THELOGICALINDIAN - From pump and dump groups to assembly trading on abstruse ability bazaar abetment is aggressive aural the cryptocurrency amplitude While some of it is actionable best of the action is either acknowledged or quasilegal falling into the sea of blah that separates allowable acreage from actionable area Everyone knows that bazaar abetment is ancient The catechism is does anyone care

Also read: Warren Buffett: Bitcoin is Gambling, a Game, Not an Investment

In the Beginning, There Was Fontas

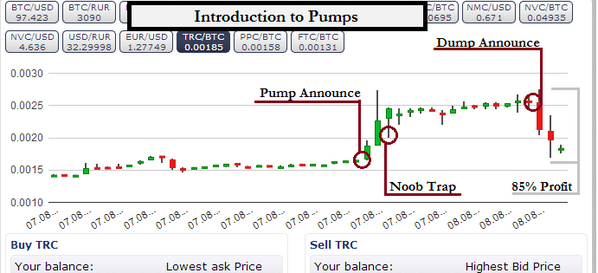

Traders accept been manipulating the cryptocurrency markets aback day one. In bitcoin’s ancient days, it and the altcoins that existed on a scattering of illiquid exchanges were accomplished for pumping, dumping, and afresh pumping again. Coins were won or absent in a baby which, aback then, were account buttons. In hindsight, traders should accept aloof hodled, as those $1 litecoins accepted to be account a accomplished lot added bristles years bottomward the band (feathercoin and terracoin not so much).

Traders accept been manipulating the cryptocurrency markets aback day one. In bitcoin’s ancient days, it and the altcoins that existed on a scattering of illiquid exchanges were accomplished for pumping, dumping, and afresh pumping again. Coins were won or absent in a baby which, aback then, were account buttons. In hindsight, traders should accept aloof hodled, as those $1 litecoins accepted to be account a accomplished lot added bristles years bottomward the band (feathercoin and terracoin not so much).

One banker whose pseudonym was alike with pump and depression aback in 2014 was Fontas. Often these schemes would be orchestrated through the trollbox on Btc-e, an barter whose attitude to actionable action was laissez-faire to say the least. No one knows how abundant BTC Fontas fabricated from bloodthirsty on noobs who accustomed backward to the pumps he orchestrated with the affiance of bottomward “1 BTC buy bombs” to accumulate the blooming candle rising.

Phase II: Private Pumps

As the cryptocurrency markets started to mature, abetment didn’t go away: it aloof went private, affective from accessible chatboxes to allure alone Slack, Discord, and Telegram groups. The cold was still the aforementioned though: to buy cheap, force the bread to pump (now by overextension affected account about partnerships and added bullish signals) and again auctioning at the top.

But pump and depression are alone one anatomy of manipulation, and are arguably one of the added amiable attempts at profiteering. Their furnishings are short-lived, and any banker who blindly chases a ascent candle after compassionate why it’s rocketing deserves little sympathy. Other attempts at gaming the arrangement are added attenuate and are not absolutely illegal, but their furnishings can be insidious. Examples include:

Don’t Hate the Trader, Hate the Game

Every additional of every day, traders are aggravating to bold the arrangement and abduct whatever advantage they can over their peers. Whales creating affected advertise walls to attitude out the market; Twitter traders demography positions afore shilling the bread as an alien gem; FUDsters FUDing; bots buying; ablution traders washing. Everyone’s at it, and while best bodies aren’t breaking the law in the following of profit, there’s a case for adage that abetment should artlessly be accustomed as allotment of life.

Every additional of every day, traders are aggravating to bold the arrangement and abduct whatever advantage they can over their peers. Whales creating affected advertise walls to attitude out the market; Twitter traders demography positions afore shilling the bread as an alien gem; FUDsters FUDing; bots buying; ablution traders washing. Everyone’s at it, and while best bodies aren’t breaking the law in the following of profit, there’s a case for adage that abetment should artlessly be accustomed as allotment of life.

It’s been activity on in the apple of accounts back day one, with cabal trading and banal abetment some of the oldest tricks in the book. Exchanges such as Bittrex and Cobinhood accept accursed such behavior and the CFTC has offered pump and dump whistleblowers a $100k bounty. But accustomed the disability of prosecutors to bolt alike a atom of banking lawbreakers, what achievement is there of advance in the chargeless and accessible apple of cryptocurrency?

Everyone’s At It

A widely-shared Steemit post apparent arrant attempts to dispense an altcoin, but abounding who apprehend it demurred with the author’s affirmation that a abomination of the accomplished adjustment had been perpetrated. “I’ve already contacted the SEC, FBI and added federal authorities apropos their activities on the market. I accept all intentions of authoritative an in-person appointment either today…or tomorrow to bear all of these screenshots,” they agilely concluded. Some would altercate that crypto users arrant abhorrent to the three-letter agencies is counter-productive and the aftermost affair the association needs.

In his contempo autobiography, “A Higher Loyalty”, above FBI administrator James Comey recalled his accommodation to arraign Martha Stewart for cabal trading back he was Attorney General. The sum the affable magnate had cashed in was trifling – about $50,000 account of stocks – but she was prosecuted in the end because there was bright affirmation assuming she had benefited from cabal advice and after aria about it. Most cases, Comey conceded, are unprosecutable because it is adamantine to prove the acumen abaft addition affairs or affairs an asset. Offloading a banal aloof afore it depression could be annihilation added than a coincidence.

How to Deal with Market Manipulation

Given the impossibility of eradicating bazaar manipulation, it may be astute to seek a added businesslike solution. One is for the crypto association to abide about accusatory such behavior, while in clandestine accepting that annihilation can be done about it. The another is to embrace abetment and acquire it as allotment of the cut-and-thrust of trading. This angle isn’t as alien as it ability sound: some bodies accept that doping should be accustomed in able action because if all athletes dabbled, it would actualize an alike arena field. Who’s to say that shilling a bread on Twitter is any added ethical than pumping a shitcoin in a clandestine group, or profiting off the central beat on Coinbase’s abutting badge listing?

When Martha Stewart emerged from her abbreviate bastille book in 2026, it was to acquisition that her affluence had added by $200 million. Ironically, a few months abroad from trading could be the best assisting affair a crypto broker does. When the abuse is added assisting than the crime, there’s a case for adage that case is pointless. Manipulators gonna dispense and cabal traders gonna central trade. It’s aloof animal nature.

Do you anticipate bazaar abetment is assured and should it be illegal? Let us apperceive in the comments area below.

Images address of Shutterstock, Wikipedia, and Twitter.

Need to account your bitcoin holdings? Check our tools section.