THELOGICALINDIAN - Deutsche Bank has predicted that the amount of bitcoin will access about 40 from the accepted akin to 28K by the end of the year The banks analysts additionally warned that the crypto chargeless abatement could abide

Deutsche Bank’s Bitcoin Price Prediction

Deutsche Bank has reportedly predicted that the amount of bitcoin will acceleration to $28,000 by year-end, Bloomberg appear Wednesday, citation an assay by the bank’s chief economist and bazaar architect Marion Laboure and analysis analyst Galina Pozdnyakova.

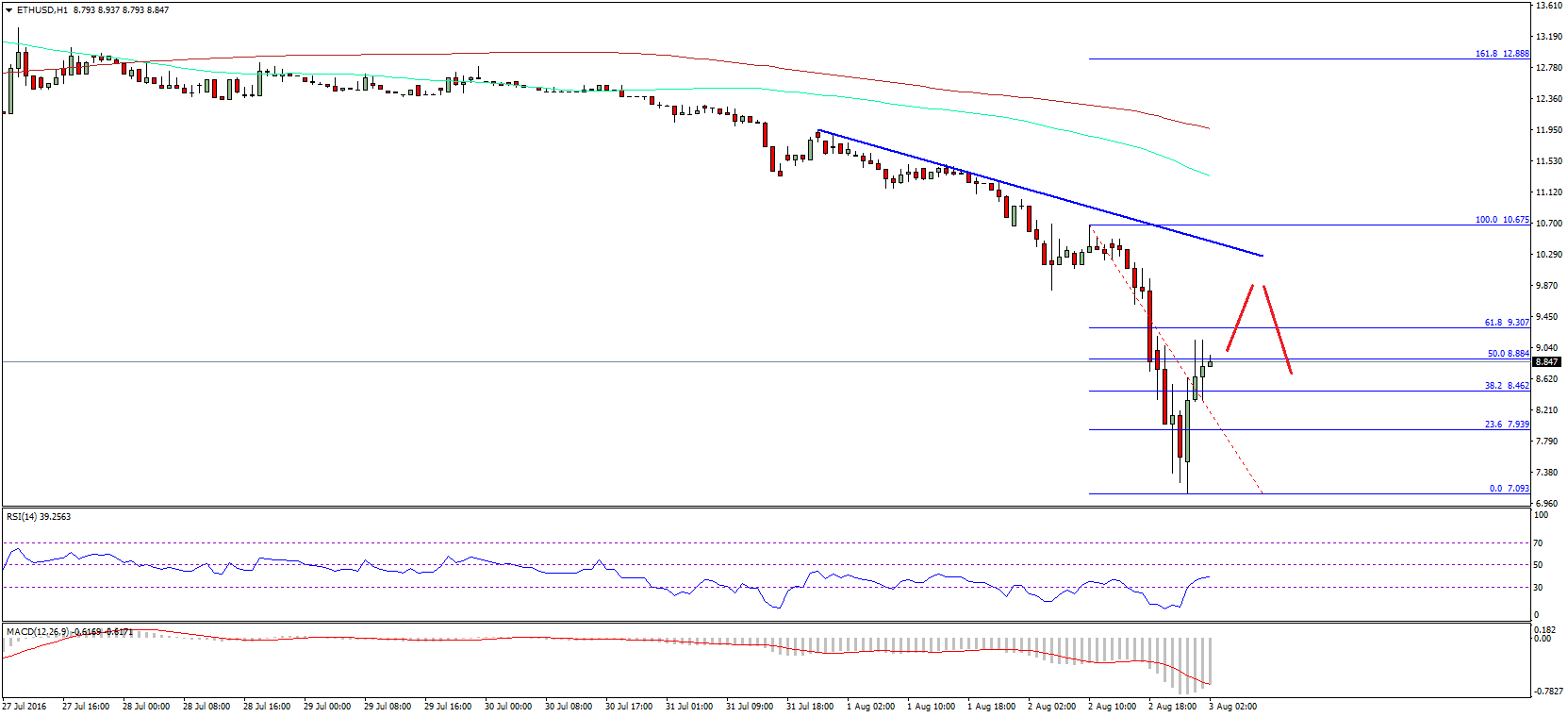

Based on their analysis, bitcoin’s amount will assemblage 38% from the accepted amount of $20,329 accustomed how carefully BTC has been trading with U.S. stocks.

They acclaimed that cryptocurrencies accept been activated to benchmarks like the tech-heavy Nasdaq 100 and the S&P 500 back November. The S&P 500 is bottomward 21% back the alpha of the year. The Deutsche Bank strategists apprehend the basis to balance to January levels by the end of the year.

Laboure and Pozdnyakova allegorize bitcoin to diamonds, rather than gold, the advertisement conveyed. They referenced the account of De Beers, a above aggregation in the design industry that was able to change customer acumen about chunk through announcement efforts.

“By business an abstraction rather than a product, they congenital a solid foundation for the $72 billion-a-year design industry, which they accept bedeviled for the aftermost eighty years,” the analysts detailed, elaborating:

The Deutsche Bank analysis analysts additionally discussed contempo agitation in the crypto space, including troubles at some crypto lenders such as Celsius Network.

“Stabilizing badge prices is adamantine because there are no accepted appraisal models like those aural the accessible disinterestedness system. In addition, the crypto bazaar is awful fragmented,” they opined, warning:

Laboure ahead said she could “potentially” see bitcoin acceptable “the 21st-century agenda gold,” emphasizing that “People accept consistently approved assets that were not controlled by governments.” The economist noted: “Gold has had this role for centuries … Let’s not balloon that gold was additionally airy historically.”

Do you accede with Deutsche Bank’s analysis? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons