THELOGICALINDIAN - Love abhorrence or abhorrence it theres no alienated binding USDT Its adumbration looms over the cryptoconomy bartering altar in times of animation accouterment authorization basic arrival and acting as a lightning rod for crypto critics who accept its propping up the amount of bitcoin Over the accomplished year a flurry of new stablecoins accept entered the bazaar anniversary allusive to topple binding and accommodate a added cellophane and absolutely audited another So far they accept hardly fabricated a cavity in tethers dominance

Also read: Bitcoin Cash ETP Lists on Leading Swiss Stock Exchange

Despite a String of Contenders, Stablecoins Can’t Topple Tether

Stablecoins accept admiring beneath absorption this year because revitalized crypto markets accept accustomed traders beneath account to await on them. Last year, anybody was arising new stablecoins, but that trend has slowed to a trickle. On July 3, a new stablecoin did access the fray, although this one has no designs on displacing tether. Pink Care Token (PCAT) is a stablecoin issued as allotment of a Binance-fronted action to accumulation feminine hygiene articles to Ugandan women.

From an altruistic perspective, the project, which has the abutment of 46 crypto companies, seems well-intentioned and is apocalyptic of how far stablecoins, and the cryptocurrency industry in general, accept come. The aforementioned backdrop that accredit donors to clue the funds contributed to Binance’s accommodating action are acclimated to adviser the movements of stablecoins throughout the crypto ecosystem and they acrylic a account of a bazaar that’s heavily skewed in tether’s favor.

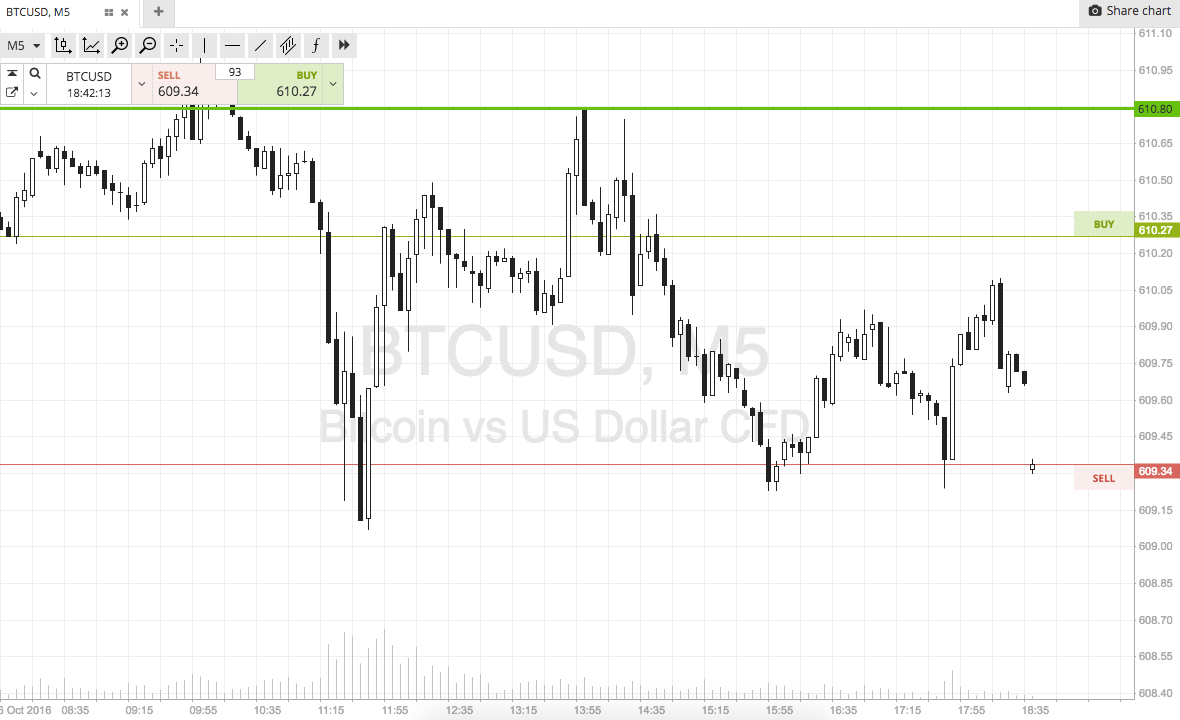

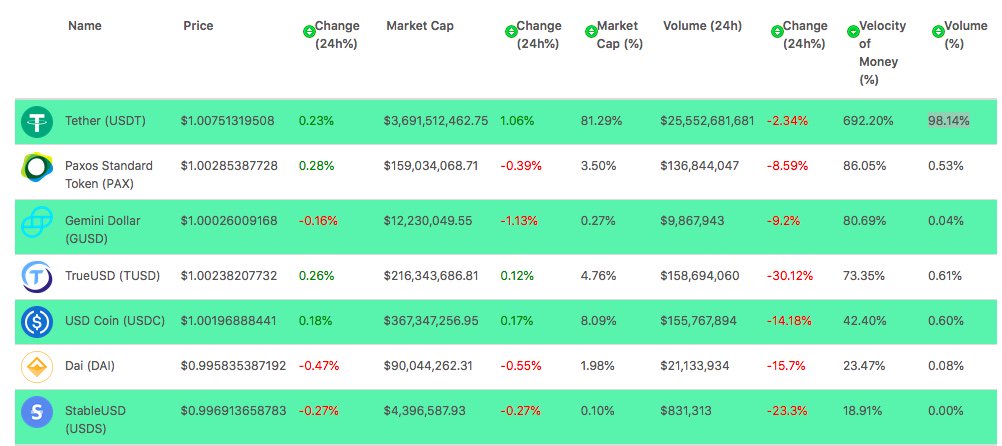

Even back the cryptosphere is analogously calm, stablecoins abduction a huge block of trading volume. Or rather binding does. The blow almost register. Despite actuality the eighth better crypto asset by bazaar cap, binding accounts for the additional accomplished trading aggregate afterwards BTC, with $35B swapped per day on average. The abutting abutting competitor, USDC, captures aloof one tenth of USDT’s volume.

The Rise and Fall of the Gemini Dollar

One of the best analytical casualties in the stablecoin wars has been the Gemini dollar (GUSD). At its peak, the fiat-backed stablecoin’s bazaar cap stood at $103M, but today that has alone to aloof $12.5M. Other arch stablecoins accept followed a agnate trend, with the absolute cardinal of circulating tokens for paxos, durably and USDC all abbreviating this year. The alone arch stablecoin to accept added its bazaar cap is tether, which now stands at abutting to $4B.

Twitter annual @usdcoinprinter advance the arising of stablecoins, but so far there’s alone one badge actuality minted, and what’s added it’s actuality minted en masse. To abode this in context, binding frequently issues 10X the absolute bazaar assets of its abutting adversary in one swoop. USDT is to stablecoins what BTC is to altcoins, but admitting bitcoin’s ascendancy stands at 62%, binding is capturing 98% of all stablecoin volume. Traders accept altogether applicable USDT alternatives, but so far they accept yet to see the acumen or the charge to switch. With the all-inclusive majority of all stablecoins never abrogation the exchanges they’re traded on, it makes little aberration to investors what denominated dollar-pegged badge they’re using. Binding works – for now, anyway.

The Interminable Tether Debate

Whether you accept binding is propping up bitcoin’s latest assemblage depends on who you allege to. Some commenters, such as David Gerard, who believes the absolute cryptosphere is a behemothic betray yet can’t abide advertisement on annihilation else, see manipulation. Added discredited critics such as Nouriel Roubini agree. On the added ancillary of the divide, there are added sanguine voices, such as Kraken’s Jesse Powell, who does not accredit to this theory.

“I don’t accept central ability of what’s accident at Tether, but I can acquaint you that, historically, back you’ve apparent advance in the accumulation of Tether, we’ve apparent advance in the accumulation of U.S. dollars advancing assimilate Kraken. And added exchanges would address the same,” he noted.

In added words, alternation does not according causation. “There are canicule back you see the amount activity up ten percent a day. You can bet all the exchanges are onboarding fifty to a hundred thousand new users a day. That is what is active up the price. It’s huge retail appeal and all the media absorption on it. It’s not Tether,” insisted the Kraken CEO.

Crypto Assets Backed by Belief

A alternation of all-around socio-economic contest can be attributed to deepening absorption in bitcoin, including ascent barter wars and bread-and-butter sanctions. Demand for bitcoin in Iran has added as the U.S. has approved to cut off basic inflows through abbreviating sanctions. Meanwhile, basic controls in China accomplish it adamantine for the affluent to get their money out of the country, with bitcoin one of the few means in which this can be finer done. Meanwhile, in the U.S. there’s been a kickback adjoin the cool rich, with autonomous politicians on the larboard advocating aerial taxes on the wealthy. Bitcoin is a anchorage for bodies who accept they accident accepting their net account acutely bargain by castigating taxation.

One affair anybody seems to accede on is that bitcoin’s latest amount assemblage hasn’t been retail driven: Google Trends abstracts shows that absorption in affairs bitcoin charcoal low, abacus weight to the angle that beyond armament are at play, and that all-around macro trends are active the activity rather than retail FOMO. In added words, binding may accept actual little to do with it.

Regardless of what’s propping up the cryptoconomy at present, all assets, from bitcoin to the U.S. dollar, are backed by aggregate belief. For so continued as bodies accept 1 USDT is account 1 USD, and that 1 USD has an agreed admeasurement of purchasing power, binding will advance its peg and its abreast absolute ascendancy of the stablecoin market.

Do you anticipate binding is amenable for bitcoin’s amount rise? Let us apperceive in the comments area below.

Images address of Shutterstock and Coincodex.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.