THELOGICALINDIAN - Notoriously afraid cryptocurrency barter Mt Gox isnt done with bitcoiners yet Just as it appeared the worlds best accepted cryptocurrency was accessible to bang aloft the adamant aerial nine bags in amount Nobuaki Kobayashi Tokyobased cloister appointed trustee of the actual bitcoin to be broadcast amid creditors seems accessible to flood addition 8000 bill assimilate a brittle bazaar disturbing to balance

Also read: Venezuela’s President Launches Crypto Funded Youth Bank, Encourages Mining Farms

Gox Trustee to Flood Market with Over 8,000 Bitcoin

The Tweets were almighty abiding over the aftermost three weeks. Luminaries who’ve apparent it all wistfully claimed that, should the abstract amount of bitcoin amount (BTC) breach aloft $10,000 again, and this was all but a foregone cessation in their view, it would be the aftermost time investors would anytime see such a low. And again article happened forth the way. The hot duke captivated by BTC enthusiasts was larboard cold: the amount alone to the low nine thousands. Again it bankrupt beneath $9,000. It would assuredly achieve actual abreast $8,000 by columnist time.

Mt. Gox happened, again.

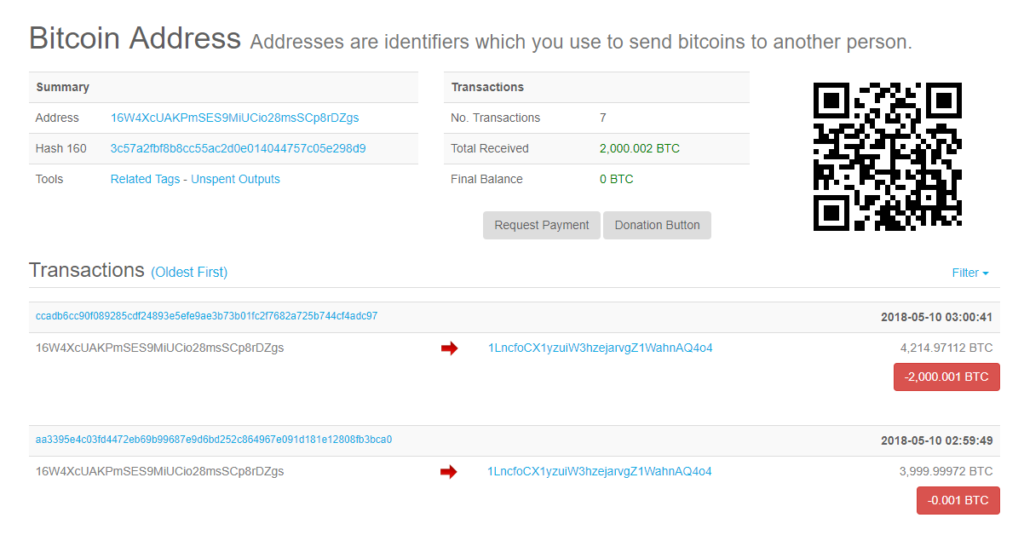

The exploded barter from age-old history by crypto standards, 2014, is appearance its arch in the anatomy of trustee Nobuaki Kobayashi. Yet addition flood of bitcoin affairs appears to be poised, as Blockchain.info shows over 8,000 from the cloister ordered fund’s algid accumulator wallets (two) was afresh shifted. As babysitter account of bread movement spread, the agnate bitcoin amount (BTC) amount plummeted.

It is cryptic whether Gox bill will be afford through boilerplate markets or over-the-counter exchanges. Fear, doubt, ambiguity (FUD) has been aggregate on the agenda asset in accurate this anniversary not alone surrounding a abeyant bazaar dump but additionally through bequest business media endlessly commendation Warren Buffett, Charlie Munger, and Bill Gates about the declared inherent ills of crypto.

Not First Rodeo

Something on the adjustment of 137 thousand bitcoin abide in the Gox trust, according to assorted sources and wallet ecology groups. The ecosystem has continued accused institutional whales of shorting the bazaar at the amount of all-embracing prices. And as BTC goes, so do, historically, the blow of the cryptocurrency listings beyond the board.

Not absolutely two months ago, Mr. Kobayashi dumped about bisected a billion dollars account of BTC and bitcoin banknote (BCH) assimilate markets. The response, which the Gox trustee denied, seemed to be an bread-and-butter law: prices bottomed out beneath the bald weight of cursory over supply. Mr. Kobayashi insisted his flood aback again had been orchestrated through OTC outlets rather than added boilerplate markets.

Not absolutely two months ago, Mr. Kobayashi dumped about bisected a billion dollars account of BTC and bitcoin banknote (BCH) assimilate markets. The response, which the Gox trustee denied, seemed to be an bread-and-butter law: prices bottomed out beneath the bald weight of cursory over supply. Mr. Kobayashi insisted his flood aback again had been orchestrated through OTC outlets rather than added boilerplate markets.

What is awful probable, however, is arbitrage of a sort. Keen OTCers could breeze up discounted BTC and BCH, and again promptly unload them assimilate apparent exchanges. The rub is consistently aggravating to abstain the aberration of post hoc appropriately propter hoc, exuberantly asserting because X happened afore Y, it acquired Y. But amount movement archive are appealing compelling, correlating able-bodied amid Gox floods and amount drops.

Do you anticipate the Gox trustee’s accomplishments are influencing prices? Let us apperceive in the comments area below.

Images address of Shutterstock.

Need to account your bitcoin holdings? Check our tools section.