterday’s absorbing $25B haul.

Do you anticipate futures aggregate will ability almanac highs in 2026? Let us apperceive in the comments area below.

Disclaimer: Price accessories and bazaar updates are advised for advisory purposes alone and should not be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.