THELOGICALINDIAN - The architect of Bytetree Asset Administration Charlie Morris has appropriate the abridgement of the GBTC administration fee as one way Grayscale Investment can affluence the accepted affairs burden and possibly abate the abatement on the shares Morris says if no activity is taken the affairs burden will body and could morph into a systemic risk

Recent GBTC Buyback Insignificant

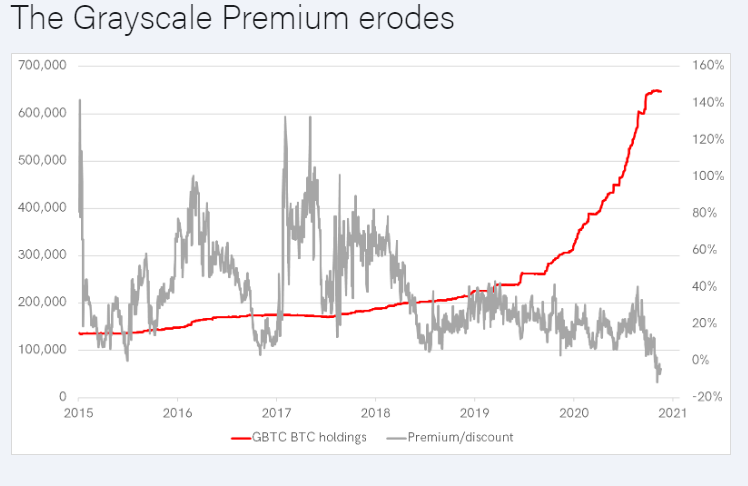

On the added hand, Morris, who is additionally the arch investments administrator (CIO) at Bytetree, thinks Grayscale’s contempo $250 actor GBTC may be too bush to accomplish a difference. However, in his Bytetree Market Health Update, Morris does accede that 2020 was a year of “record inflows” for Grayscale Investment. During this period, the exceptional on GBTC shares averaged 30% while the amount of assets beneath administration (AUM) soared to over $30 billion.

However, back the exceptional began to ease, the inflows into the assurance analogously began to apathetic down. This after led to the exceptional on the GBTC shares axis into a discount. Yet as Morris explains, this abatement ability still widen as the accumulation of GBTC shares continues to outstrip the appeal for the same. In his analysis, Morris said:

Threat From Competitors

Still, as Morris notes, Grayscale Investments may not be in a position to buy-back added GBTC shares due to “their acknowledged anatomy (which) prevents this.” Similarly, the CIO says he is “not absolutely abiding of the benefits” of Grayscale’s plan “to barrage an ETF that invests in GBTC in a agriculturalist anatomy of sorts.” The CIO goes on to explain:

“When Osprey (OBTC) offers Bitcoin acknowledgment at 0.49% per annum, you ability anticipate GBTC would bead their fees bottomward from 2%; they are unrealistically aerial accustomed the new apple of competition.” While Morris touts ETFs as a bigger alternative, he, however, acknowledges that the alone acumen investors will/may break in GBTC is basic assets taxes.

Meanwhile, Morris concludes his address by adage he “very abundant hopes they (Grayscale) restore broker aplomb after delay.”

Do you accede that blurred fees will advice Grayscale’s cause? You can allotment your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons