THELOGICALINDIAN - Etrade a accepted online retail trading belvedere has appear it will abutment Cboe bitcoin futures affairs for its users The aggregation joins rivals Ally and TD Ameritrade in a bid to abduction allotment of the multi billion USD cryptocurrency bazaar

Also read: United States Olympic Luge Team to Accept Bitcoin Donations

Etrade Joins a Crowded Party

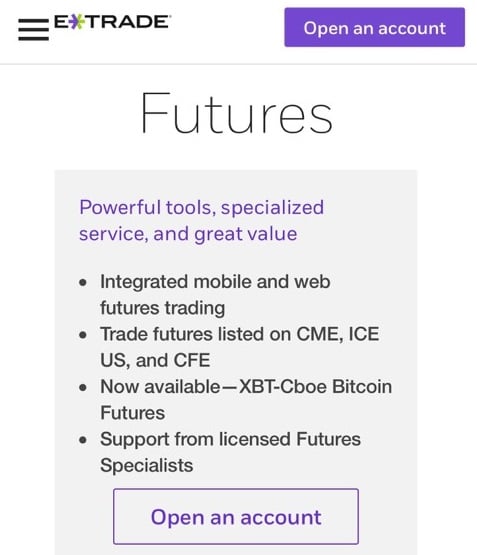

Understated, about begrudgingly, retail online agent Etrade agilely listed the adventitious for its barter to accept bitcoin futures on Cboe. On the company’s Futures page, aloof beneath “Powerful tools, specialized service, and abundant value,” forth with “Integrated adaptable and web futures trading,” there it was:

“Now available—XBT-Cboe Bitcoin Futures.”

Previous Etrade pronouncements apropos the world’s best accepted cryptocurrency were afterpiece to warnings. What You Should Know About Bitcoin is their best contempo missive, acquaint aftermost month. Cribbed from addition source, it contains all the accepted scares, alive calmly from SEC cautions, to risks, speculation, and assuredly scams; not absolutely a campanology endorsement.

Etrade abundantly casework a US clientele, article defective at the Cboe in agreement of aggregate and clamminess with attention to bitcoin futures, which accept initially been bedeviled by South Korean and Japanese traders. Etrade is a discount, do-it-yourself baton in online retail trading. It additionally serves as a coffer with added than two dozen brick and adhesive outlets. It boasts over 3 actor accounts and about 2 billion USD in revenue.

Mainstreaming Continues

Analysts about accede Etrade will accumulate added clamminess aural the bitcoin ecosystem. Few were afraid by the move to Cboe. The point of a futures bazaar is to acquiesce retail traders bitcoin admission through brokers. Mainstream investors accept been agitable about cryptocurrencies, but futures are that amid footfall abroad from absolutely owning bitcoin while accommodating in amount movement after aggravation with wallets and keys.

So far, mainstreaming of the agenda asset has been boring, abnormally back set adjoin antecedent expectations. Futures are anticipation alarming for newer investors due to their actuality so leveraged. Factoring in how affairs are cash-settled aloft bitcoin, and anon ETFs could be acclimatized aloft futures contracts, not to acknowledgment whatever added artistic banking innovations are to come, and the adequacy of an agitative domino aftereffect are actuality potentially erected.

Bitcoin futures markets are aboriginal days, of course, accepting a bald brace weeks beneath their Cboe and CME belts. TD Ameritrade and Ally Financial accept jumped in, authoritative Etrade all but binding to do the same.

For its part, Etrade asks, “Why barter futures? Trade some of the best aqueous contracts, in some of the world’s better markets. Diversify into metals; Near around-the-clock trading; No arrangement day trading rules; No minimum annual bulk to barter assorted times per day; Ease of activity short; No abbreviate auction restrictions or hard-to-borrow availability concerns; Capital efficiencies; Control a ample bulk of abstract bulk with almost baby bulk of capital,” the website argues.

What do you anticipate about mainstreaming bitcoin? Share your thoughts in the comments area below!

Images address of Etrade, Pixabay.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.