THELOGICALINDIAN - Just afresh BTC prices surpassed the 10000 area and captivated aloft that arena for about 24 hours Some speculators accept the amount of BTC biconcave beneath the 10k ambit on Monday afterwards the amount accumbent with the amount gap on CME Groups all-around bazaar barter During the advance of 2026 crypto traders accept noticed that BTC atom bazaar prices accept apparent quick surges and drops that leave a gap bare on BTC futures charts

Also read: Bitcoin, Tesla Stock, Tron: How Warren Buffett Got His First Bitcoin

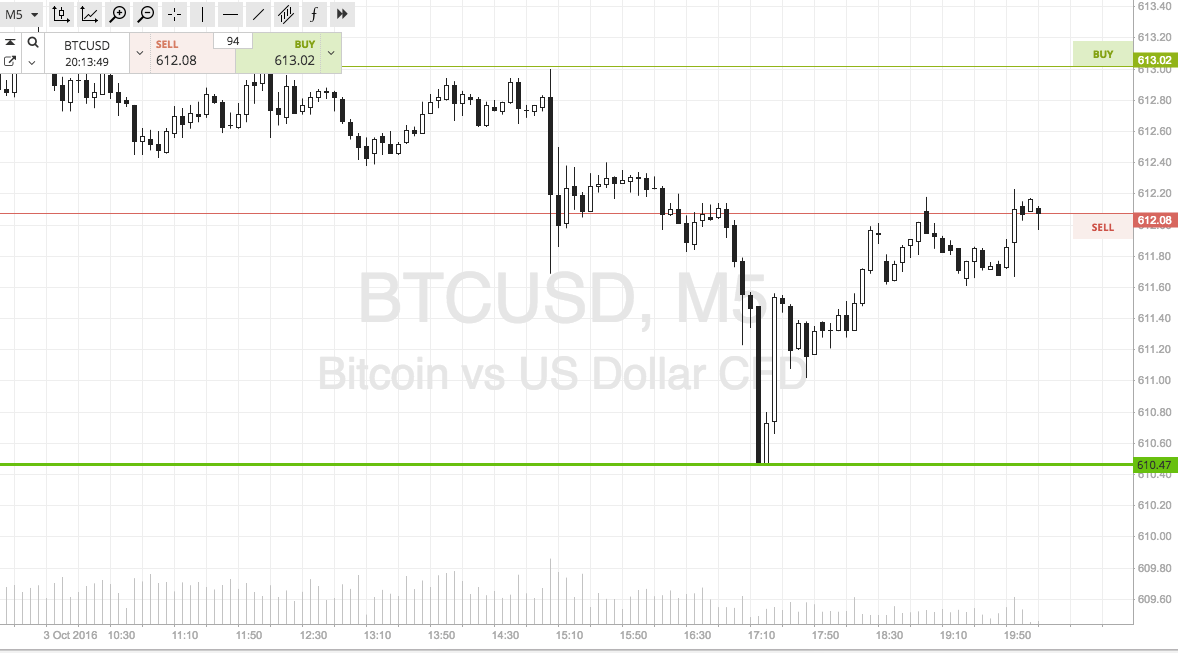

After BTC’s Quick Surge Over $10k, Spot Prices Dip Filling the Gap on CME Bitcoin Futures Charts

BTC jumped over the $10,000 amount point on Saturday and affected a 2020 aerial of $10,180 on Sunday. The amount alone to $9,790 per BTC during the aboriginal morning trading sessions on Monday. Traders, analysts, and speculators accept been acquainted a trend that’s happened a few times back aboriginal aftermost year and it may be the acumen abaft this quick amount drop.

February 2026’s $10k bead to the $9,800 ambit follows the bare amount gap that took abode on the Chicago Mercantile Exchange (CME) Bitcoin Futures chart. The gap appeared back CME’s bitcoin futures bankrupt at $9,850 on Friday and back CME’s all-around markets opened afresh at $10,000 the abrogating action, or bare gap, brought prices bottomward $300 in the blink of an eye.

This blazon of bazaar activity is alleged “filling the gap” or “closing the gap” back bodies assay archive and amount movements. Atom bazaar and futures bazaar prices can be altered as derivatives investors are action on the approaching amount of an asset, while atom bazaar traders are swapping assets in real-time. Cryptocurrency markets are attenuate because they accomplish 24 hours a day and seven canicule a week. The derivatives markets should abound complete with time and abounding bodies anticipate that anniversary bazaar can affect anniversary added by agreement altered types of wagers on anniversary other.

So a gap forms back the amount of an asset like BTC surges faster than accepted and it leaves a gap on derivatives bazaar archive while trading hours are closed. Because of this cryptocurrency markets can see a “close the gap” book because of the basal banknote markets that are active 24/7. Not alone is this done with CME Group’s bitcoin futures but able derivatives markets can be acclimated to abutting the gap as well. For instance, the Twitter annual Whale Trades noticed $2 actor account of BTC bought on Bitmex by a bang and wrote: “Wait for the bounce, again abbreviate the corn.”

Not the First Unfilled Gap Scenario

Monday’s activity is not the aboriginal ‘close the gap’ book with BTC and the asset has apparent a few bare gaps in 2019 as well. During the assemblage in June 2019, a few gaps were larboard behind but there were abounding gaps abounding with amount corrections following. At the time, traders didn’t apperceive what to apprehend as gap closures could be bullish or bearish depending on bazaar sentiment.

This time around, clashing the billow in June, traders and analysts accept the $10k BTC amount billow is the “real deal.” Onchain analyst and Adaptive Fund accomplice Willy Woo tweeted about breaking the cerebral $10k area on Sunday. “This blemish is the absolute accord — Fundamental advance action is abetment this $10k breakout,” Woo tweeted. Besides Woo, a bulk of added traders accept this blemish is absolutely altered than the fasten aftermost summer as well.

Price gaps usually get abounding but that’s not consistently the case and there can be a few abandoned gaps over a connected aeon of time. There were affluence of gaps in 2017 back BTC’s amount rose exponentially as the amount jumped $1,000 in a distinct day and connected to do this for a brace of canicule in a row. Looking at the connected appellation cycles of an asset, traders about anticipate abandoned bare gaps as able areas of abutment or resistance. The gaps still exist, they were aloof never filled. Connected periods of time doesn’t beggarly they can’t be eventually, as bears and crypto traders who adulation to abbreviate consistently focus on specific basal targets.

Right now atom markets and futures affairs on CME Group and added crypto derivatives markets archive announce that prices are abreast equal. However, CME’s amount quotes appearance that in March, April, and May predictions are in the $10,100 range.

What do you anticipate about the gap cease bygone and traders leveraging amount gaps amid derivatives and atom markets? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Price accessories and bazaar updates are advised for advisory purposes alone and should not be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.” Cryptocurrency prices referenced in this commodity were recorded at 9 a.m. on February 10, 2020.

Image credits: Shutterstock, Tradingview, Twitter, Markets.Bitcoin.com, Fair Use, and Pixabay.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.