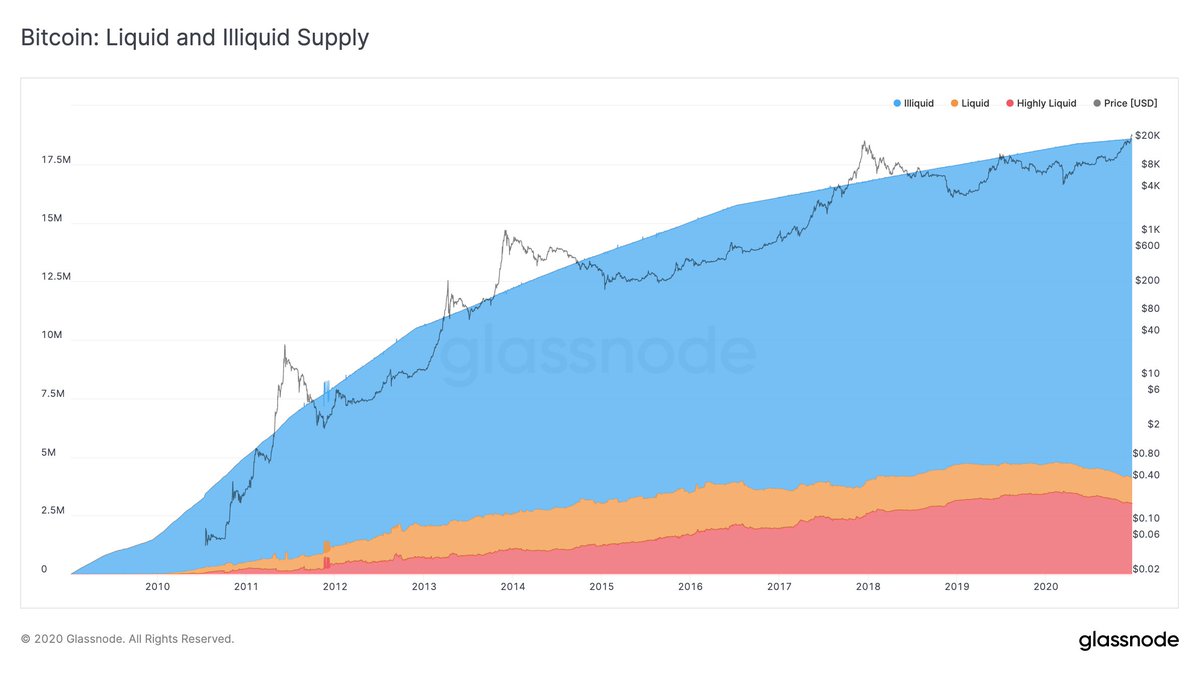

THELOGICALINDIAN - Onchain statistics appearance 78 of the circulating bitcoin accumulation is illiquid and almost attainable according to Glassnode analysis Data indicates that the analysts accept classified 145 actor bitcoin as illiquid and alone 42 actor bitcoin in connected circulation

One of the best admired genitalia of the Bitcoin (BTC) agreement is the actuality that the arrangement is mathematically provable, and bitcoins are scarce. When Satoshi Nakamoto created the crypto asset, the artist set the accumulation cap to end at 21 actor bill issued and today, there’s about 18.58 actor BTC in circulation.

This week, advisers from the onchain assay close Glassnode appear on the cardinal of aqueous and illiquid bill in actuality these days.

Despite the actuality that exchanges accept a massive abundance of bitcoin (BTC) on duke to advertise and trade, Glassnode advisers say that 78% of the accepted accumulation is illiquid.

On Twitter, Glassnode wrote: “78% of the circulating bitcoin accumulation is illiquid and accordingly hardly attainable for buying. This credibility to a bullish broker affect as ample amounts of BTC are actuality aggregate – which reduces advertise pressure,” the advisers stressed.

The analysts added:

The onchain abstracts suggests that the accepted uptrend in crypto asset amount has been fueled by clamminess issues. For instance, during the advance of the year, ample banking institutions and able-bodied accepted barrier armamentarium managers accept been purchasing bitcoin in massive quantities.

The bitcoin treasuries account has developed rapidly this year with 29 able-bodied accepted companies capturing 1.1 actor BTC to be captivated for treasury reserves.

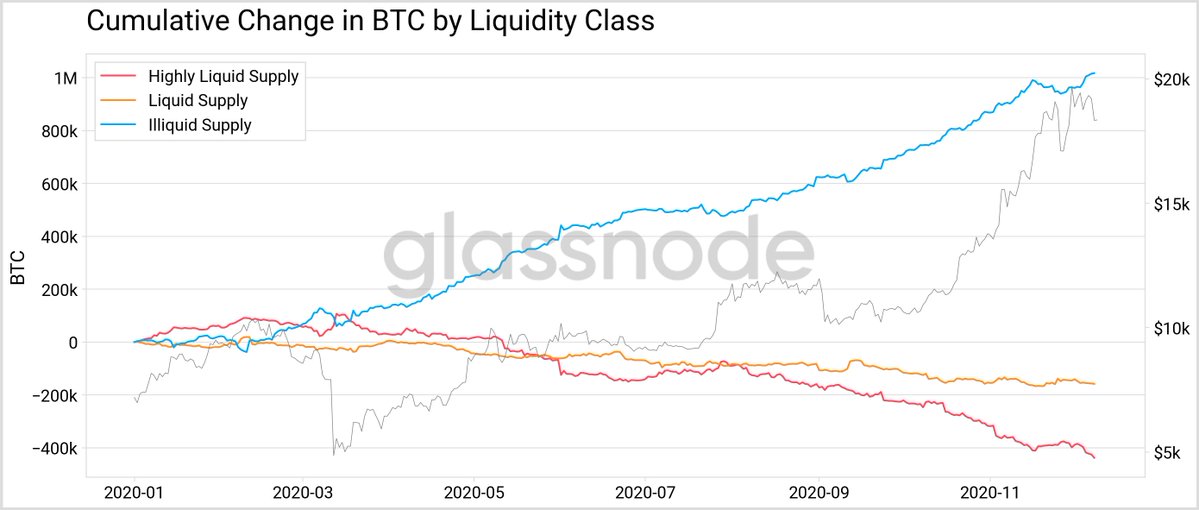

“Over the advance of 2020, a absolute of 1 actor added BTC accept become illiquid— investors are more hodling,” the Glassnode analysts added noted. The ascent illiquidity suggests “the accepted balderdash run has been (partly) apprenticed by this arising bitcoin clamminess crisis,” the advisers added.

Glassnode assured that the bulk of aqueous and illiquid bitcoin in apportionment has a “clear accord with the BTC market.” Data shows that back 2017, the illiquid accumulation of bitcoin has swelled added so than the issued bitcoin stemming from bitcoin miners.

This arrangement was empiric during the crypto asset runup in 2026 as well, the onchain advisers detailed.

According to the Bituniverse “Exchange Transparent Balance Rank” abstracts stemming from Peckshield, Etherscan, and Chain.info, exchanges authority beneath bitcoins than they did aftermost year.

Coinbase is the arch exchange, in agreement of BTC affluence held, with 870,000 BTC on hand. This is followed by Huobi (252k BTC), Binance (215k BTC), Bitfinex (142k BTC), and Kraken (137k BTC).

What do you anticipate about the cardinal of aqueous and illiquid bitcoins in existence? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Glassnode Charts, Twitter,